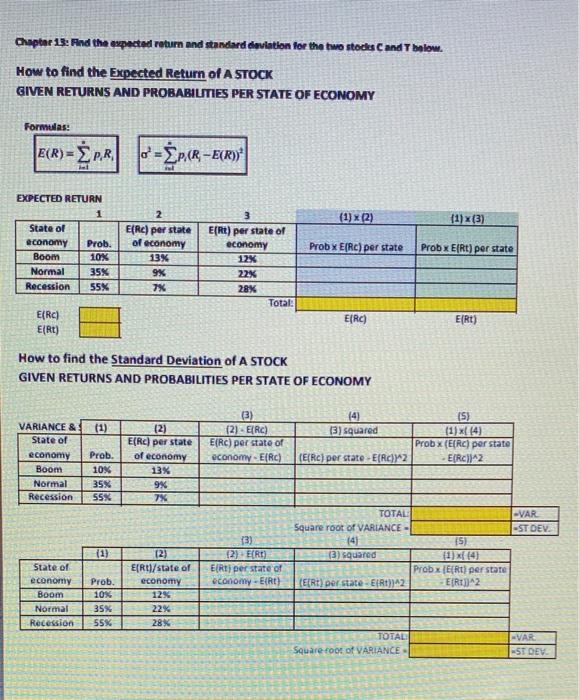

Question: Chapter 13: And the expected return and standard deviation for the two stocks Cand Tholow How to find the Expected Return of A STOCK GIVEN

Chapter 13: And the expected return and standard deviation for the two stocks Cand Tholow How to find the Expected Return of A STOCK GIVEN RETURNS AND PROBABILITIES PER STATE OF ECONOMY Formulas: E(R)= ERR -=EpcR , - E(R)" (1) X (2) (1)x(3) EXPECTED RETURN 1 State of economy Prob. Boom 10% Normal 35% Recession 55% 2 E(RC) per state of economy 13% 9% 7% Probx E[Rc) per state Prob x E(Rt) per state EfRt) per state of economy 12% 22% 28% Total: E(RC) E(Rt) E(RC) E(RL) How to find the Standard Deviation of A STOCK GIVEN RETURNS AND PROBABILITIES PER STATE OF ECONOMY (1) (4) 13) squared VARIANCE & State of economy Boom Normal Recession B) (2) - E(RC) E[Rc) per state of economy E(RC) (2) E(RC) per state of economy 13% 9% 7X (5) (1)x(14) Prob x (ERC) per state E[Rc)^2 Prob. 10% 35% SSX (ERC) per state-E(RC)^2 -VAR -ST DEV. (1) 13) 12) ERT) Ett per state of economy - E(R) TOTAL Square root of VARIANCE- 141 15) 3) squared Probx (Rt) per state (E(Rt) per state-EfRt)^2 ER12 State of economy Boom Normal Recession Prob. 10% 35% 55% 12) E[RU]/state of economy 12% 22% 28% TOTAL Square foot of VARIANCE -VAR EST DEV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts