Question: Chapter 12 Financial Planning Exercise 12 Calculating and comparing current yields Two bonds are given a. A 5.5%, 22-year bond at 118.432 b. A 13.9%,

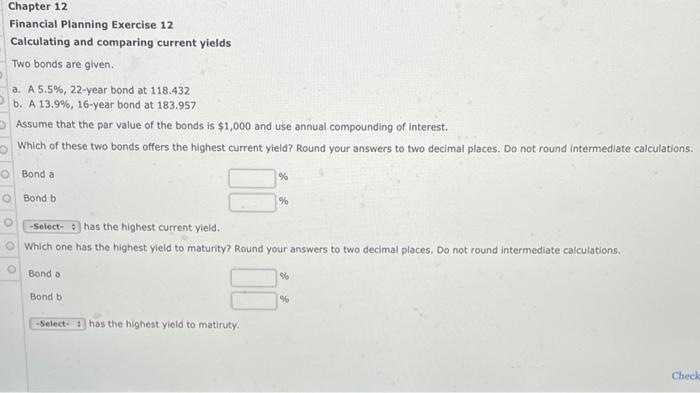

Chapter 12 Financial Planning Exercise 12 Calculating and comparing current yields Two bonds are given a. A 5.5%, 22-year bond at 118.432 b. A 13.9%, 16-year bond at 183.957 Assume that the par value of the bonds is $1,000 and use annual compounding of interest. Which of these two bonds offers the highest current yield? Round your answers to two decimal places. Do not round Intermediate calculations. O Bond a % Bond b % -Select has the highest current yield. Which one has the highest yield to maturity? Round your answers to two decimal places. Do not round intermediate calculations. Bonda 96 Bond b 96 -Select has the highest yield to matiruty Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts