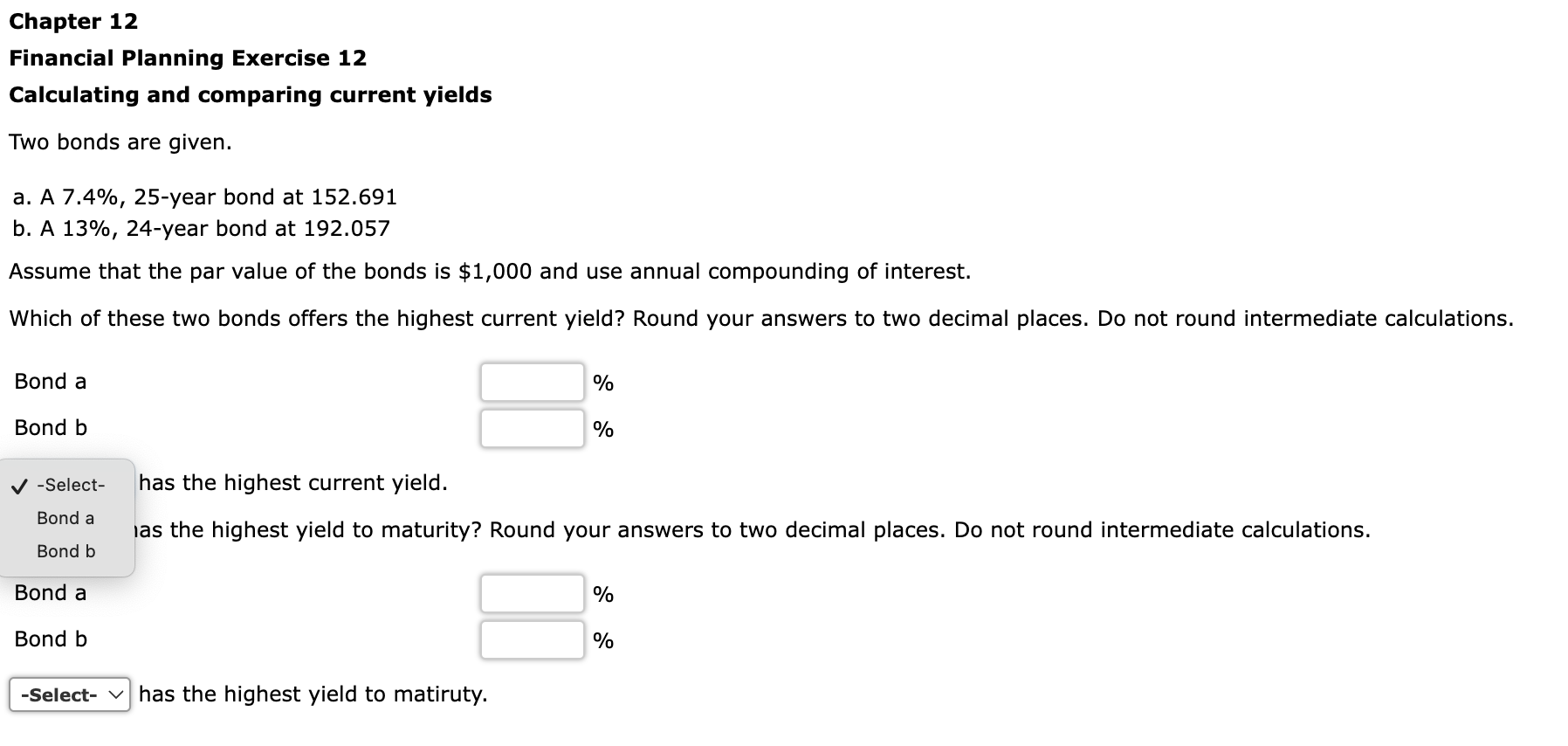

Question: Financial Planning Exercise 12 Calculating and comparing current yields Two bonds are given. a. A 7.4%, 25-year bond at 152.691 b. A 13%, 24-year bond

Financial Planning Exercise 12 Calculating and comparing current yields Two bonds are given. a. A 7.4\\%, 25-year bond at 152.691 b. A 13\\%, 24-year bond at 192.057 Assume that the par value of the bonds is \\( \\$ 1,000 \\) and use annual compounding of interest. Which of these two bonds offers the highest current yield? Round your answers to two decimal places. Do not round intermediate calculations. Bond a Bond b \ \ has the highest current yield. las the highest yield to maturity? Round your answers to two decimal places. Do not round intermediate calculations. Bond a \ Bond \\( b \\) \ has the highest yield to matiruty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts