Question: Chapter 19 Managerial Analysis Discussion Post Group/section restrictions Available on Sunday, September 29, 2019 12:00 AM EDT Must post first Jordan and Taylor are beginning

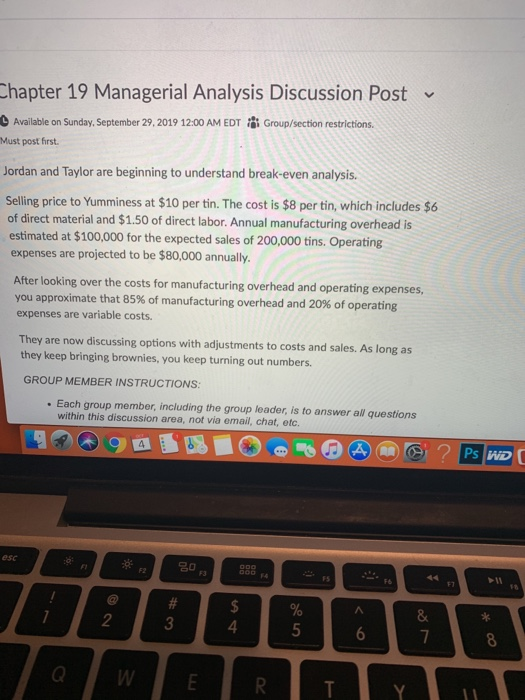

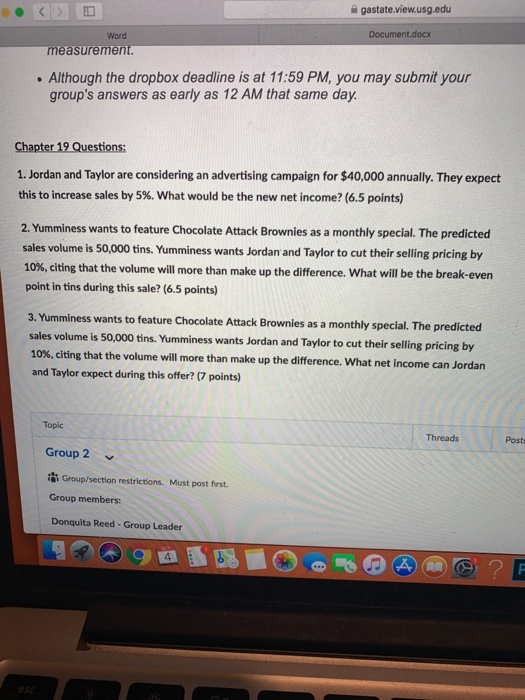

Chapter 19 Managerial Analysis Discussion Post Group/section restrictions Available on Sunday, September 29, 2019 12:00 AM EDT Must post first Jordan and Taylor are beginning to understand break-even analysis Selling price to Yumminess at $10 per tin. The cost is $8 per tin, which includes $6 of direct material and $1.50 of direct labor. Annual manufacturing overhead is estimated at $100,000 for the expected sales of 200,000 tins. Operating expenses are projected to be $80,000 annually After looking over the costs for manufacturing overhead and operating expenses you approximate that 85 % of manufacturing overhead and 20 % of operating expenses are variable costs. They are now discussing options with adjustments to costs and sales. As long as they keep bringing brownies, you keep turning out numbers. GROUP MEMBER INSTRUCTIONS: Each group member, including the group leader, is to answer all questions within this discussion area, not via email, chat, etc. Ps WD A esc 44 E3 FA $ % & 2 4 5 7 W E R T Y gastate.view.usg.edu Document.docx Word measurement. Although the dropbox deadline is at 11:59 PM, you may submit your group's answers as early as AM that same day. Chapter 19 Questions: 1. Jordan and Taylor are considering an advertising campaign for $40,000 annually. They expect this to increase sales by 5 %. What would be the new net income? (6.5 points) 2. Yumminess wants to feature Chocolate Attack Brownies as a monthly special. The predicted sales volume is 50,000 tins. Yumminess wants Jordan and Taylor to cut their selling pricing by 10 % , citing that the volume will more than make up the difference. What will be the break-even point in tins during this sale? (6.5 points) 3. Yumminess wants to feature Chocolate Attack Brownies asa monthly special. The predicted sales volume is 50,000 tins. Yumminess wants Jordan and Taylor to cut their selling pricing by 10 % , citing that the volume willl more than make up the difference. What net income can Jordan and Taylor expect during this offer? (7 points) Topic Threads Posts Group 2 Group/section restrictions. Must post first Group members: Donquita Reed - Group Leader esc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts