Question: CHAPTER 14 I OPTIONS. PUTS AND CALLS 587 P14.13 Nick Fitzgerald holds a well-diversified portfolio of high-quality, large-cap stocks heading for a big fall (perhaps

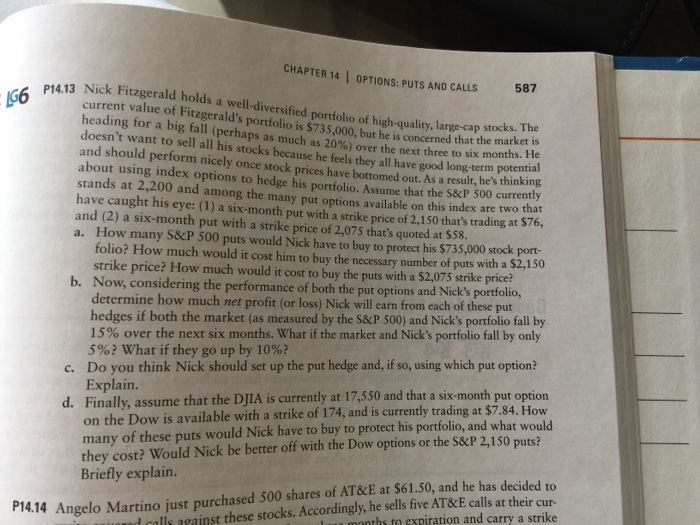

CHAPTER 14 I OPTIONS. PUTS AND CALLS 587 P14.13 Nick Fitzgerald holds a well-diversified portfolio of high-quality, large-cap stocks heading for a big fall (perhaps as much as 20%) over the next three to six month. He doesn't want to sell all his stocks because he feels they all have good long-term potential and should perform nicely once stock prices have bottomed out. As a result, he's think about using index options to hedge his portfolio. Assume that the S&P 500 c stands at 2,200 and among the many put options available on this in urrently at and (2) a six-month put with a strike price of 2,075 that's quoted at $58. a. How many S&cP 500 puts would Nick have to buy to protect his $735,000 stock port- at folio? How much would it cost him to buy the necessary number of puts with a $2,150 strike price? How much would it cost to buy the puts with a $2,075 strike price? Now, considering the performance of both the put options and Nick's portfolio, determine how much net profit (or loss) Nick will earn from eac hedges if both the market (as measured by the S&P 500) and Nick's portfolio fall by 15% over the next six months. What if the market and Nick's portfolio fall by only 5%? What if they go up by 10%? Do you think Nick should set up the put hedge and, if so, using which put option? Explain. Finally, assume that the DJIA is currently at 17,550 and th on the Dow is available with a strike of 174, and is currently trading at $7.84. How many of these puts would Nick have to buy to protect his portfolio, and what would they cost? Would Nick be better off with the Dow options or the S&P 2,150 puts? Briefly explain. b. h of these put c. at a six-month put option d. P14.14 Angelo Martino just purchased 500 shares of AT&E at $61.50, and he has decided to nths to expiration and carry a strike d calls aeainst these stocks. Accordingly, he sells five AT&E calls at their cur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts