Question: Chapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit 2 On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to

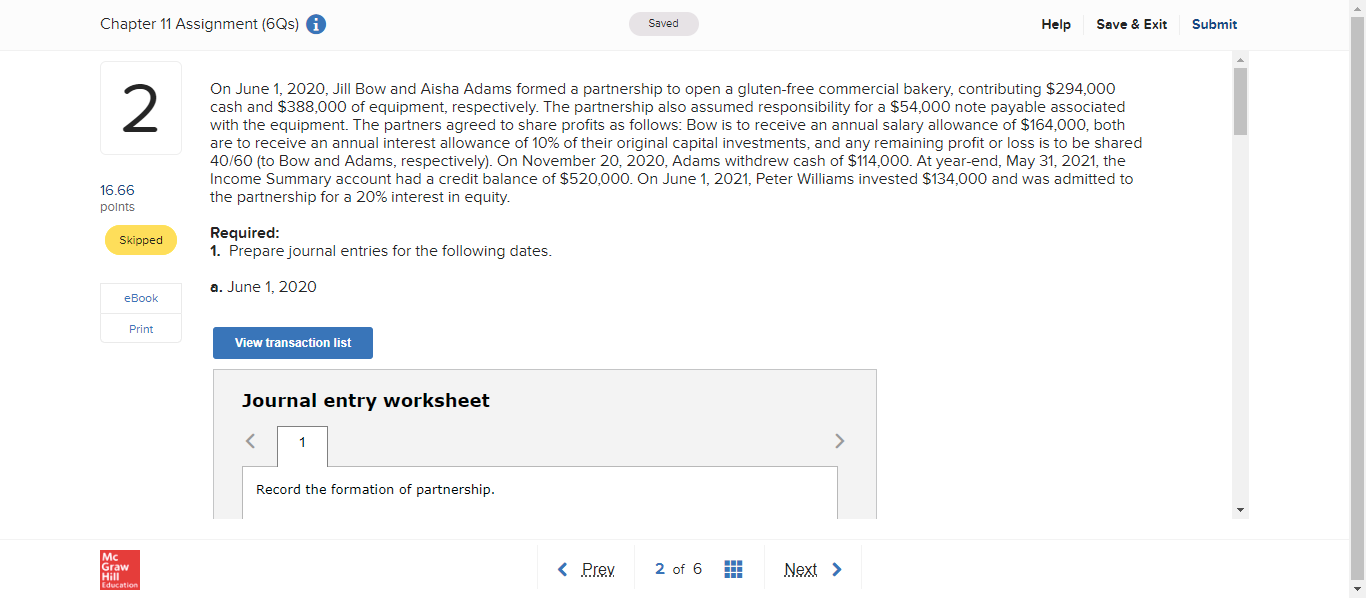

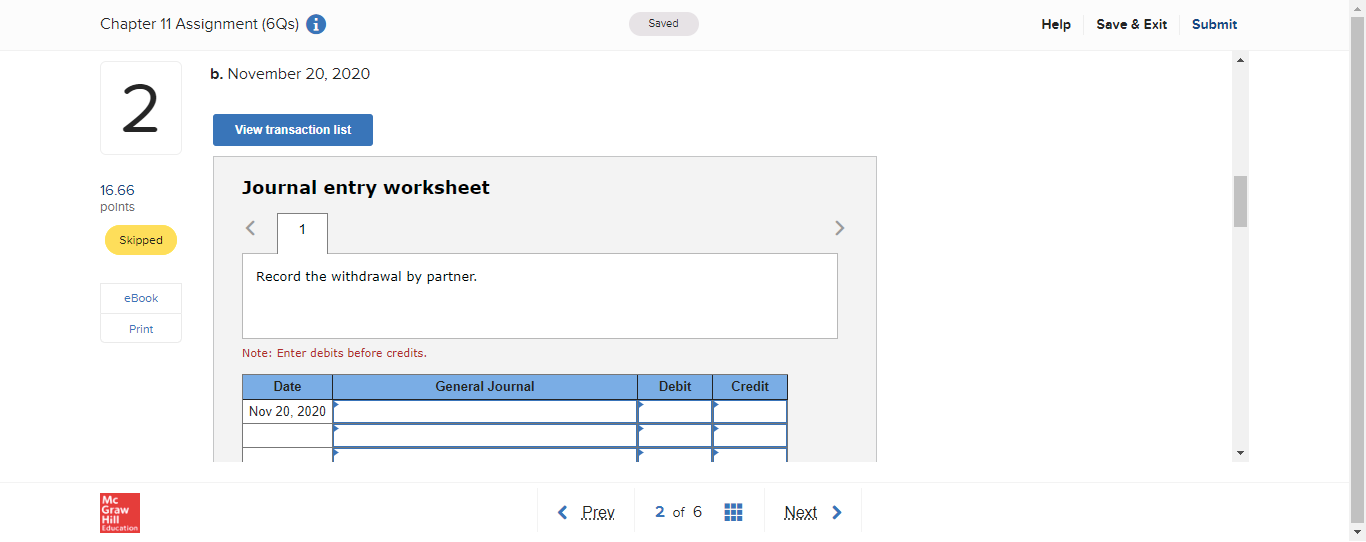

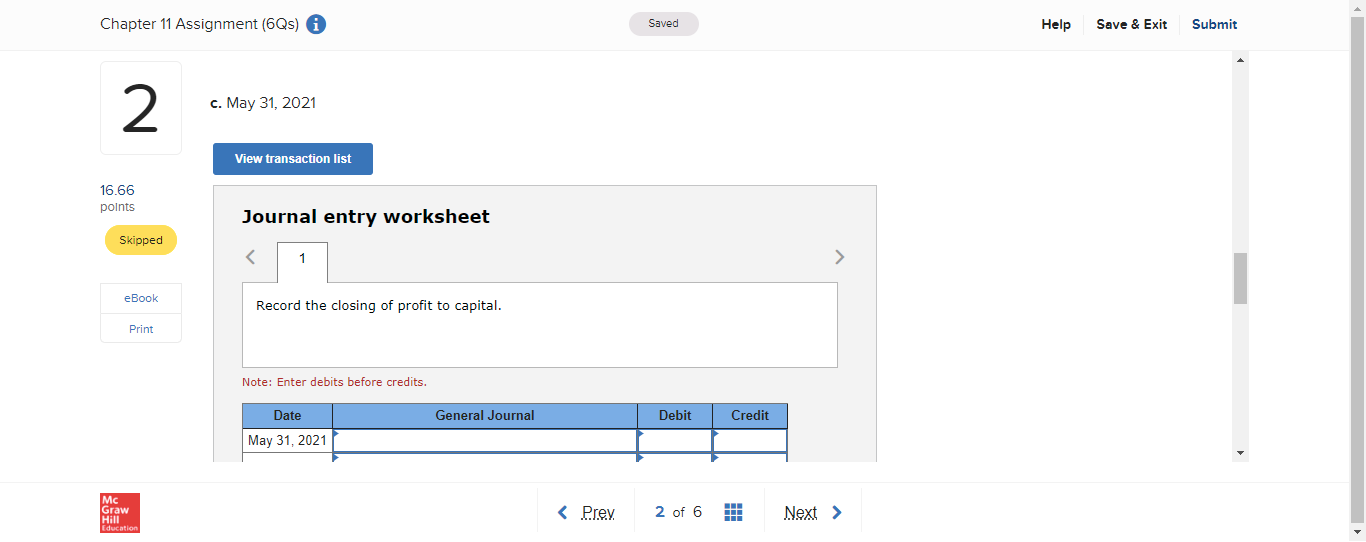

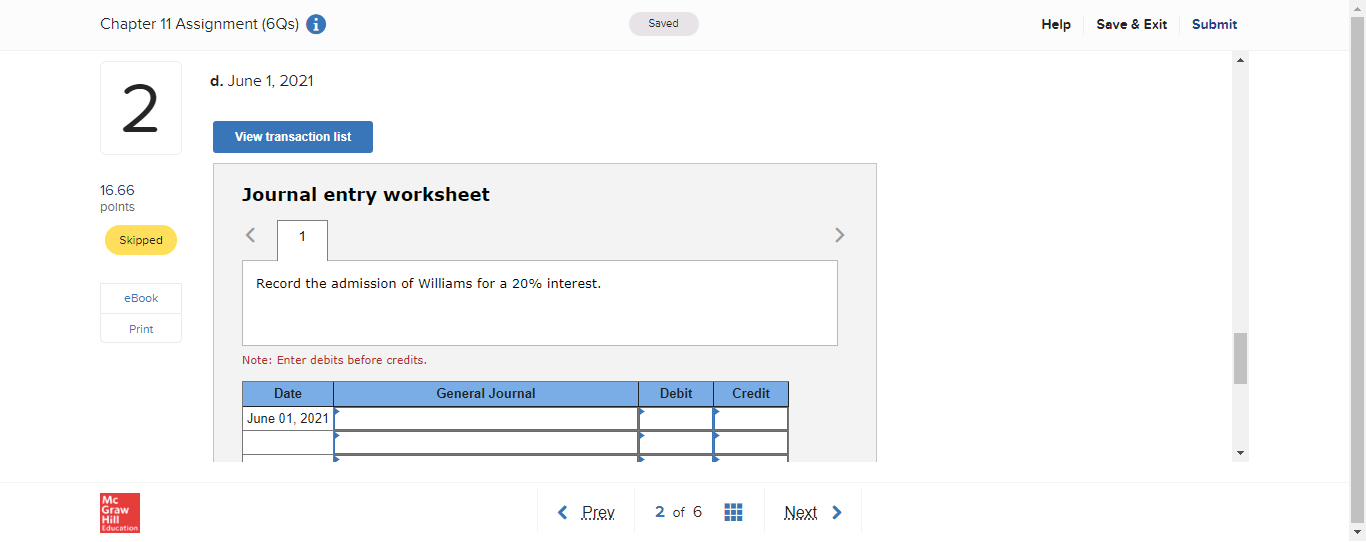

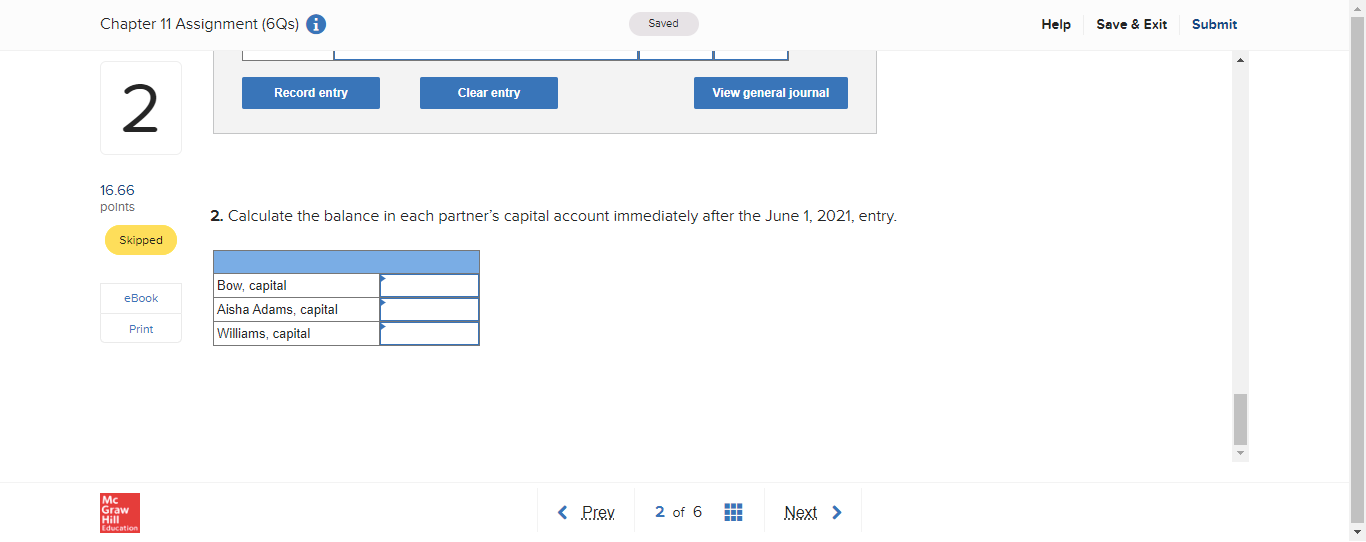

Chapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit 2 On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $294,000 cash and $388,000 of equipment, respectively. The partnership also assumed responsibility for a $54,000 note payable associated with the equipment. The partners agreed to share profits as follows: Bow is to receive an annual salary allowance of $164,000, both are to receive an annual interest allowance of 10% of their original capital investments, and any remaining profit or loss is to be shared 40/60 (to Bow and Adams, respectively). On November 20, 2020, Adams withdrew cash of $114,000. At year-end, May 31, 2021, the 16.66 Income Summary account had a credit balance of $520,000. On June 1, 2021, Peter Williams invested $134,000 and was admitted to the partnership for a 20% interest in equity. points Skipped Required: 1. Prepare journal entries for the following dates. a. June 1, 2020 eBook Print View transaction list Journal entry worksheet Record the formation of partnership. Mc Graw Hill EducationChapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit b. November 20, 2020 2 View transaction list 16.66 Journal entry worksheet points Skipped Record the withdrawal by partner. eBook Print Note: Enter debits before credits. Date General Journal Debit Credit Nov 20, 2020 Mc Graw 2 of 6 Hill EducationChapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit 2 c. May 31, 2021 View transaction list 16.66 points Journal entry worksheet Skipped > eBook Record the closing of profit to capital. Print Note: Enter debits before credits. Date General Journal Debit Credit May 31, 2021 Mc Graw Hill EducationChapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit d. June 1, 2021 2 View transaction list 16.66 Journal entry worksheet points Skipped Record the admission of Williams for a 20% interest. eBook Print Note: Enter debits before credits. Date General Journal Debit Credit June 01, 2021 Mc Graw Hill EducationChapter 11 Assignment (6Qs) i Saved Help Save & Exit Submit 2 Record entry Clear entry View general journal 16.66 points 2. Calculate the balance in each partner's capital account immediately after the June 1, 2021, entry. Skipped Bow, capital eBook Aisha Adams, capital Print Williams, capital Mc Graw Education