Question: Chapter 10 Financial Planning Exercise 2 Evaluating homeowner's policy coverage Last year, Eleanor and Felix Knight bought a home with a dwelling replacement value of

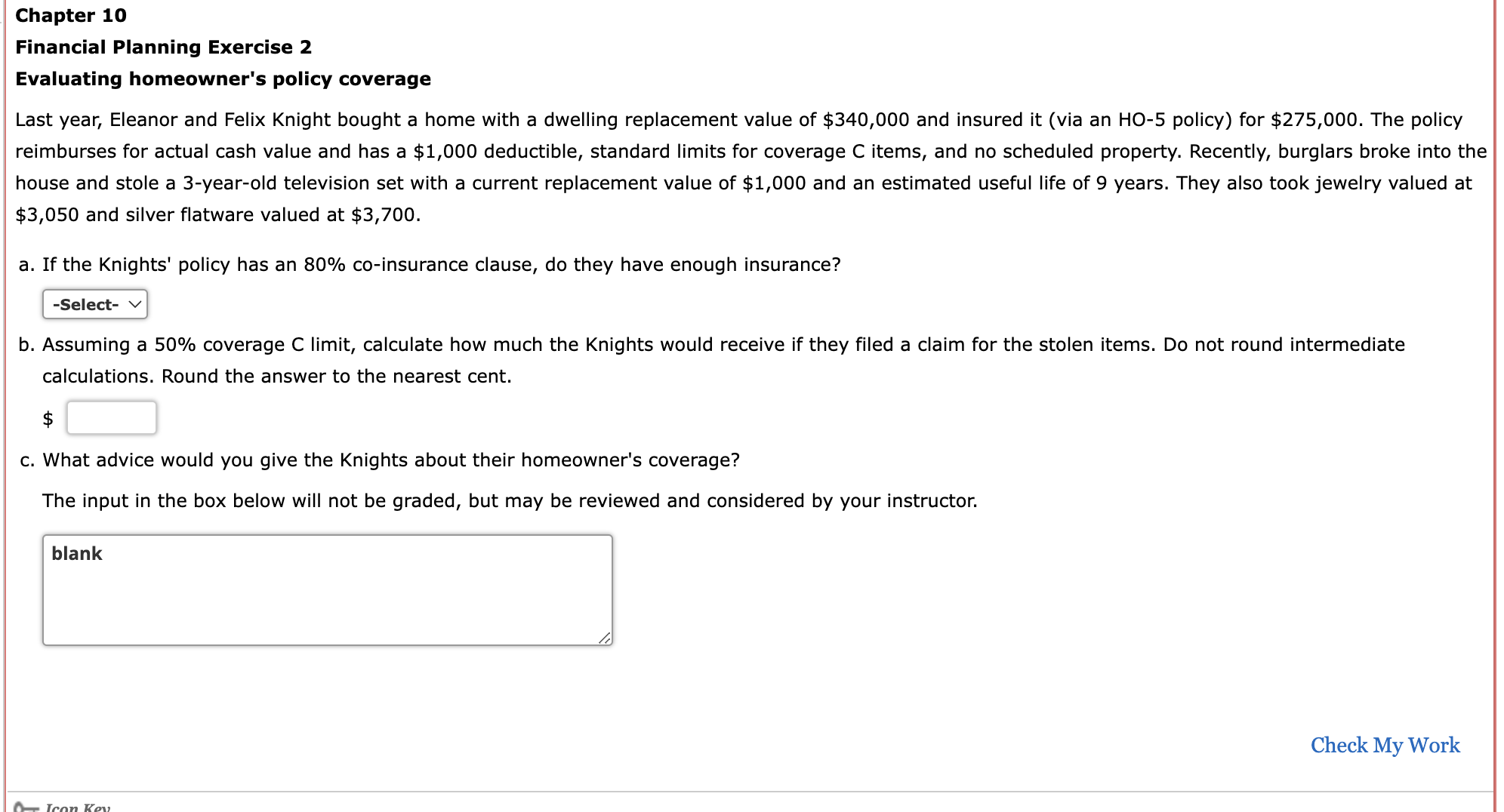

Chapter 10 Financial Planning Exercise 2 Evaluating homeowner's policy coverage Last year, Eleanor and Felix Knight bought a home with a dwelling replacement value of $340,000 and insured it (via an HO-5 policy) for $275,000. The policy reimburses for actual cash value and has a $1,000 deductible, standard limits for coverage C items, and no scheduled property. Recently, burglars broke into the house and stole a 3-year-old television set with a current replacement value of $1,000 and an estimated useful life of 9 years. They also took jewelry valued at $3,050 and silver flatware valued at $3,700. a. If the Knights' policy has an 80% co-insurance clause, do they have enough insurance? b. Assuming a 50\% coverage C limit, calculate how much the Knights would receive if they filed a claim for the stolen items. Do not round intermediate calculations. Round the answer to the nearest cent. $ c. What advice would you give the Knights about their homeowner's coverage? The input in the box below will not be graded, but may be reviewed and considered by your instructor. Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts