Question: Chapter 15 Dec 459 CASE STUDY Polaris Industries Inc. operations and integration at Polaris Industries Inc, . te September 2010 Suresh Krishna, vice president of

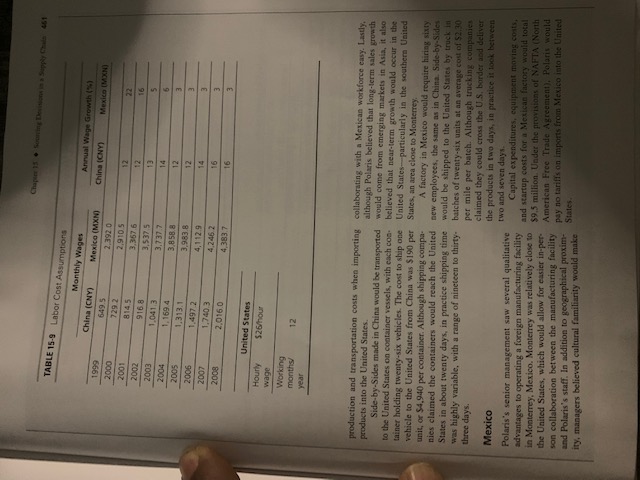

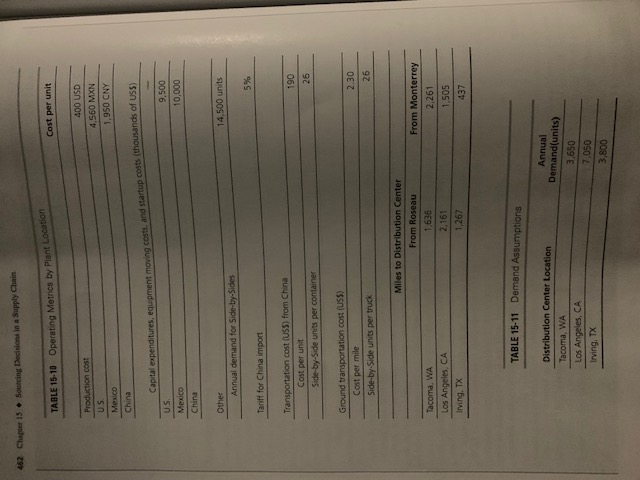

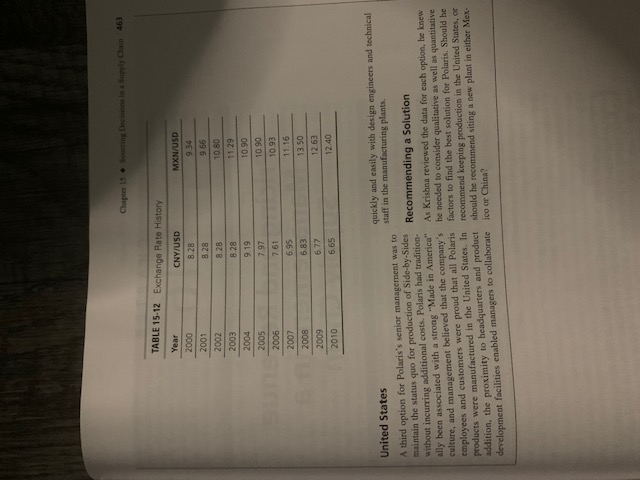

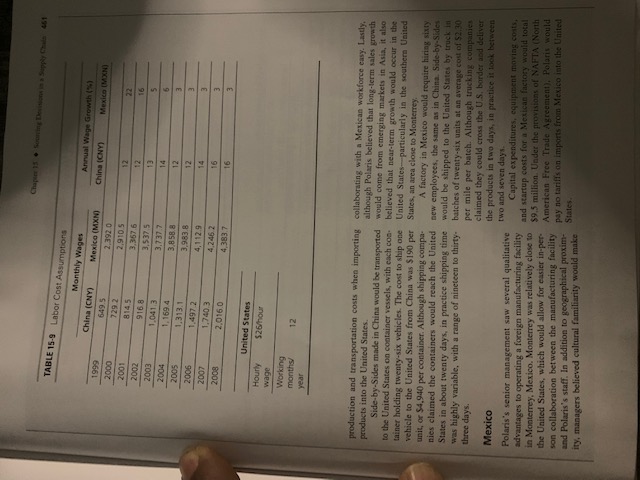

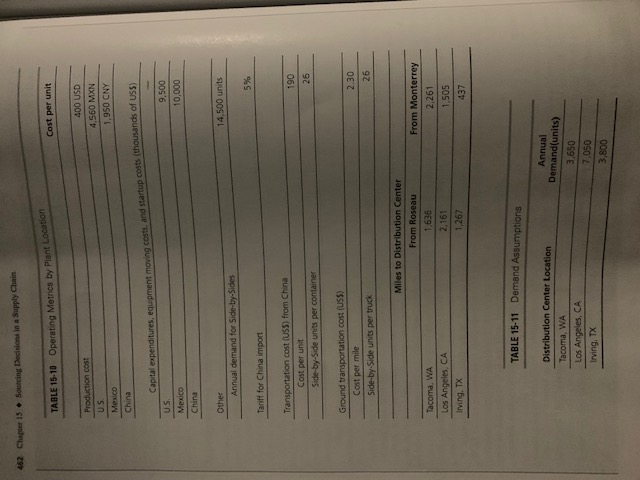

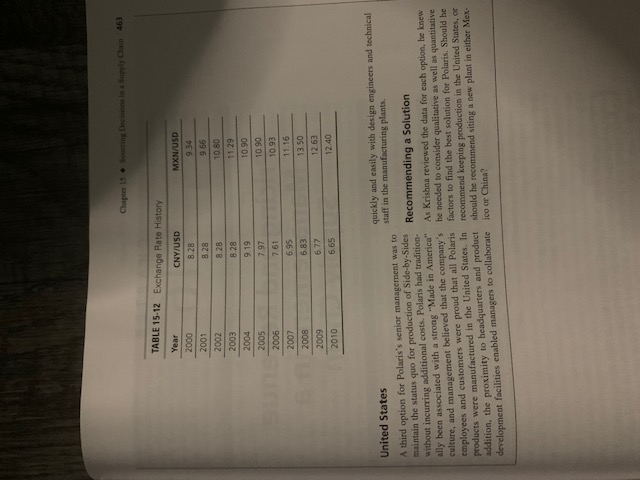

Chapter 15 Dec 459 CASE STUDY Polaris Industries Inc. operations and integration at Polaris Industries Inc, . te September 2010 Suresh Krishna, vice president of entered the parts, accessories, and apparel teement manufacturer of all-terrain vehicles (ATV), Side-by. which grew significantly over the next decade. Finally, Polaris also introduced its first on-road vehicle in Minnesota, deliberating the recommendation he was Sides, and snowmobiles, sat in his office in Medina. 1998 motorcycle with the brand me to compete with Harley Davidson Combined, these Side-by-Side vehicles. developing for a new plant to manufacture the company's products were forecasted to bring in 52.2 billion enue in 2011. Polaris's total revenue grew more than The economic slowdown in the United Sutes had 20 percent in 2010 and was expected to proto company was considering whether it should follow the put considerable pressure on Polaris's profits, so the percent in 2011 Polaris was the dominant player in the ORV mar lead of several of its competitors and open a facility in ket based on market share. In 2010 ORVs accounted for country with lower labor costs. China and Mexico were 69 percent of Polaris's sales, with Side-by-Sides com- shortlisted as possible locations for the new factory, prising the majority of sales in this segment. Looking which would be the first Polaris manufacturing facility ahead, the company was excited by the potential growth located outside the Midwestern United States. By the in emerging markets. From Latin America to Asia, end of the year Krishna needed to recommend to CEO Polaris had begun to invest heavily in marketing to Scott Wine and the board of directors whether Polaris increase awareness of its brand. For example, in China should build a new plant abroad or continue to manufac- the company placed off-road image advertising in racing ture in its American facilities. and extreme sports enthusiast publications. Similarly, in Latin America Polaris was leveraging its brand in the Polaris industries Inc. utility vehicle space to penetrate the substantial agricul- tural industries Established in 1954, Polaris was a manufacturer of high-performance motorsport products, including Manufacturing ATVs, Side-by-Sides, and snowmobiles. With nearly $2 billion in sales in 2010, it was a strong player in the In 2010 all of Polaris's manufacturing operations were $10 billion power sports market alongside competitors located in the northern Midwest. In addition to its cor- Yamaha, Honda, Arctic Cat, Ski-Doo, and Harley porate headquarters in Medina, Minnesota, and prod- uct development and innovation center in Wyoming. Davidson Polaris's customers were primarily located in Minnesota, Polaris operated three manufacturing North America (85 percent); its international customers facilities in Roseau, Minnesota: Osceola, Wisconsin: and Spirit Lake, Iowa. Roseau, the birthplace of the Polaris snowmobile, housed research, development. and manufacturing for the snowmobile, ATV, and were concentrated in Europe. Foreign markets were becoming increasingly important to Polaris, interna. tonal revenue had grown 21 percent in 2010, and was were sold through 1.500 distributors in the United States state-of-the-art injection molding plant that produced forecasted to grow even more in 2011. Polaris products Side-by-Side divisions. Roseau also included a small and 1.000 distributors in the rest of the world. Polaris's heritage was deeply rooted in the plastie parts for the Roseau and Spirit Lake factories As demand grew for ATV and on-road vehicles, power sports industry. The company introduced its Polaris established an additional manufacturing facil first snowmobile in the 1950s and its first ATV in ity in 1994 at Spirit Lake. This facility produced select 1985. Between 1985 and 2010 Polaris sold more than ATV. Watercraft, and Victory motorcycle models two million ATVs. In 1992 Polaris entered the per Osceola was primarily an engine and components sup. Sonal watercraft market, but it lacked a sustainable plier for the other two facilities All other components were sourced through more 1998 the company introduced the first Side by Side han so slobal supplier in 2010 Polaris oured off-road vehicle (ORV), which was expected to sur almost 40 percent of its components and materials from distribution system and exited the business in 2004. In ATV sales during 2011. Also in 1998. Polaris de the Supreme 460 Chapter 15 Sourcing Decisions in Supply Chain The company was also increasing low-cost country design of the supply chain. They concluded that the be (LCC) sourcing, almost doubling lis LCC spend to options were either to continue production in existing approximately 34 percent in 2010 American factories or to build a new plant in China To support its production capabilities in and Mexico around the northern United States, Polaris had three Beyond the specific pluses and minuses of each warehouse facilities in Minnesota for raw materials, location, Krishna needed to consider the following in export processing and distribution. When demand for making a final decision parts, apparel, and accessories exceeded the compa- The majority of demand for Side-by-Sides was in my's warehouse capacity in 1997, a new distribution the southern United States. The states with the center was opened in Vermillion, South Dakota. In highest share of sales volume in 2010 were Texas addition to its U.S. locations, Polaris also owned and and California operated regional sales and distribution centers in . Side-by-Sides were high volume-to-weight/low Winnipeg Canada, and in Northern Europe and value-to-weight products, which meant that ship Australia ping costs accounted for a large fraction of their retail price Redesigning the Supply Chain Polaris's senior management placed a high value Krishna had to consider the tradeoff between manufac- on case of communication with its manufacturing turing and transportation costs when redesigning the plants and believed that in person interaction supply chain for Side-by-Side products. On one hand, among managers, design engineers, and produc- manufacturing in markets with low labor costs could tion staff was a key driver of the company's long- result in significant savings. Although labor rates in term product innovation traditional LCCs such as China were rising. U.S.-based . If Polaris moved production of Side-by-Sides labor was still more costly. On the other hand, with oil abroad, the company planned to lay off sixty work prices rising steadily. Krishna knew transportation ers at its Roseau plant. Each worker would be paid costs would be far lower if he kept production close to a one-time severance of $20,000. customers. Polaris assumed that demand for Side-by-Sides Senior management at Polaris was also con- would remain flat for the next five years. cerned about a manufacturing talent gap in the United States. Over the past twenty years, decreased funding Data on labor costs, production costs, transpor for community colleges and trade schools had resulted tation costs, capital expenditures, and exchange rates in technical workers becoming increasingly difficult to for each location are included in Tables 15-9 through 15-12 find. Moreover, young trade school graduates were less interested in moving to the locations where Polaris operated, which were small towns with only one large China employer. By comparison, well-trained technical talent was relatively easy to find in many South American Polaris's senior executives were excited about the low and Asian countries. costs in China, but labor costs had been rising in the Lastly, Polaris expected much of its future sales manufacturing-heavy eastern region; over time the com growth would come from overseas markets, pany would likely have to look further inland to find particularly emerging markets. There were multiple low-cost labor, which would further increase the length ways to enter these markets, including acquisitions and variability of product transportation. Polaris also and joint ventures, but building a facility in an emerg- had concerns about its ability to successfully collaborate future demand ing market could potentially help Polaris capture with a Chinese factory due to time-zone differences and cultural dissimilarities Operating a factory in China would require Polaris Choosing a Manufacturing Location to hire sixty new employees on location. It also would result in a one-time charge of $10 million for capital optimizing the manufacture of Side-by-Sides and the Krishna and his team considered several options for expenditures, equipment moving costs, and startup costs Polaris would have to pay a 5 percent tariff on all 1999 Annual Wage Growth China C Mexico MXN 22 TABLE 15-3 Labor Cost Assumptions Monthly Wages China (CNY) Mexico (MXNO 649.5 2,392 0 2000 7292 2,9105 2001 8145 3.3576 2002 9168 3,5375 2003 1.0413 3,737.7 2004 1.169.4 3,858.8 2005 1.313.1 3,9838 2006 1,4972 4,112.9 2007 1,740.3 4.2462 2008 2,016,0 4,383.7 5 12 12 13 14 12 12 14 5 3 3 3 16 16 3 3 United States Hourly 526 hour wage Working months 12 year production and transportation costs when importing collaborating with a Mexican workforce easy. Lastly, products into the United States although Polaris believed that long-term sales growth Side-by-Sides made in China would be transported would come from emerging markets in Asia, it also to the United States on container vessels, with each con believed that near term growth would occur in the tainer holding twenty-six vehicles. The cost to ship one United States particularly in the southern United vehicle to the United States from China was $190 per States, an area close to Monterrey unit, or $4.940 per container. Although shipping compa A factory in Mexico would require hiring sixty nies claimed the containers would reach the United new employees, the same as in China. -by-Sides States in about twenty days, in practice shipping time would be shipped to the United States by truck in was highly variable, with a range of nineteen to thirty batches of twenty-six units at an average cost of $2.30 three days. per mile per batch. Although trucking companies claimed they could cross the U.S. border and deliver Mexico the products in two days, in practice it look between Polaris's senior management saw several qualitative two and seven days. Capital expenditures, equipment moving costs, advantages to operating a foreign manufacturing facility and startup costs for a Mexican factory would total in Monterrey, Mexico. Monterrey was relatively close to $9.5 million. Under the provisions of NAFTA (North the United States, which would allow for easier in-per son collaboration between the manufacturing facility American Free Trade Agreement). Polaris would and Polaris's staff. In addition to geographical proxim- pay no tariffs on imports from Mexico into the United States. ity, managers believed cultural familiarity would make 462 Chapter 15 Sourcing Decisions in a Supply Chain TAALE 15-10 Operating Metrics by Piant Location Cost per unit Production cost US 400 USD 4,560 MXN 1,950 CNY Mexico China Capital expenditures, equipment moving costs, and startup costs (thousands of USS) US 9.500 10,000 Mexico China Other Annual demand for Side-by-Sides 14,500 units 5% Tariff for China import Transportation cost (USS) from China Cost per unit Side-by-Side units per container 190 26 Ground transportation cost (5) Cost per mile Side-by-Side units per truck 2.30 26 Tacoma, WA Los Angeles, CA Irving, TX Miles to Distribution Center From Roseau 1.636 2,161 1,267 From Monterrey 2,261 1.505 437 TABLE 15-11 Demand Assumptions Distribution Center Location Tacoma, WA Los Angeles, CA Irving, TX Annual Demand(units) 3,650 7.050 3,800 Chapter 15 . being Deco Supply Chain 463 TABLE 15-12 Exchange Rate History Year 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 CNY/USD 8.28 8.28 8.28 8.28 9.19 7.97 7.61 6.95 6.83 6.77 6.65 MXN/USD 9.34 9.66 10.80 1129 10.90 10.90 10.93 11.16 13.50 12.63 12.40 2010 United States quickly and easily with design engineers and technical A third option for Polaris's senior management was to staff in the manufacturing plants. without incurring additional costs. Polaris had tradition- maintain the status quo for production of Side-by-Sides Recommending a Solution ally been associated with a strong "Made in America As Krishna reviewed the data for each option, he knew culture, and management believed that the company's he needed to consider qualitative as well as quantitative employees and customers were proud that all Polaris factors to find the best solution for Polaris. Should he products were manufactured in the United States. In recommend keeping production in the United States, or addition, the proximity to headquarters and product should he recommend siting a new plant in either Mex- development facilities enabled managers to collaborate ico or China? Chapter 15 Dec 459 CASE STUDY Polaris Industries Inc. operations and integration at Polaris Industries Inc, . te September 2010 Suresh Krishna, vice president of entered the parts, accessories, and apparel teement manufacturer of all-terrain vehicles (ATV), Side-by. which grew significantly over the next decade. Finally, Polaris also introduced its first on-road vehicle in Minnesota, deliberating the recommendation he was Sides, and snowmobiles, sat in his office in Medina. 1998 motorcycle with the brand me to compete with Harley Davidson Combined, these Side-by-Side vehicles. developing for a new plant to manufacture the company's products were forecasted to bring in 52.2 billion enue in 2011. Polaris's total revenue grew more than The economic slowdown in the United Sutes had 20 percent in 2010 and was expected to proto company was considering whether it should follow the put considerable pressure on Polaris's profits, so the percent in 2011 Polaris was the dominant player in the ORV mar lead of several of its competitors and open a facility in ket based on market share. In 2010 ORVs accounted for country with lower labor costs. China and Mexico were 69 percent of Polaris's sales, with Side-by-Sides com- shortlisted as possible locations for the new factory, prising the majority of sales in this segment. Looking which would be the first Polaris manufacturing facility ahead, the company was excited by the potential growth located outside the Midwestern United States. By the in emerging markets. From Latin America to Asia, end of the year Krishna needed to recommend to CEO Polaris had begun to invest heavily in marketing to Scott Wine and the board of directors whether Polaris increase awareness of its brand. For example, in China should build a new plant abroad or continue to manufac- the company placed off-road image advertising in racing ture in its American facilities. and extreme sports enthusiast publications. Similarly, in Latin America Polaris was leveraging its brand in the Polaris industries Inc. utility vehicle space to penetrate the substantial agricul- tural industries Established in 1954, Polaris was a manufacturer of high-performance motorsport products, including Manufacturing ATVs, Side-by-Sides, and snowmobiles. With nearly $2 billion in sales in 2010, it was a strong player in the In 2010 all of Polaris's manufacturing operations were $10 billion power sports market alongside competitors located in the northern Midwest. In addition to its cor- Yamaha, Honda, Arctic Cat, Ski-Doo, and Harley porate headquarters in Medina, Minnesota, and prod- uct development and innovation center in Wyoming. Davidson Polaris's customers were primarily located in Minnesota, Polaris operated three manufacturing North America (85 percent); its international customers facilities in Roseau, Minnesota: Osceola, Wisconsin: and Spirit Lake, Iowa. Roseau, the birthplace of the Polaris snowmobile, housed research, development. and manufacturing for the snowmobile, ATV, and were concentrated in Europe. Foreign markets were becoming increasingly important to Polaris, interna. tonal revenue had grown 21 percent in 2010, and was were sold through 1.500 distributors in the United States state-of-the-art injection molding plant that produced forecasted to grow even more in 2011. Polaris products Side-by-Side divisions. Roseau also included a small and 1.000 distributors in the rest of the world. Polaris's heritage was deeply rooted in the plastie parts for the Roseau and Spirit Lake factories As demand grew for ATV and on-road vehicles, power sports industry. The company introduced its Polaris established an additional manufacturing facil first snowmobile in the 1950s and its first ATV in ity in 1994 at Spirit Lake. This facility produced select 1985. Between 1985 and 2010 Polaris sold more than ATV. Watercraft, and Victory motorcycle models two million ATVs. In 1992 Polaris entered the per Osceola was primarily an engine and components sup. Sonal watercraft market, but it lacked a sustainable plier for the other two facilities All other components were sourced through more 1998 the company introduced the first Side by Side han so slobal supplier in 2010 Polaris oured off-road vehicle (ORV), which was expected to sur almost 40 percent of its components and materials from distribution system and exited the business in 2004. In ATV sales during 2011. Also in 1998. Polaris de the Supreme 460 Chapter 15 Sourcing Decisions in Supply Chain The company was also increasing low-cost country design of the supply chain. They concluded that the be (LCC) sourcing, almost doubling lis LCC spend to options were either to continue production in existing approximately 34 percent in 2010 American factories or to build a new plant in China To support its production capabilities in and Mexico around the northern United States, Polaris had three Beyond the specific pluses and minuses of each warehouse facilities in Minnesota for raw materials, location, Krishna needed to consider the following in export processing and distribution. When demand for making a final decision parts, apparel, and accessories exceeded the compa- The majority of demand for Side-by-Sides was in my's warehouse capacity in 1997, a new distribution the southern United States. The states with the center was opened in Vermillion, South Dakota. In highest share of sales volume in 2010 were Texas addition to its U.S. locations, Polaris also owned and and California operated regional sales and distribution centers in . Side-by-Sides were high volume-to-weight/low Winnipeg Canada, and in Northern Europe and value-to-weight products, which meant that ship Australia ping costs accounted for a large fraction of their retail price Redesigning the Supply Chain Polaris's senior management placed a high value Krishna had to consider the tradeoff between manufac- on case of communication with its manufacturing turing and transportation costs when redesigning the plants and believed that in person interaction supply chain for Side-by-Side products. On one hand, among managers, design engineers, and produc- manufacturing in markets with low labor costs could tion staff was a key driver of the company's long- result in significant savings. Although labor rates in term product innovation traditional LCCs such as China were rising. U.S.-based . If Polaris moved production of Side-by-Sides labor was still more costly. On the other hand, with oil abroad, the company planned to lay off sixty work prices rising steadily. Krishna knew transportation ers at its Roseau plant. Each worker would be paid costs would be far lower if he kept production close to a one-time severance of $20,000. customers. Polaris assumed that demand for Side-by-Sides Senior management at Polaris was also con- would remain flat for the next five years. cerned about a manufacturing talent gap in the United States. Over the past twenty years, decreased funding Data on labor costs, production costs, transpor for community colleges and trade schools had resulted tation costs, capital expenditures, and exchange rates in technical workers becoming increasingly difficult to for each location are included in Tables 15-9 through 15-12 find. Moreover, young trade school graduates were less interested in moving to the locations where Polaris operated, which were small towns with only one large China employer. By comparison, well-trained technical talent was relatively easy to find in many South American Polaris's senior executives were excited about the low and Asian countries. costs in China, but labor costs had been rising in the Lastly, Polaris expected much of its future sales manufacturing-heavy eastern region; over time the com growth would come from overseas markets, pany would likely have to look further inland to find particularly emerging markets. There were multiple low-cost labor, which would further increase the length ways to enter these markets, including acquisitions and variability of product transportation. Polaris also and joint ventures, but building a facility in an emerg- had concerns about its ability to successfully collaborate future demand ing market could potentially help Polaris capture with a Chinese factory due to time-zone differences and cultural dissimilarities Operating a factory in China would require Polaris Choosing a Manufacturing Location to hire sixty new employees on location. It also would result in a one-time charge of $10 million for capital optimizing the manufacture of Side-by-Sides and the Krishna and his team considered several options for expenditures, equipment moving costs, and startup costs Polaris would have to pay a 5 percent tariff on all 1999 Annual Wage Growth China C Mexico MXN 22 TABLE 15-3 Labor Cost Assumptions Monthly Wages China (CNY) Mexico (MXNO 649.5 2,392 0 2000 7292 2,9105 2001 8145 3.3576 2002 9168 3,5375 2003 1.0413 3,737.7 2004 1.169.4 3,858.8 2005 1.313.1 3,9838 2006 1,4972 4,112.9 2007 1,740.3 4.2462 2008 2,016,0 4,383.7 5 12 12 13 14 12 12 14 5 3 3 3 16 16 3 3 United States Hourly 526 hour wage Working months 12 year production and transportation costs when importing collaborating with a Mexican workforce easy. Lastly, products into the United States although Polaris believed that long-term sales growth Side-by-Sides made in China would be transported would come from emerging markets in Asia, it also to the United States on container vessels, with each con believed that near term growth would occur in the tainer holding twenty-six vehicles. The cost to ship one United States particularly in the southern United vehicle to the United States from China was $190 per States, an area close to Monterrey unit, or $4.940 per container. Although shipping compa A factory in Mexico would require hiring sixty nies claimed the containers would reach the United new employees, the same as in China. -by-Sides States in about twenty days, in practice shipping time would be shipped to the United States by truck in was highly variable, with a range of nineteen to thirty batches of twenty-six units at an average cost of $2.30 three days. per mile per batch. Although trucking companies claimed they could cross the U.S. border and deliver Mexico the products in two days, in practice it look between Polaris's senior management saw several qualitative two and seven days. Capital expenditures, equipment moving costs, advantages to operating a foreign manufacturing facility and startup costs for a Mexican factory would total in Monterrey, Mexico. Monterrey was relatively close to $9.5 million. Under the provisions of NAFTA (North the United States, which would allow for easier in-per son collaboration between the manufacturing facility American Free Trade Agreement). Polaris would and Polaris's staff. In addition to geographical proxim- pay no tariffs on imports from Mexico into the United States. ity, managers believed cultural familiarity would make 462 Chapter 15 Sourcing Decisions in a Supply Chain TAALE 15-10 Operating Metrics by Piant Location Cost per unit Production cost US 400 USD 4,560 MXN 1,950 CNY Mexico China Capital expenditures, equipment moving costs, and startup costs (thousands of USS) US 9.500 10,000 Mexico China Other Annual demand for Side-by-Sides 14,500 units 5% Tariff for China import Transportation cost (USS) from China Cost per unit Side-by-Side units per container 190 26 Ground transportation cost (5) Cost per mile Side-by-Side units per truck 2.30 26 Tacoma, WA Los Angeles, CA Irving, TX Miles to Distribution Center From Roseau 1.636 2,161 1,267 From Monterrey 2,261 1.505 437 TABLE 15-11 Demand Assumptions Distribution Center Location Tacoma, WA Los Angeles, CA Irving, TX Annual Demand(units) 3,650 7.050 3,800 Chapter 15 . being Deco Supply Chain 463 TABLE 15-12 Exchange Rate History Year 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 CNY/USD 8.28 8.28 8.28 8.28 9.19 7.97 7.61 6.95 6.83 6.77 6.65 MXN/USD 9.34 9.66 10.80 1129 10.90 10.90 10.93 11.16 13.50 12.63 12.40 2010 United States quickly and easily with design engineers and technical A third option for Polaris's senior management was to staff in the manufacturing plants. without incurring additional costs. Polaris had tradition- maintain the status quo for production of Side-by-Sides Recommending a Solution ally been associated with a strong "Made in America As Krishna reviewed the data for each option, he knew culture, and management believed that the company's he needed to consider qualitative as well as quantitative employees and customers were proud that all Polaris factors to find the best solution for Polaris. Should he products were manufactured in the United States. In recommend keeping production in the United States, or addition, the proximity to headquarters and product should he recommend siting a new plant in either Mex- development facilities enabled managers to collaborate ico or China