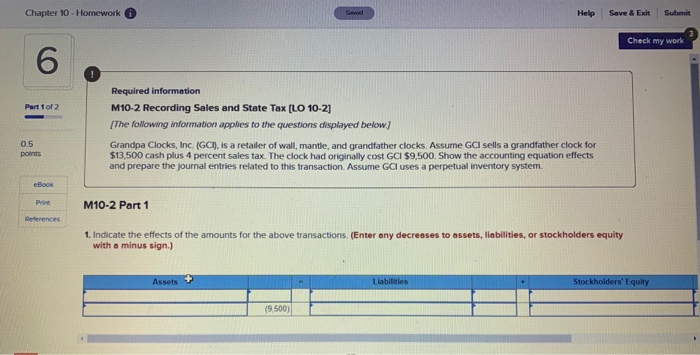

Question: Chapter 10 - Homework Help Save & Exit Submit Check my work Required information M10-2 Recording Sales and State Tax [LO 10-2] [The following information

![work Required information M10-2 Recording Sales and State Tax [LO 10-2] [The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7c0e42c692_80366f7c0e382494.jpg)

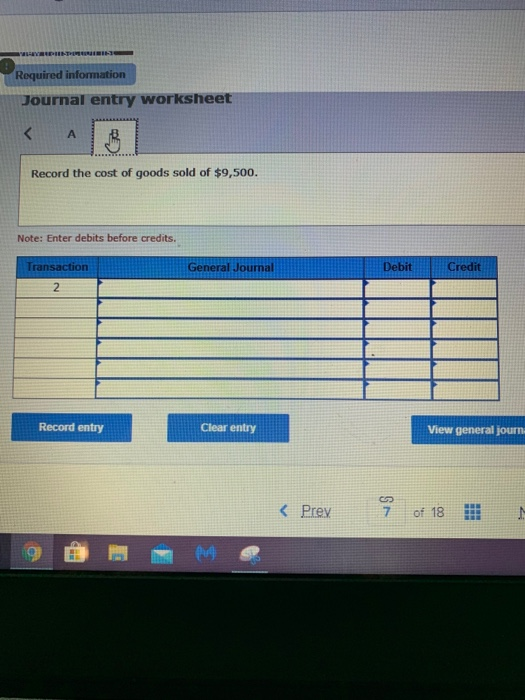

Chapter 10 - Homework Help Save & Exit Submit Check my work Required information M10-2 Recording Sales and State Tax [LO 10-2] [The following information applies to the questions displayed below) Grandpa Clocks, Inc. (GCT), is a retailer of wall, mantle, and grandfather clocks. Assume GCI sells a grandfather clock for $13,500 cash plus 4 percent sales tax. The clock had originally cost GCI $9,500. Show the accounting equation effects and prepare the journal entries related to this transaction Assume GCI uses a perpetual inventory system. M10-2 Part 1 1. Indicate the effects of the amounts for the above transactions. (Enter any decreases to assets, liabilities, or stockholders equity with a minus sign.) Assets + Llabilities Stockholders' Equity EVENTERIN Required information Journal entry worksheet Record the sales revenue of $13,500 plus 4 percent sales tax. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general jour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts