Question: Chapter 06 Practice Test Question 17 15 Asset Allocation Between Risky and Riskless Investments You have a risky portfolio with a beta of 1.3. You

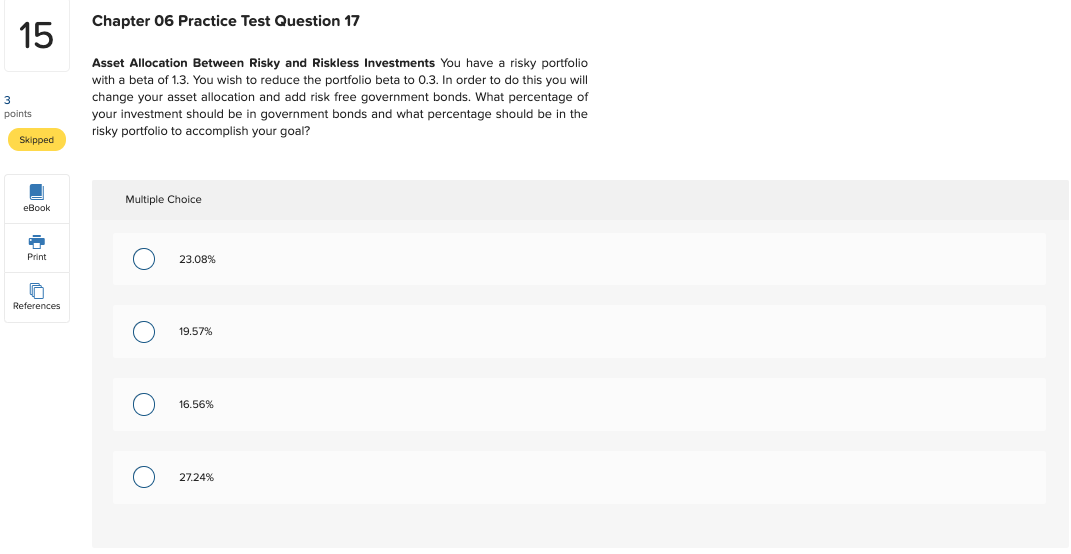

Chapter 06 Practice Test Question 17 15 Asset Allocation Between Risky and Riskless Investments You have a risky portfolio with a beta of 1.3. You wish to reduce the portfolio beta to 0.3. In order to do this you will change your asset allocation and add risk free government bonds. What percentage of your investment should be in government bonds and what percentage should be in the risky portfolio to accomplish your goal? points Skipped Multiple Choice eBook Print O 23.08% References O 19.57% O ) 16.56% o 27.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts