Question: Chapter 12 Basic Homework eBook Calculator Print Item The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $103,000 and $72,000, respectively, on

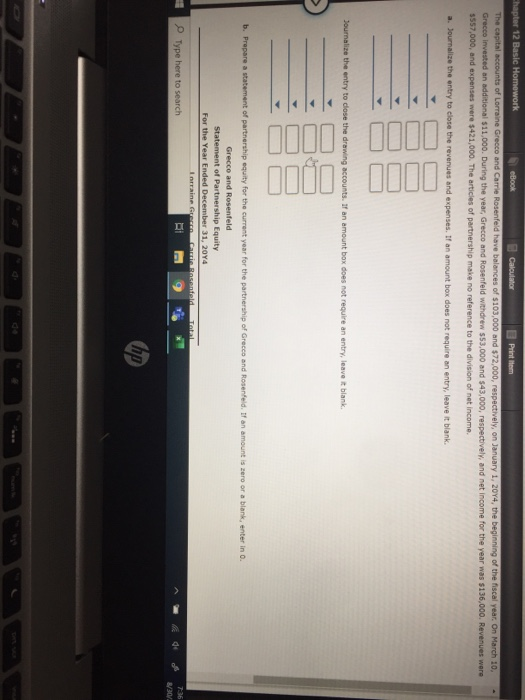

Chapter 12 Basic Homework eBook Calculator Print Item The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $103,000 and $72,000, respectively, on January 1, 2014, the beginning of the fiscal year. On March 10, Grecco invested an additional $11,000. During the year, Grecco and Rosenfeld withdrew $53.000 and 543,000, respectively, and net income for the year was $136,000. Revenues were 5557,000, and expenses were $421,000. The articles of partnership make no reference to the division of net income. a. Journalize the entry to close the revenues and expenses. If an amount box does not require an entry, leave it blank. E Journalize the entry to close the drawing accounts. If an amount box does not require an entry, leave it blank b. Prepare a statement of partnership equity for the current year for the partnership of Grecco and Rosenfeld. If an amount is zero or a blank, enter in o. Grecco and Rosenfeld Statement of Partnership Equity For the Year Ended December 31, 2014 Irraine Guecen Cautin Rasentral Total Type here to search BE 7:36 8/30/ hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts