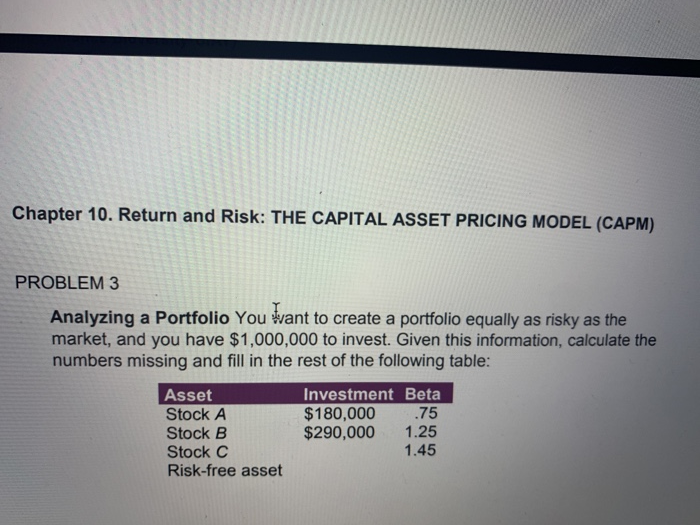

Question: Chapter 10. Return and Risk: THE CAPITAL ASSET PRICING MODEL (CAPM) PROBLEM 3 Analyzing a Portfolio You want to create a portfolio equally as risky

Chapter 10. Return and Risk: THE CAPITAL ASSET PRICING MODEL (CAPM) PROBLEM 3 Analyzing a Portfolio You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, calculate the numbers missing and fill in the rest of the following table: Asset Investment Beta Stock A $180,000 .75 Stock B $290,000 1.25 Stock C 1.45 Risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts