Question: Chapter 10 Liabilities 473 EXERCISE 10.2 Listed below are eight events or transactions of Ge a. Made an adjusting entry to record interest on a

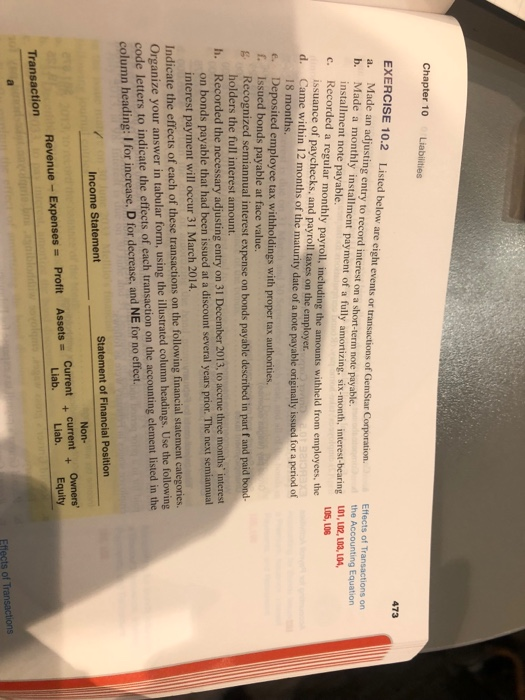

Chapter 10 Liabilities 473 EXERCISE 10.2 Listed below are eight events or transactions of Ge a. Made an adjusting entry to record interest on a short-term note payable. b. Made a monthly installment payment of a fully amortizing, six-month, interest-bearing , Liz, Effects of Transactions on the Accounting Equation L01, L02, L03, LO4 LO5, LOS installment note payable. Recorded a regular monthly payroll, including the issuance of paychecks, and payroll taxes on the employer. c. withheld from employees, the d. Came within 12 months of the maturity date of a note payable originally issued for :a 18 months. Deposited employee tax withholdings with proper tax authorities. Issued bonds payable at face value. Recognized semiannual interest expense on bonds payable described in part f and paid holders the full interest amount e. f. h. Recorded the necessary adjusting entry on 31 December 2013, to accrue three months interest on bonds payable that had been issued at a discount several years prior. The next semiannual interest payment will occur 31 March 2014. Indicate the effects of each of these transactions on the following financial statement categor Organize your answer in tabular form, using the illustrated column headings. Use the following code letters to indicate the effects of each transaction on the accounting element listed in the column heading: I for increase, D for decrease, and NE for no effect. Statement of Financial Position Income Statement Non- Revenue - Expenses Profit Assets Current + current + Owners' Equity Liab. Liab Transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts