Question: Chapter 10, Problem 021 (GO Tutorial) Your answer is partially correct. Try again. Milliken uses a digitally controlled dyer for placing intricate and integrated patterns

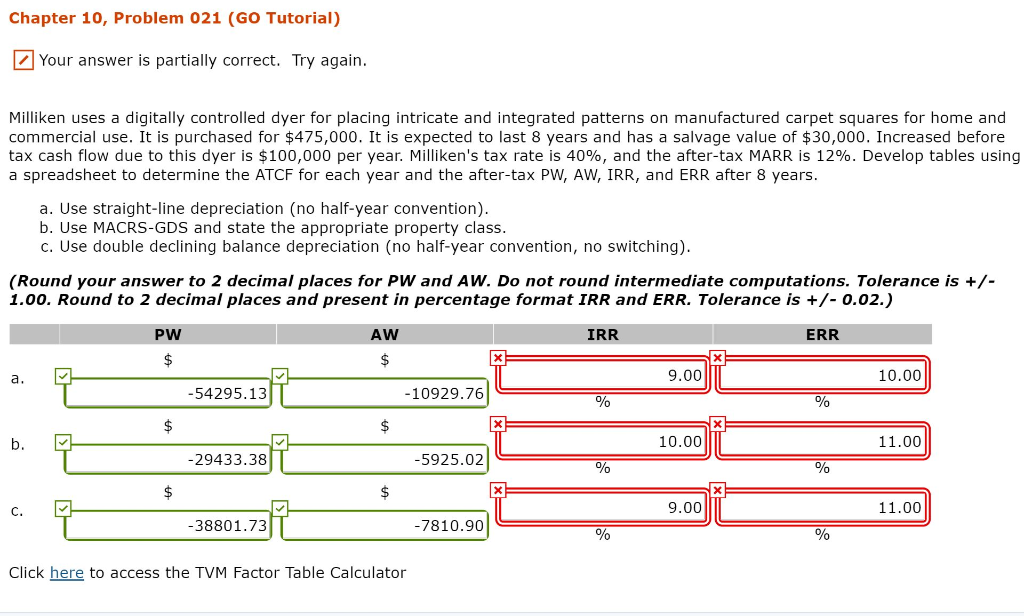

Chapter 10, Problem 021 (GO Tutorial) Your answer is partially correct. Try again. Milliken uses a digitally controlled dyer for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $475,000. It is expected to last 8 years and has a salvage value of $30,000. Increased before tax cash flow due to this dyer is $100,000 per year. Milliken's tax rate is 40%, and the after-tax MARR is 12%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after 8 years. a. Use straight-line depreciation (no half-year convention). b. Use MACRS-GDS and state the appropriate property class. c. Use double declining balance depreciation (no half-year convention, no switching). (Round your answer to 2 decimal places for PW and AW. Do not round intermediate computations. Tolerance is +/- 1.00. Round to 2 decimal places and present in percentage format IRR and ERR. Tolerance is +/- 0.02.) PW AW IRR ERR $ a. 9.00 T 10.00|| -54295.13 -10929.76 % % $ b. BR 10.00 11.00 -29433.38 -5925.02 % 9.00 11.00 C -38801.73 T -7810.90 9% Click here to access the TVM Factor Table Calculator Chapter 10, Problem 021 (GO Tutorial) Your answer is partially correct. Try again. Milliken uses a digitally controlled dyer for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $475,000. It is expected to last 8 years and has a salvage value of $30,000. Increased before tax cash flow due to this dyer is $100,000 per year. Milliken's tax rate is 40%, and the after-tax MARR is 12%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after 8 years. a. Use straight-line depreciation (no half-year convention). b. Use MACRS-GDS and state the appropriate property class. c. Use double declining balance depreciation (no half-year convention, no switching). (Round your answer to 2 decimal places for PW and AW. Do not round intermediate computations. Tolerance is +/- 1.00. Round to 2 decimal places and present in percentage format IRR and ERR. Tolerance is +/- 0.02.) PW AW IRR ERR $ a. 9.00 T 10.00|| -54295.13 -10929.76 % % $ b. BR 10.00 11.00 -29433.38 -5925.02 % 9.00 11.00 C -38801.73 T -7810.90 9% Click here to access the TVM Factor Table Calculator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts