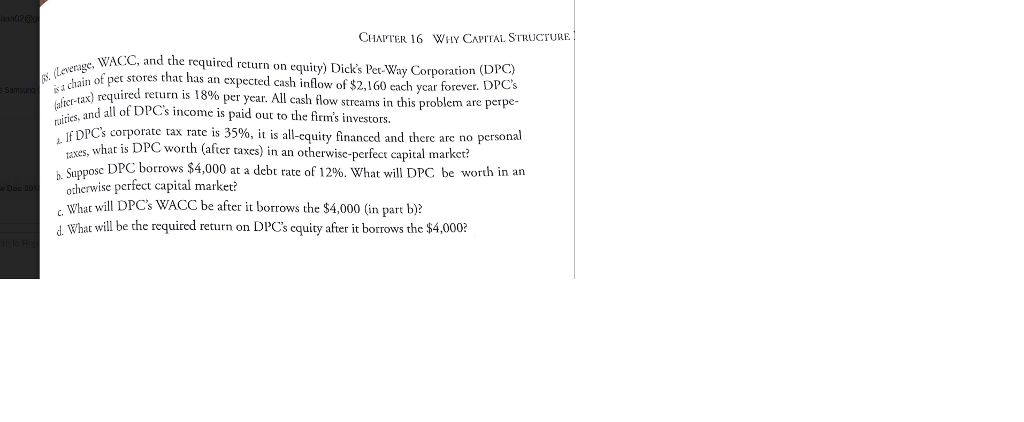

Question: CHAPTER 16 WHY CAPITAL STRUCTURE WACC, and the required return on equity) Dick's Pet-Way Corporation (DPC stores that has an expected cash inflow of $2,160

CHAPTER 16 WHY CAPITAL STRUCTURE WACC, and the required return on equity) Dick's Pet-Way Corporation (DPC stores that has an expected cash inflow of $2,160 each ycar forever. DPCs uired return is 18% peryear. All cash flow streams in this problem are perpe. isa chain of pran tax) requi ee and all of DPCs income is paid out to the firm's investors. If DPC's corporate tax rate is 35%, it is all-cquiry financed and there are no personal what is DPC worth (after taxes) in an otherwise-perfect capital markcti axes, se DPC borrows $4,000 at a debt rate of 12%. What will DPC be worth in an otherwise perfect capital market? What will DPC's WACC be after it borrows the $4,000 (in part b) b. Suppose C. d. What will be che required return on DPC's cquity after it borrows the $4,000? CHAPTER 16 WHY CAPITAL STRUCTURE WACC, and the required return on equity) Dick's Pet-Way Corporation (DPC stores that has an expected cash inflow of $2,160 each ycar forever. DPCs uired return is 18% peryear. All cash flow streams in this problem are perpe. isa chain of pran tax) requi ee and all of DPCs income is paid out to the firm's investors. If DPC's corporate tax rate is 35%, it is all-cquiry financed and there are no personal what is DPC worth (after taxes) in an otherwise-perfect capital markcti axes, se DPC borrows $4,000 at a debt rate of 12%. What will DPC be worth in an otherwise perfect capital market? What will DPC's WACC be after it borrows the $4,000 (in part b) b. Suppose C. d. What will be che required return on DPC's cquity after it borrows the $4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts