Question: Chapter 12 Assignment Chegg Study | Gu 12 Assignment Question 8 (of 9) value 1.00 points You are a consultant to a firm evaluating an

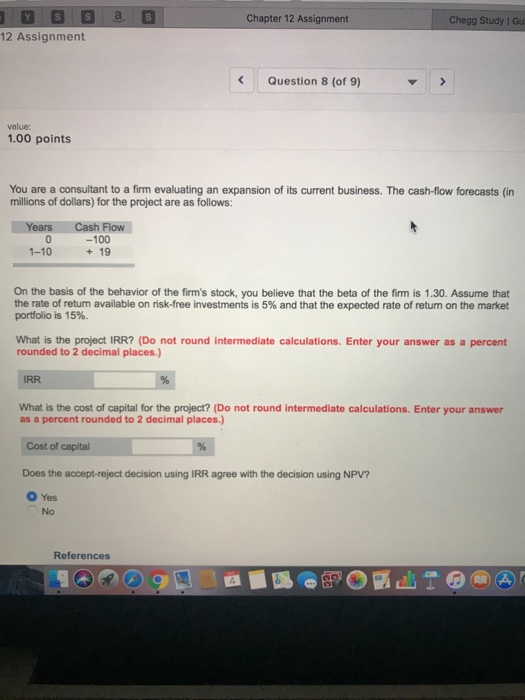

Chapter 12 Assignment Chegg Study | Gu 12 Assignment Question 8 (of 9) value 1.00 points You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Cash Flow -100 +19 1-10 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.30. Assume that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 15%. What is the project IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) IRR What is the cost of capital for the project? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) 2 decimal Cost of capital Does the accept-reject decision using IRR agree with the decision using NPV? Yes No References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts