Question: Chapter 08: Assignment - Equity Valuation Back to Assignment Attempts: Keep the Highest: 12 1. Problem 8-01 eBook Problem 8-01 The Baron Basketball Company (BBC)

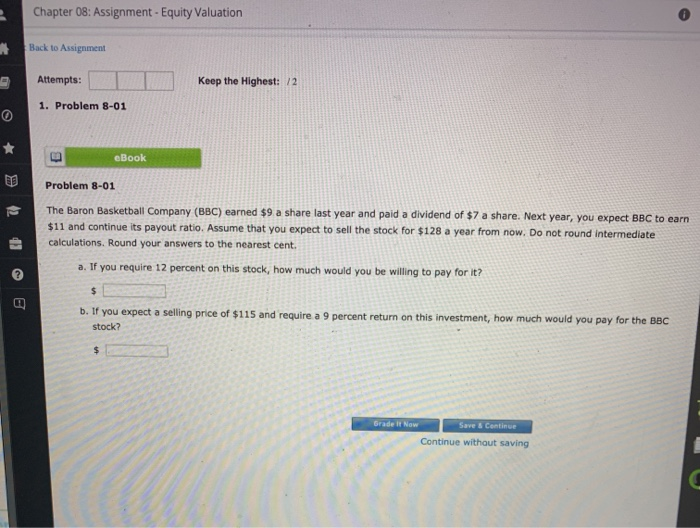

Chapter 08: Assignment - Equity Valuation Back to Assignment Attempts: Keep the Highest: 12 1. Problem 8-01 eBook Problem 8-01 The Baron Basketball Company (BBC) earned $9 a share last year and paid a dividend of $7 a share. Next year, you expect BBC to earn $11 and continue its payout ratio. Assume that you expect to sell the stock for $128 a year from now. Do not round intermediate calculations. Round your answers to the nearest cent. a. If you require 12 percent on this stock, how much would you be willing to pay for it? b. If you expect a selling price of $115 and require a 9 percent return on this investment, how much would you pay for the BBC stock? Grad Now SewCenter Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts