Question: Chapter 16 Exercise Problem Listed below are 2019 year-end balance sheet and 2019 income statement for Stone Roses Co. Its sales for 2020 are projected

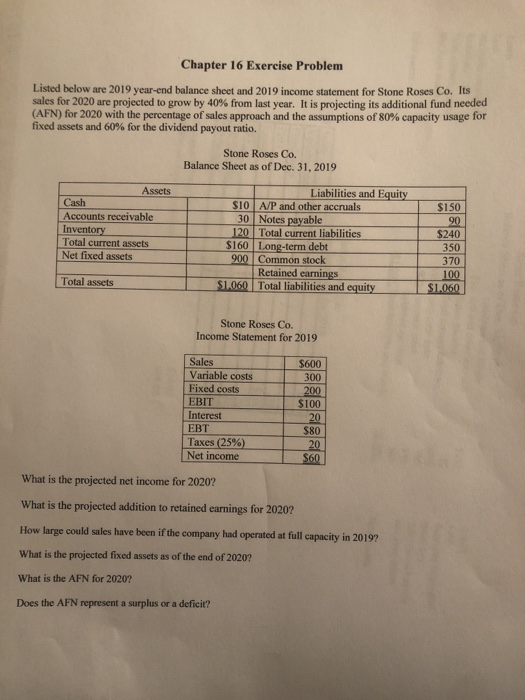

Chapter 16 Exercise Problem Listed below are 2019 year-end balance sheet and 2019 income statement for Stone Roses Co. Its sales for 2020 are projected to grow by 40% from last year. It is projecting its additional fund needed (AFN) for 2020 with the percentage of sales approach and the assumptions of 80% capacity usage for fixed assets and 60% for the dividend payout ratio. Stone Roses Co. Balance Sheet as of Dec. 31, 2019 SISO Assets Cash Accounts receivable Inventory Total current assets Net fixed assets S10 A/P and other accruals 30 Notes payable 120 Total current liabilities $160 Long-term debt 900 Common stock Retained earnings S1.060 Total liabilities and equity 90 $240 350 370 Total assets 100 $1.060 Stone Roses Co. Income Statement for 2019 Sales Variable costs Fixed costs EBIT Interest EBT Taxes (25%) $600 300 200 $100 20 What is the projected net income for 2020? What is the projected addition to retained earnings for 2020? How large could sales have been if the company had operated at full capacity in 2019? What is the projected fixed assets as of the end of 2020? What is the AFN for 2020? Does the AFN represent a surplus or a deficit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts