Question: Chapter 10 Financial Planning Exercise 2 Evaluating homeowner's policy coverage Last year, Brett and Amber Walsh bought a home with a dwelling replacement value of

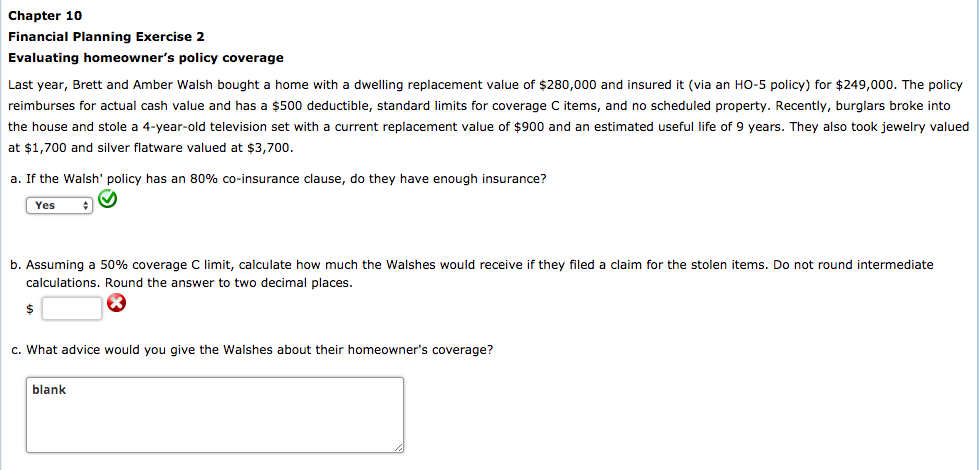

Chapter 10 Financial Planning Exercise 2 Evaluating homeowner's policy coverage Last year, Brett and Amber Walsh bought a home with a dwelling replacement value of $280,000 and insured it (via an HO-5 policy) for $249,000. The policy reimburses for actual cash value and has a $500 deductible, standard limits for coverage C items, and no scheduled property. Recently, burglars broke into the house and stole a 4-year-old television set with a current replacement value of $900 and an estimated useful life of 9 years. They also took jewelry valued at $1,700 and silver flatware valued at $3,700. a. If the Walsh' policy has an 80% co-insurance clause, do they have enough insurance? Yes b. Assuming a 50% coverage C limit, calculate how much the Walshes would receive if they filed a claim for the stolen items. Do not round intermediate calculations. Round the answer to two decimal places. $ c. What advice would you give the Walshes about their homeowner's coverage? blank

Step by Step Solution

There are 3 Steps involved in it

Here are the answers to the given questions based on the provided scenario a CoInsurance Clause Calculation The coinsurance clause requires the insure... View full answer

Get step-by-step solutions from verified subject matter experts