Question: Chapter 14 Homework Assignment No. 1 Questions - Saved to this PC ut References Malings Review View Help Search 11AA Aa Font Paragraph Styles Complete

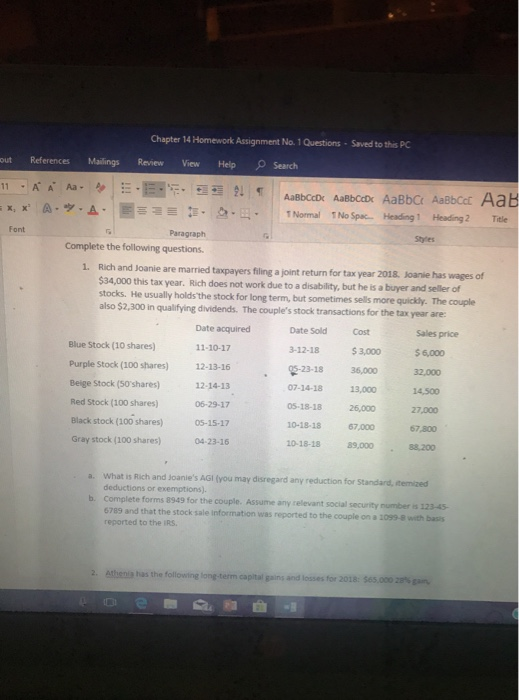

Chapter 14 Homework Assignment No. 1 Questions - Saved to this PC ut References Malings Review View Help Search 11AA Aa Font Paragraph Styles Complete the following questions are married taxpayers filing a joint return for tax year 2018 Joanie has wages of 1. Rich and Joanie married $34,000 this tax year. Rich does not work due to a disability, but he is a buyer and seller of stocks. He usually holds the stock for long term, but sometimes sells more quickly. The couple also $2,300 in qualifying dividends. The couple's stock transactions for the tax year are Date acquired Date Sold Cost Sales price 3-12-18 $3,000 6,000 32,000 14,500 27,000 Blue Stock (10 shares) 11-10-17 Purple Stock (100 shares 12-13-16 12-14-13 06-29-17 Black stock (100 shares)0S-15-17 04-23-16 23-18 36,000 07-14-18 13,000 05-18-18 26,000 10-18-18 67,000 10-18-18 89,000 eige Stock (50'shares) Red Stock (100 shares) 67.800 Gray stock (100 shares) 88,200 a. What is Ruch and Joanie's AGI (you may disregard any reduction for Standard, itemized deductions or exemptions). forms 8949 for the couple. Assume any relevant social security number is 123-45- a 1099-8 with bass 6789 and that the stock sale information was reported to the couple on reported to the iRS. 2. Athen, has the following lonngterm capital gains and losses for 2018: $65.000 28% gars Chapter 14 Homework Assignment No. 1 Questions - Saved to this PC ut References Malings Review View Help Search 11AA Aa Font Paragraph Styles Complete the following questions are married taxpayers filing a joint return for tax year 2018 Joanie has wages of 1. Rich and Joanie married $34,000 this tax year. Rich does not work due to a disability, but he is a buyer and seller of stocks. He usually holds the stock for long term, but sometimes sells more quickly. The couple also $2,300 in qualifying dividends. The couple's stock transactions for the tax year are Date acquired Date Sold Cost Sales price 3-12-18 $3,000 6,000 32,000 14,500 27,000 Blue Stock (10 shares) 11-10-17 Purple Stock (100 shares 12-13-16 12-14-13 06-29-17 Black stock (100 shares)0S-15-17 04-23-16 23-18 36,000 07-14-18 13,000 05-18-18 26,000 10-18-18 67,000 10-18-18 89,000 eige Stock (50'shares) Red Stock (100 shares) 67.800 Gray stock (100 shares) 88,200 a. What is Ruch and Joanie's AGI (you may disregard any reduction for Standard, itemized deductions or exemptions). forms 8949 for the couple. Assume any relevant social security number is 123-45- a 1099-8 with bass 6789 and that the stock sale information was reported to the couple on reported to the iRS. 2. Athen, has the following lonngterm capital gains and losses for 2018: $65.000 28% gars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts