Question: Chapter 19 Pre-Built Problems Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work

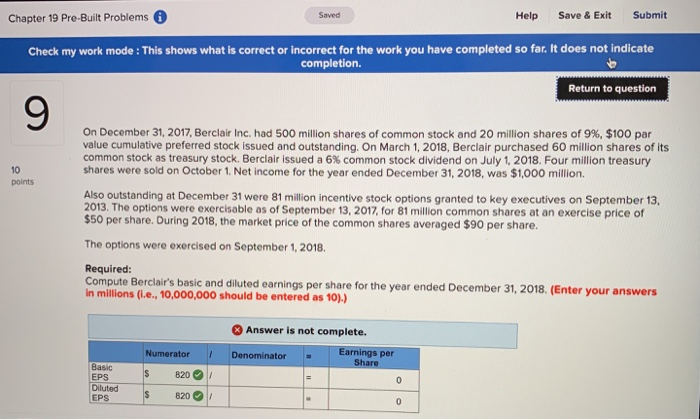

Chapter 19 Pre-Built Problems Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 9 10 points On December 31, 2017, Berclair Inc. had 500 million shares of common stock and 20 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2018, Berclair purchased 60 million shares of its common stock as treasury stock. Berclair issued a 6% common stock dividend on July 1, 2018. Four million treasury shares were sold on October 1, Net income for the year ended December 31, 2018, was $1,000 million. Also outstanding at December 31 were 81 million incentive stock options granted to key executives on September 13, 2013. The options were exercisable as of September 13, 2017, for 81 million common shares at an exercise price of $50 per share. During 2018, the market price of the common shares averaged $90 per share. The options were exercised on September 1, 2018 Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2018. (Enter your answers in millions (.e., 10,000,000 should be entered as 10).) Answer is not complete. Numerator Denominator Earnings per Share S 8201 Basic EPS Diluted EPS 0 S 820 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts