Question: Chapter 24 Managerial Analysis Discussion Question Available on Sunday, March 29, 2020 12:00 AM EDT Group/section restrictions. Must post first. Crash! Forgot to do a

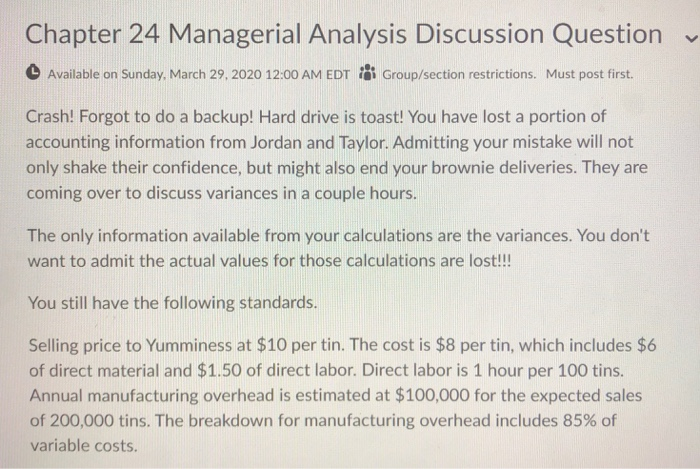

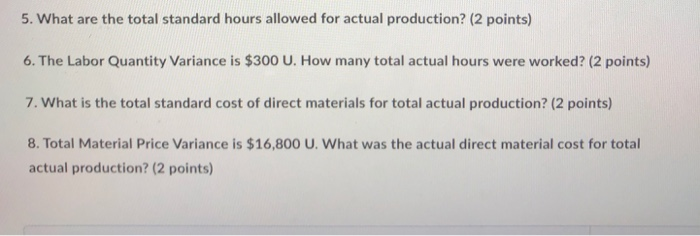

Chapter 24 Managerial Analysis Discussion Question Available on Sunday, March 29, 2020 12:00 AM EDT Group/section restrictions. Must post first. Crash! Forgot to do a backup! Hard drive is toast! You have lost a portion of accounting information from Jordan and Taylor. Admitting your mistake will not only shake their confidence, but might also end your brownie deliveries. They are coming over to discuss variances in a couple hours. The only information available from your calculations are the variances. You don't want to admit the actual values for those calculations are lost!!! You still have the following standards. Selling price to Yumminess at $10 per tin. The cost is $8 per tin, which includes $6 of direct material and $1.50 of direct labor. Direct labor is 1 hour per 100 tins. Annual manufacturing overhead is estimated at $100,000 for the expected sales of 200,000 tins. The breakdown for manufacturing overhead includes 85% of variable costs. 5. What are the total standard hours allowed for actual production? (2 points) 6. The Labor Quantity Variance is $300 U. How many total actual hours were worked? (2 points) 7. What is the total standard cost of direct materials for total actual production? (2 points) 8. Total Material Price Variance is $16,800 U. What was the actual direct material cost for total actual production? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts