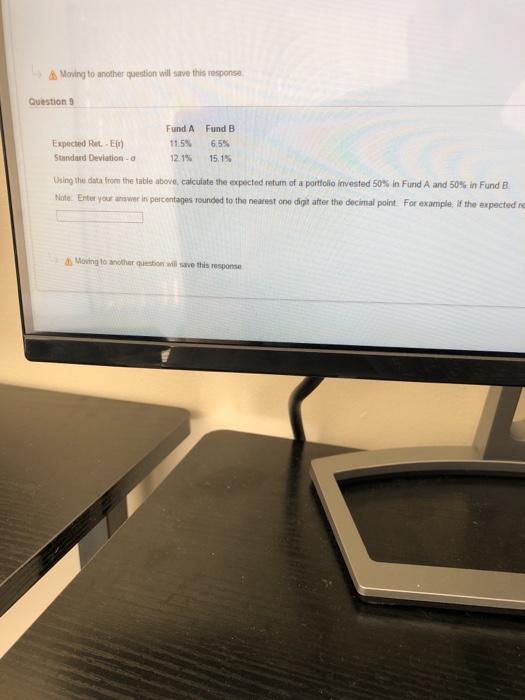

Question: Moving to another question will save this response. Question 9 Fund A 11.5% 121% Fund B 6.5% 151% Expected Ret-E) Standard Deviation-0 Using the data

Moving to another question will save this response. Question 9 Fund A 11.5% 121% Fund B 6.5% 151% Expected Ret-E) Standard Deviation-0 Using the data from the table above, calculate the expected return of a portfolio invested 50% in Fund A and 50% in Fund B Note Enter your answer in percentages rounded to the nearest one digit after the decimal point For example, if the expected re Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts