Question: Find part B only, using Flat 25% Tax rate. 09.02-PRO05 WP GO Tutorial Milliken uses a digitally controlled dyer for placing intricate and integrated patterns

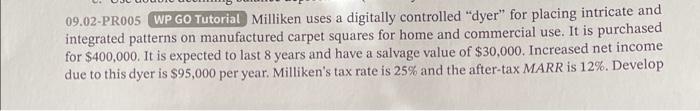

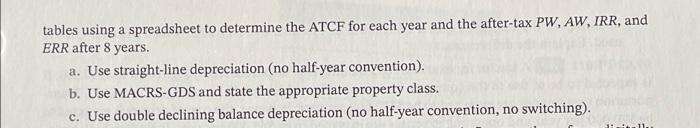

09.02-PRO05 WP GO Tutorial Milliken uses a digitally controlled "dyer" for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. It is expected to last 8 years and have a salvage value of $30,000. Increased net income due to this dyer is $95,000 per year. Milliken's tax rate is 25% and the after-tax MARR is 12%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after 8 years. a. Use straight-line depreciation (no half-year convention). b. Use MACRS-GDS and state the appropriate property class. c. Use double declining balance depreciation (no half-year convention, no switching). 11. 09.02-PRO05 WP GO Tutorial Milliken uses a digitally controlled "dyer" for placing intricate and integrated patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. It is expected to last 8 years and have a salvage value of $30,000. Increased net income due to this dyer is $95,000 per year. Milliken's tax rate is 25% and the after-tax MARR is 12%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after 8 years. a. Use straight-line depreciation (no half-year convention). b. Use MACRS-GDS and state the appropriate property class. c. Use double declining balance depreciation (no half-year convention, no switching). 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts