Question: ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims. 36 Blackboard H Handshake YLS HBS HLS+CAMBRIDGE BBJA ACJ Embraer 31 MAN Com Put on sleep music 7/12/20, 9:00 PM Lal Lab Saved Help

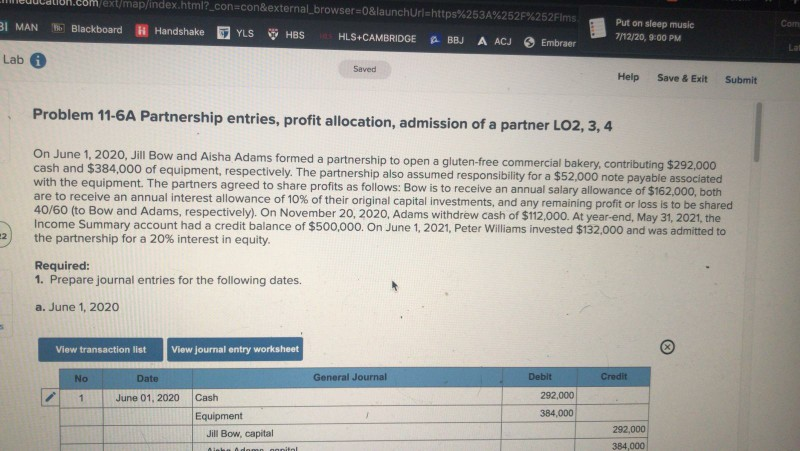

ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims. 36 Blackboard H Handshake YLS HBS HLS+CAMBRIDGE BBJA ACJ Embraer 31 MAN Com Put on sleep music 7/12/20, 9:00 PM Lal Lab Saved Help Save & Exit Submit Problem 11-6A Partnership entries, profit allocation, admission of a partner LO2, 3, 4 On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $292,000 cash and $384,000 of equipment, respectively. The partnership also assumed responsibility for a $52,000 note payable associated with the equipment. The partners agreed to share profits as follows: Bow is to receive an annual salary allowance of $162,000, both are to receive an annual interest allowance of 10% of their original capital investments, and any remaining profit or loss is to be shared 40/60 (to Bow and Adams, respectively). On November 20, 2020, Adams withdrew cash of $112,000. At year-end, May 31, 2021, the Income Summary account had a credit balance of $500,000. On June 1, 2021, Peter Williams invested $132,000 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the following dates. a. June 1, 2020 2 View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 June 01, 2020 Cash Equipment Jill Bow, capital 292,000 384,000 292,000 384,000 ALA nmn nonital ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims. 36 Blackboard H Handshake YLS HBS HLS+CAMBRIDGE BBJA ACJ Embraer 31 MAN Com Put on sleep music 7/12/20, 9:00 PM Lal Lab Saved Help Save & Exit Submit Problem 11-6A Partnership entries, profit allocation, admission of a partner LO2, 3, 4 On June 1, 2020, Jill Bow and Aisha Adams formed a partnership to open a gluten-free commercial bakery, contributing $292,000 cash and $384,000 of equipment, respectively. The partnership also assumed responsibility for a $52,000 note payable associated with the equipment. The partners agreed to share profits as follows: Bow is to receive an annual salary allowance of $162,000, both are to receive an annual interest allowance of 10% of their original capital investments, and any remaining profit or loss is to be shared 40/60 (to Bow and Adams, respectively). On November 20, 2020, Adams withdrew cash of $112,000. At year-end, May 31, 2021, the Income Summary account had a credit balance of $500,000. On June 1, 2021, Peter Williams invested $132,000 and was admitted to the partnership for a 20% interest in equity. Required: 1. Prepare journal entries for the following dates. a. June 1, 2020 2 View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 June 01, 2020 Cash Equipment Jill Bow, capital 292,000 384,000 292,000 384,000 ALA nmn nonital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts