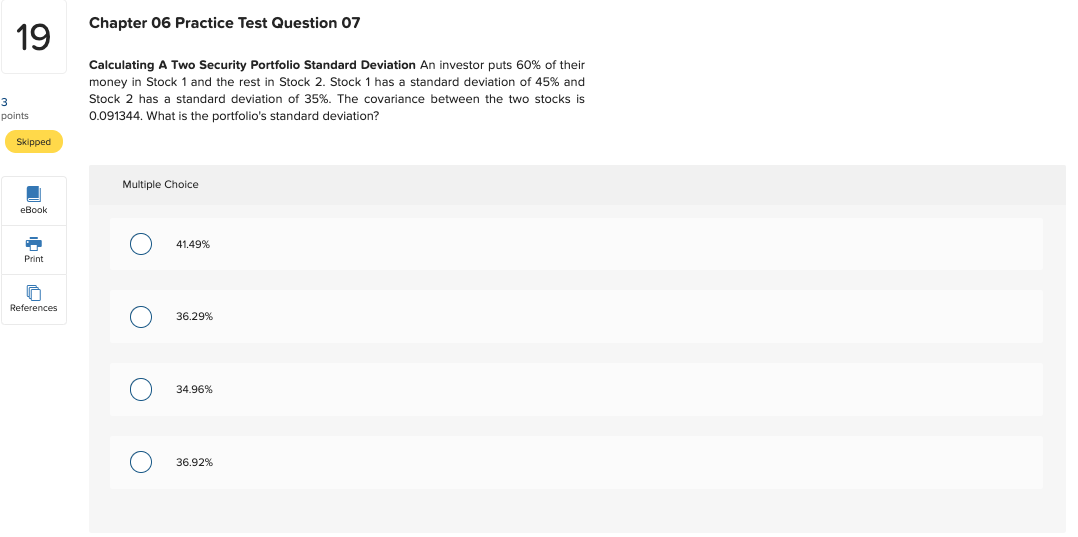

Question: Chapter 06 Practice Test Question 07 19 Calculating A Two Security Portfolio Standard Deviation An investor puts 60% of their money in Stock 1 and

Chapter 06 Practice Test Question 07 19 Calculating A Two Security Portfolio Standard Deviation An investor puts 60% of their money in Stock 1 and the rest in Stock 2. Stock 1 has a standard deviation of 45% and Stock 2 has a standard deviation of 35%. The covariance between the two stocks is 0.091344. What is the portfolio's standard deviation? points Skipped Multiple Choice eBook 41.49% Print References 36.29% 34.96% 36.92%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts