Question: Chapter 10 Exercise Problem McGee Computing Service is considering an average-risk project that will cost $92,000 at time zero and is expected to generate annual

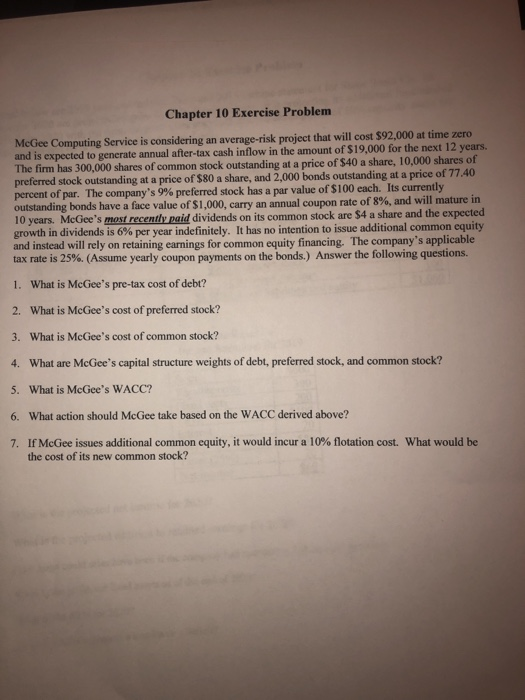

Chapter 10 Exercise Problem McGee Computing Service is considering an average-risk project that will cost $92,000 at time zero and is expected to generate annual after-tax cash inflow in the amount of $19,000 for the next 12 years. The firm has 300,000 shares of common stock outstanding at a price of $40 a share, 10,000 shares of preferred stock outstanding at a price of $80 a share, and 2,000 bonds outstanding at a price of 77.40 percent of par. The company's 9% preferred stock has a par value of $100 each. Its currently outstanding bonds have a face value of $1,000, carry an annual coupon rate of 8%, and will mature in 10 years. McGee's most recently paid dividends on its common stock are $4 a share and the expected growth in dividends is 6% per year indefinitely. It has no intention to issue additional common equity and instead will rely on retaining earnings for common equity financing. The company's applicable tax rate is 25%. (Assume yearly coupon payments on the bonds.) Answer the following questions. 1. What is McGee's pre-tax cost of debt? 2. What is McGee's cost of preferred stock? 3. What is McGee's cost of common stock? 4. What are McGee's capital structure weights of debt, preferred stock, and common stock? 5. What is McGee's WACC? 6. What action should McGee take based on the WACC derived above? 7. If McGee issues additional common equity, it would incur a 10% flotation cost. What would be the cost of its new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts