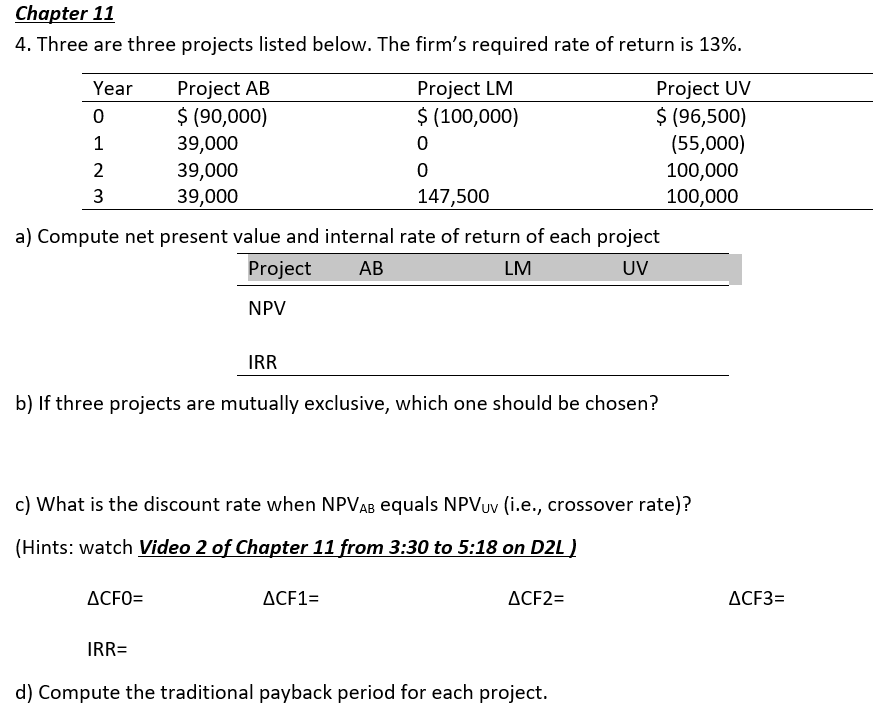

Question: Chapter 11 4. Three are three projects listed below. The firm's required rate of return is 13%. Year 0 Project LM $ (100,000) WNAO Project

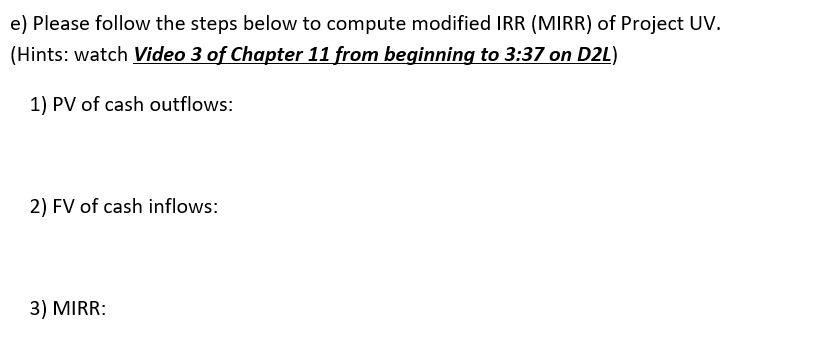

Chapter 11 4. Three are three projects listed below. The firm's required rate of return is 13%. Year 0 Project LM $ (100,000) WNAO Project AB $ 190,000) 39,000 39,000 39,000 Project UV $ (96,500) (55,000) 100,000 100,000 147,500 a) Compute net present value and internal rate of return of each project Project AB LM UV NPV IRR b) If three projects are mutually exclusive, which one should be chosen? c) What is the discount rate when NPVAB equals NPVUV (i.e., crossover rate)? (Hints: watch Video 2 of Chapter 11 from 3:30 to 5:18 on D2L) ACFO= ACF1= ACF2= ACF3= IRR= d) Compute the traditional payback period for each project. e) Please follow the steps below to compute modified IRR (MIRR) of Project UV. (Hints: watch Video 3 of Chapter 11 from beginning to 3:37 on D2L) 1) PV of cash outflows: 2) FV of cash inflows: 3) MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts