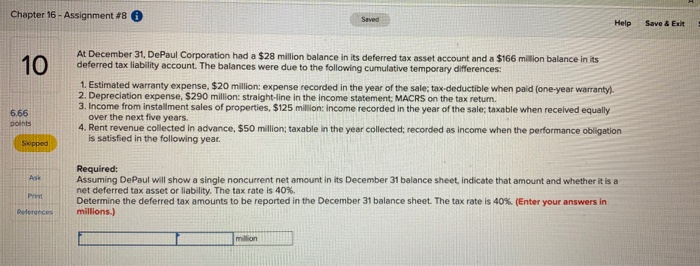

Question: Chapter 16 - Assignment #8 Help Save & Exit At December 31, DePaul Corporation had a $28 million balance in its deferred tax asset account

Chapter 16 - Assignment #8 Help Save & Exit At December 31, DePaul Corporation had a $28 million balance in its deferred tax asset account and a $166 million balance in its deferred tax liability account. The balances were due to the following cumulative temporary differences: 1. Estimated warranty expense, $20 million expense recorded in the year of the sale, tax deductible when paid (one-year warranty 2. Depreciation expense, $290 million straight-line in the income statement: MACRS on the tax return. 3. Income from installment sales of properties, $125 million income recorded in the year of the sale; taxable when received equally over the next five years. 4. Rent revenue collected in advance. $50 million; taxable in the year collected; recorded as income when the performance obligation is satisfied in the following year. Required: Assuming DePaul will show a single noncurrent net amount in its December 31 balance sheet. Indicate that amount and whether it is a net deferred tax asset or liability. The tax rate is 40% Determine the deferred tax amounts to be reported in the December 31 balance sheet. The tax rate is 40% Enter your answers in millions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts