Question: Chapter 2 Homework 0 Saved Help Save & Exit Submit 12 10 points eBook Print References Check my work A On January 1, NewTune Company

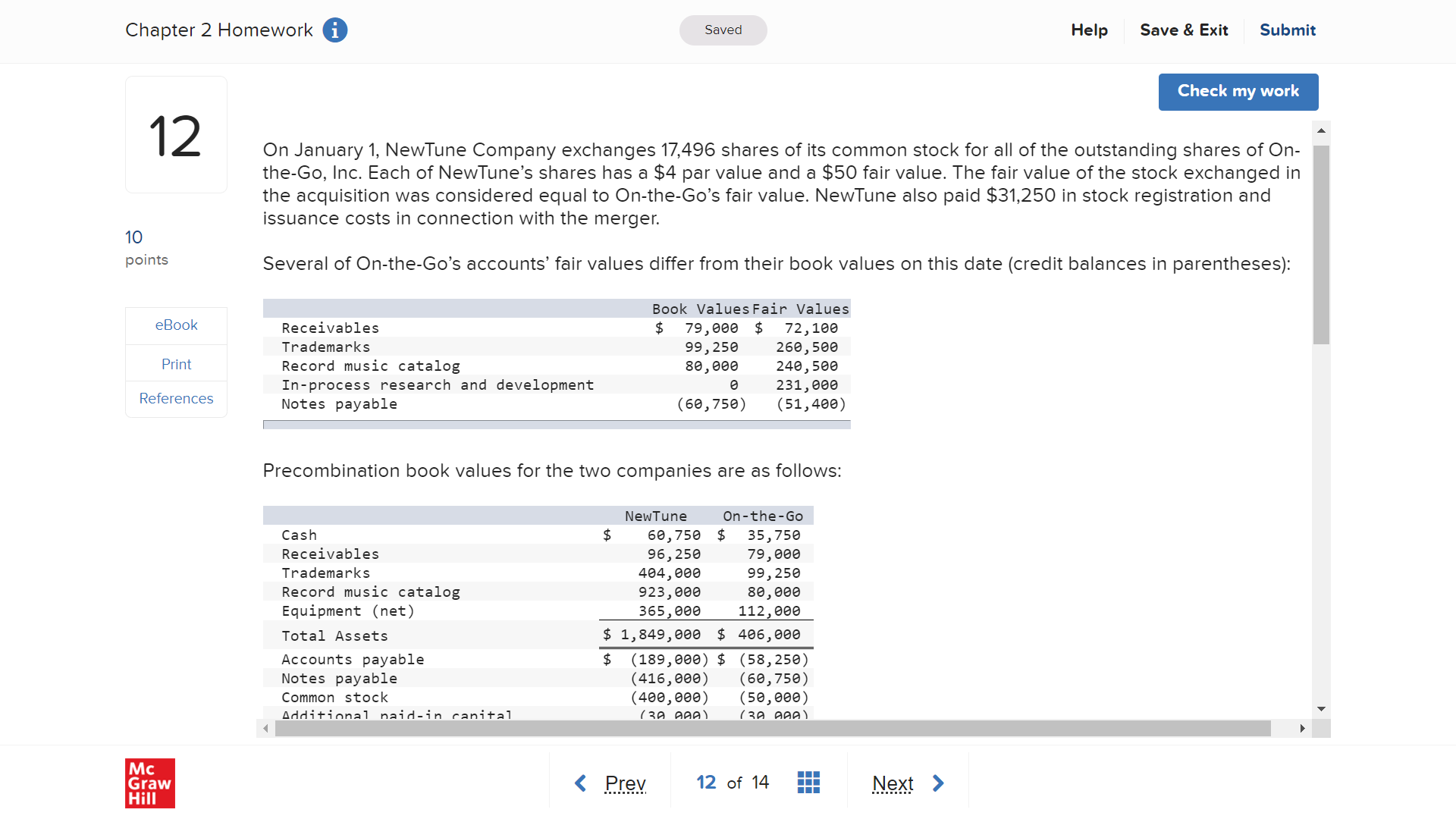

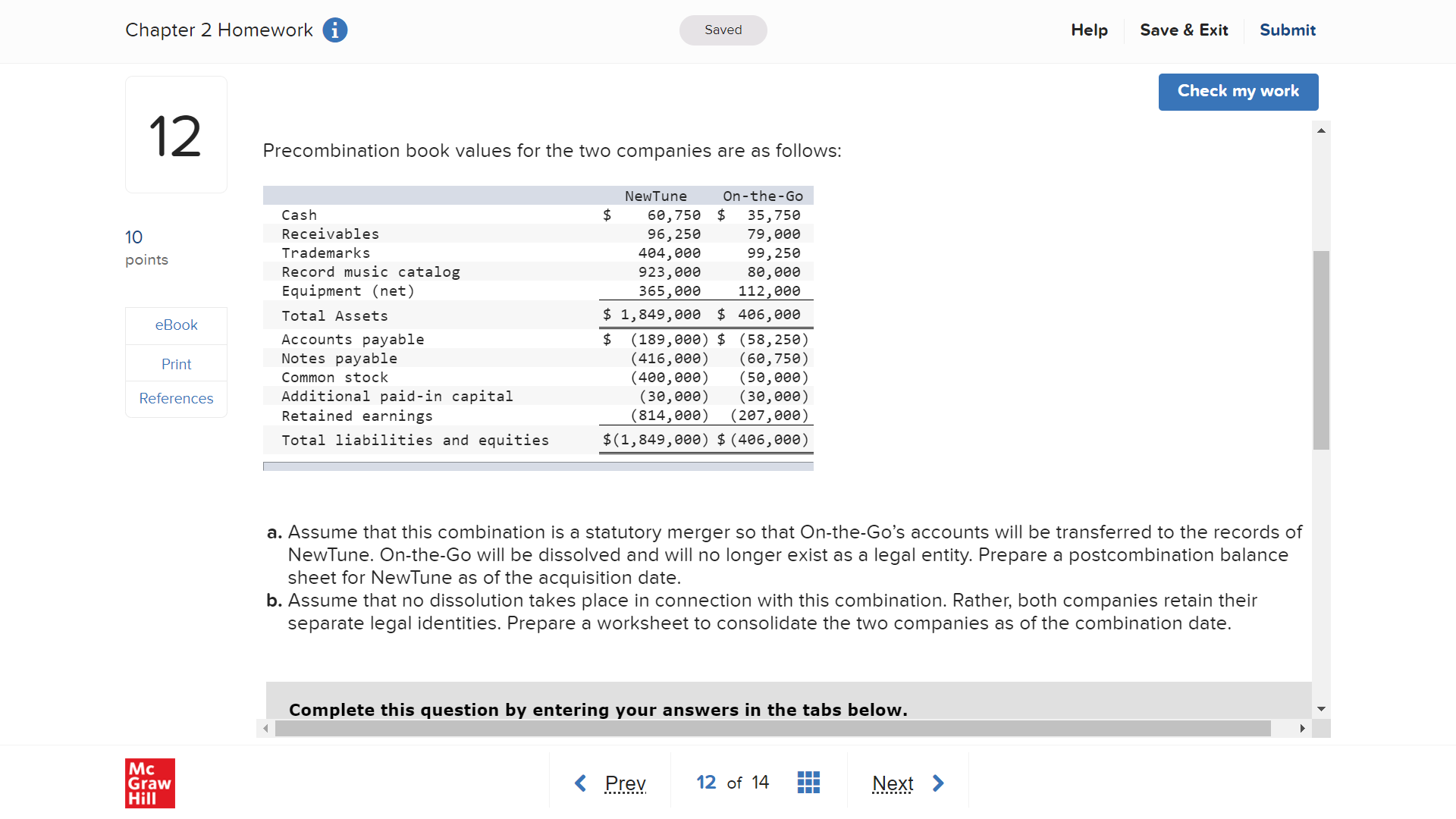

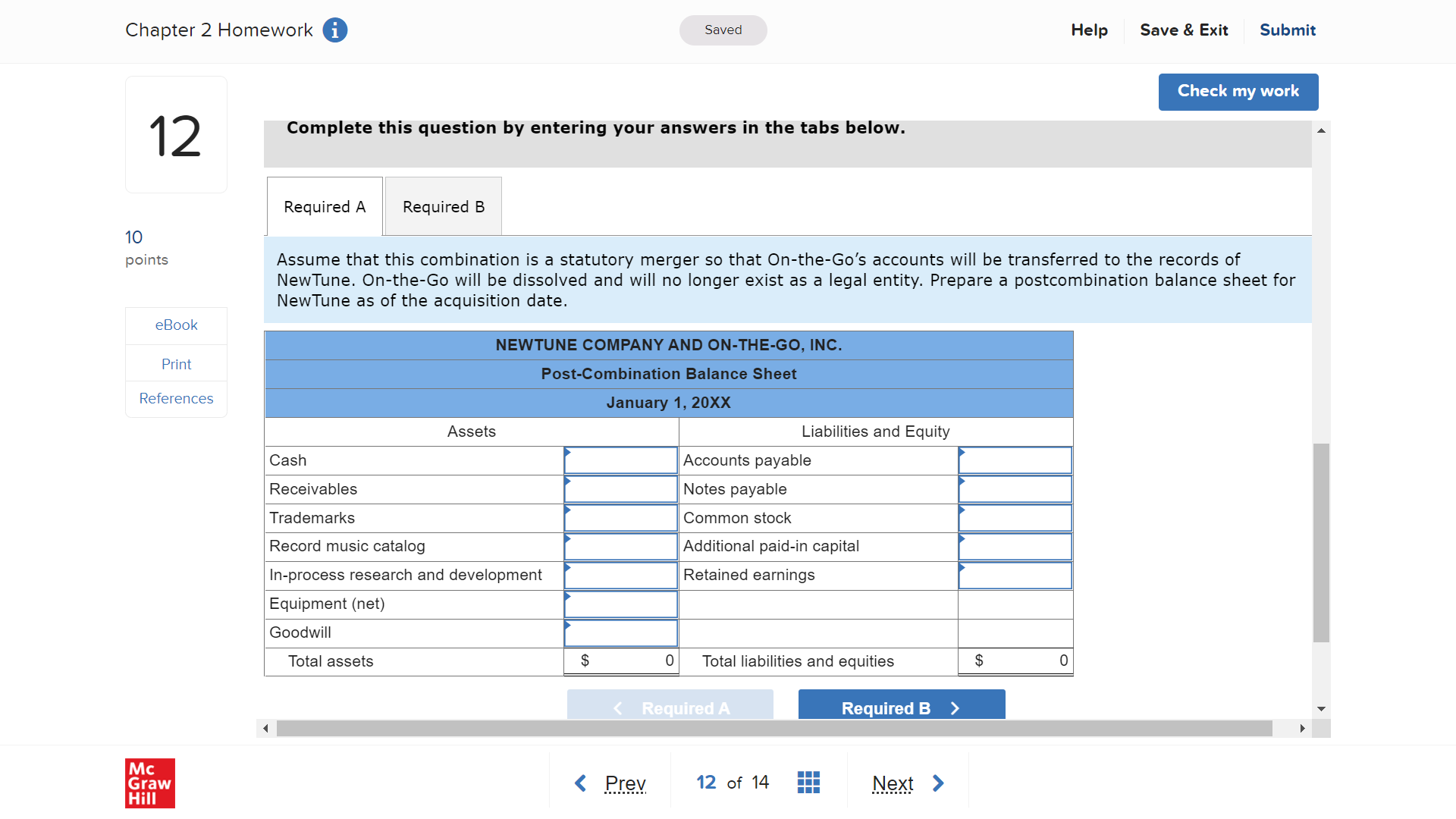

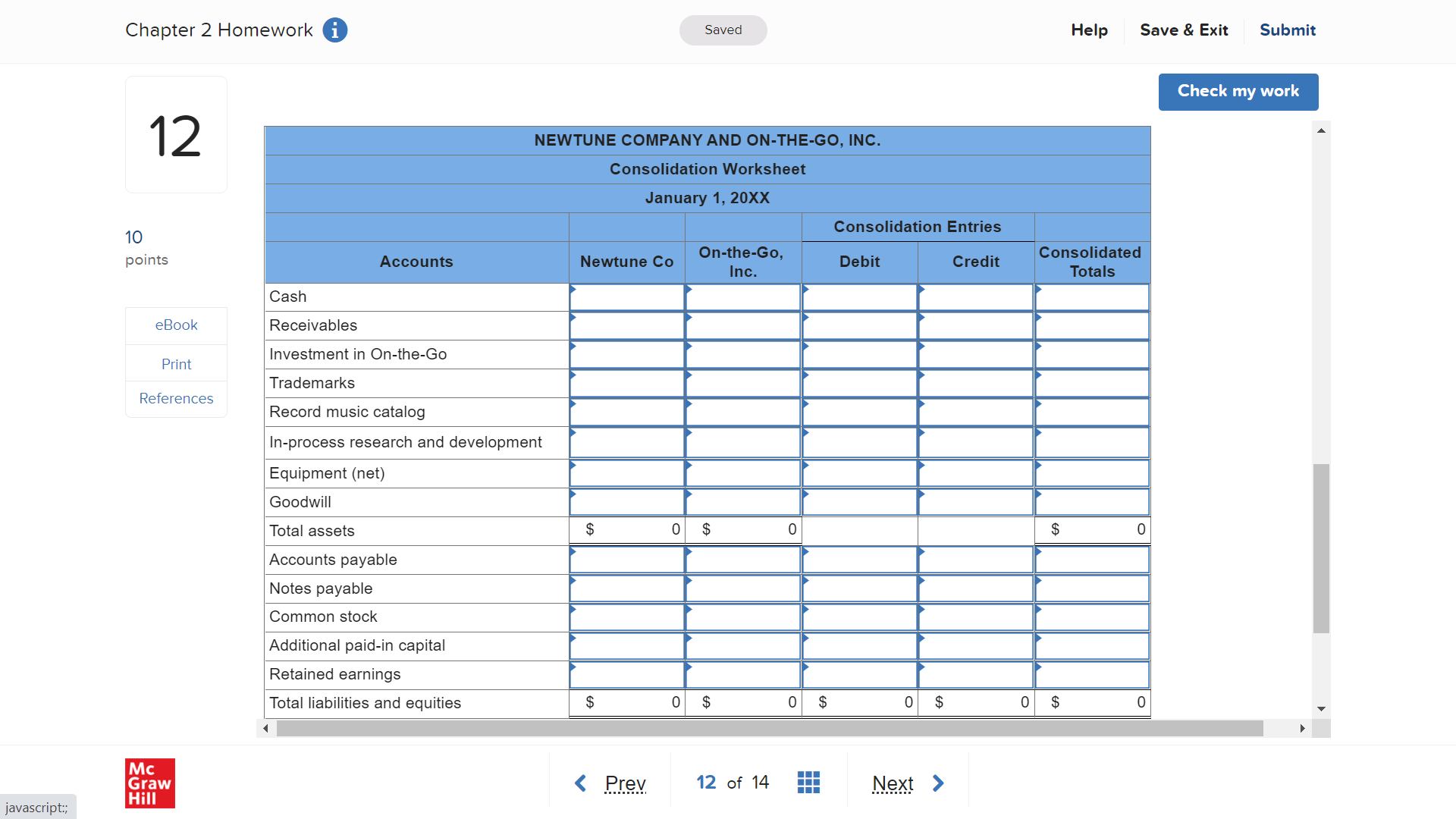

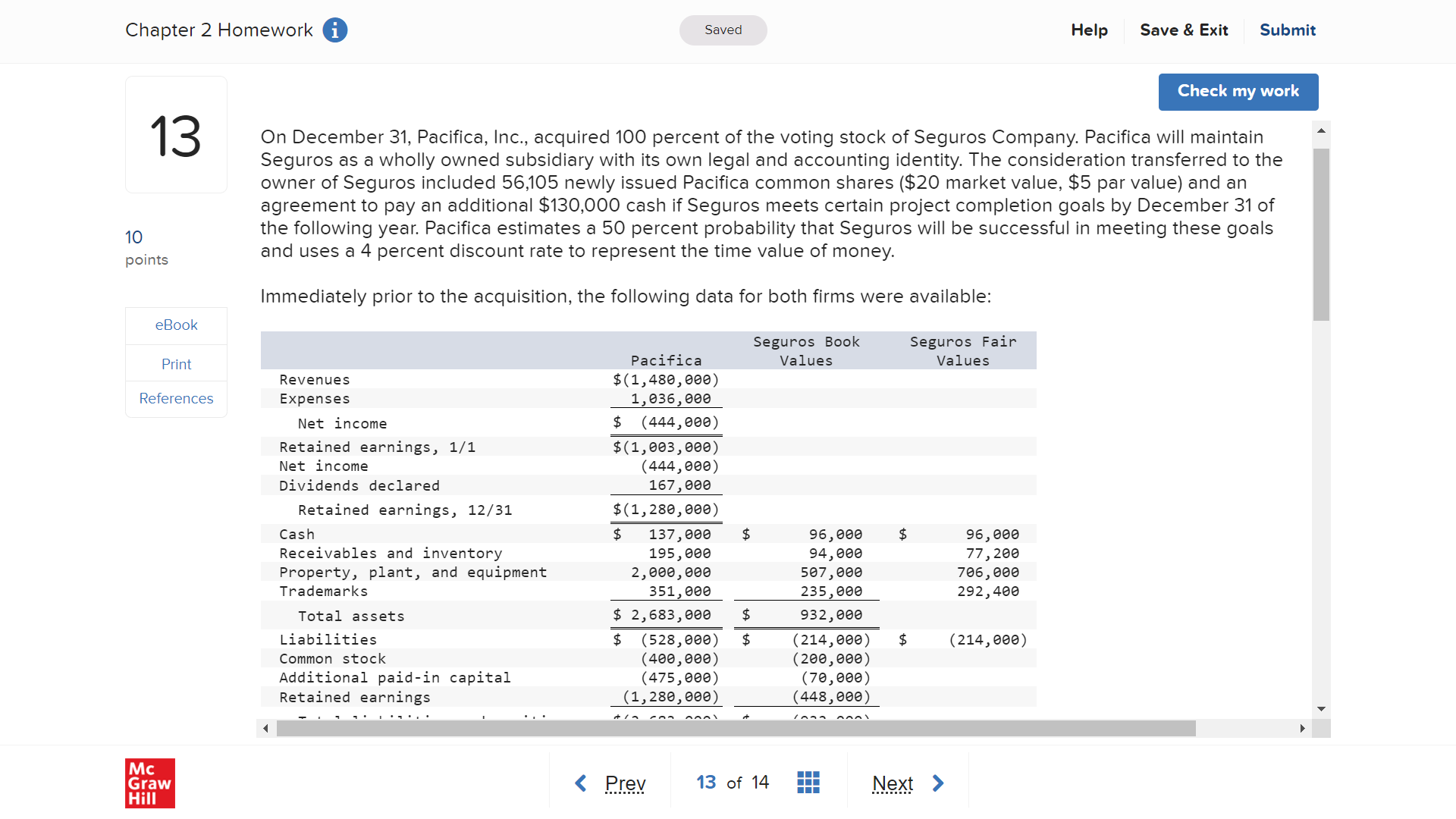

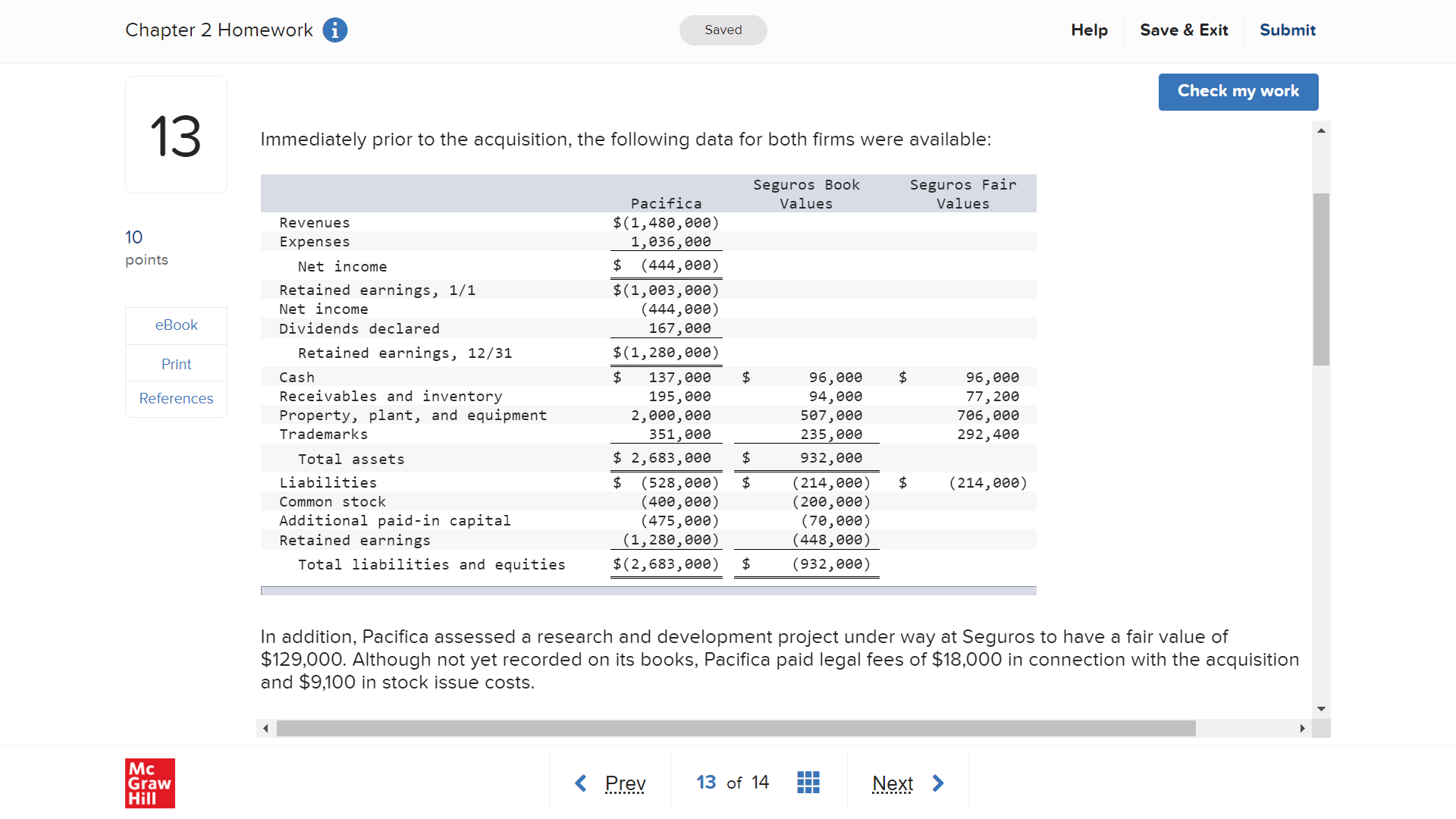

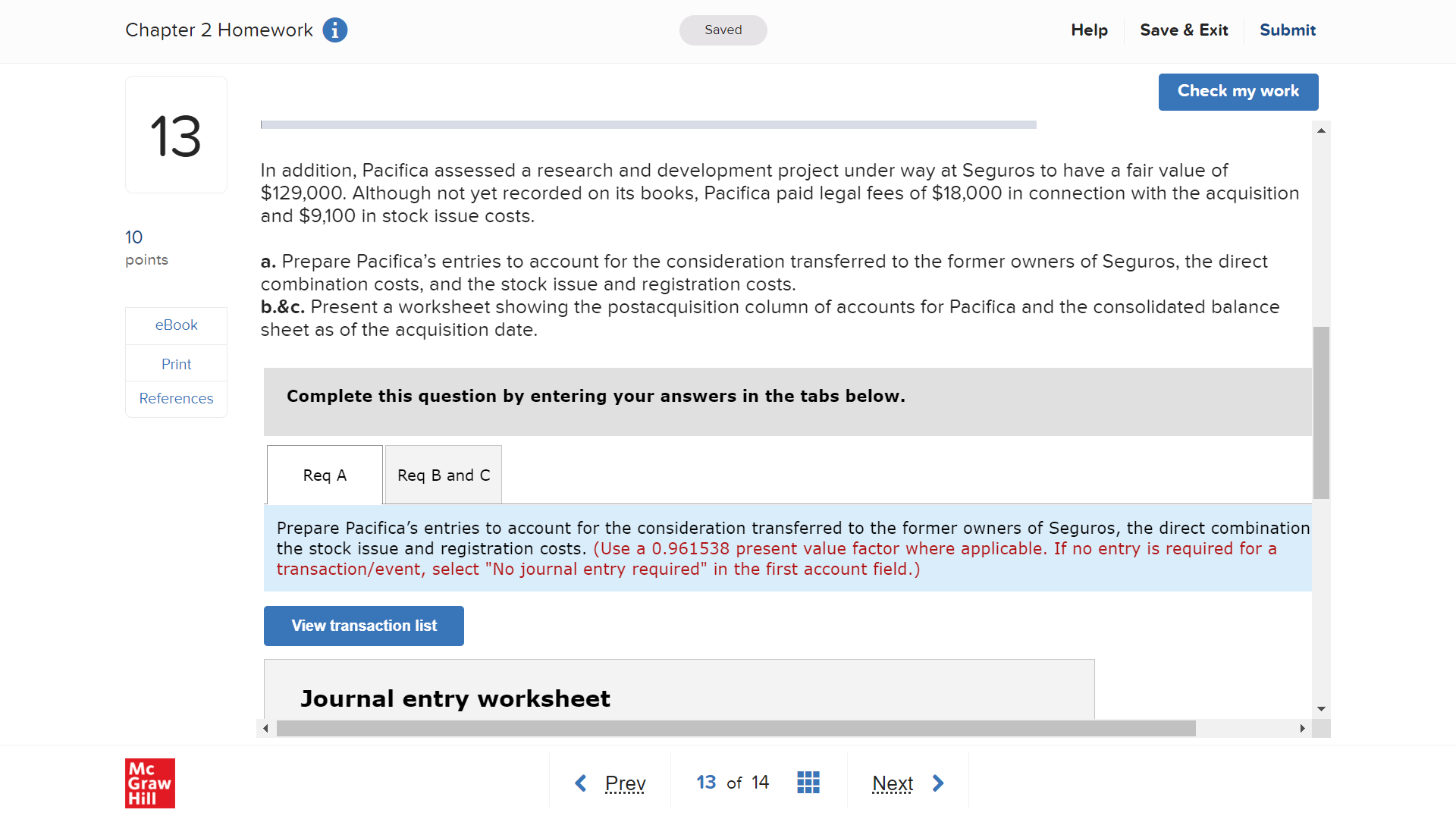

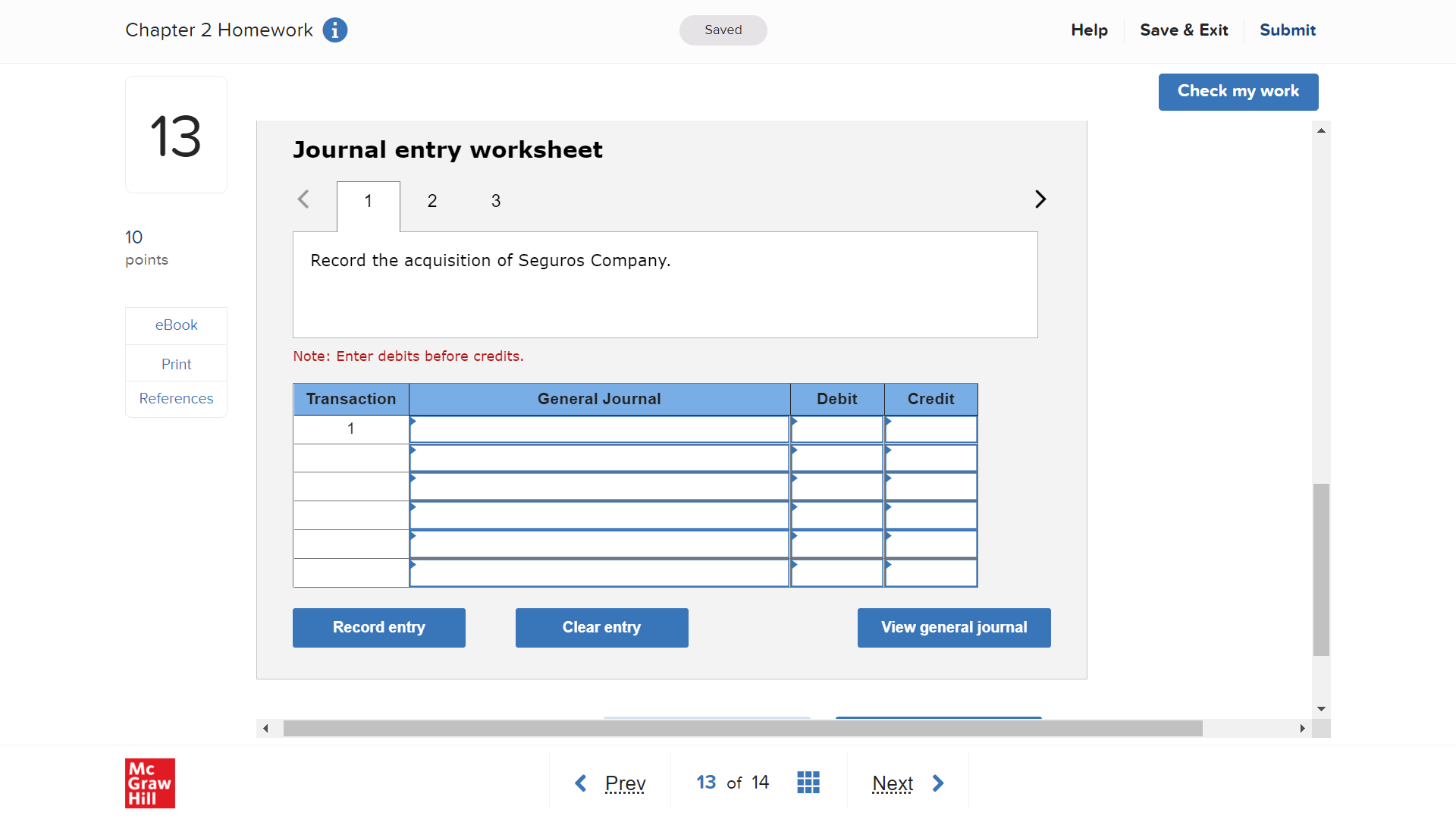

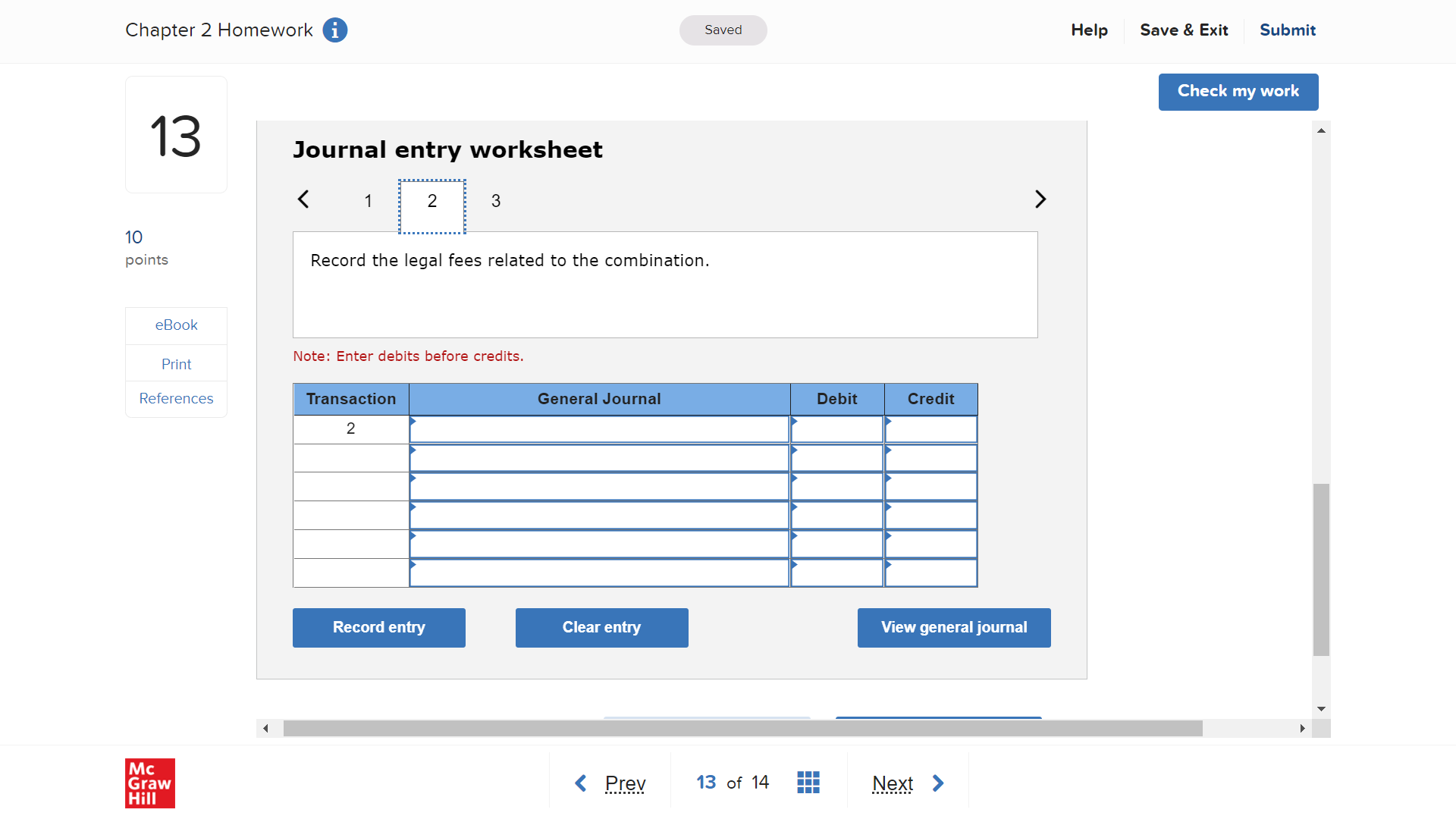

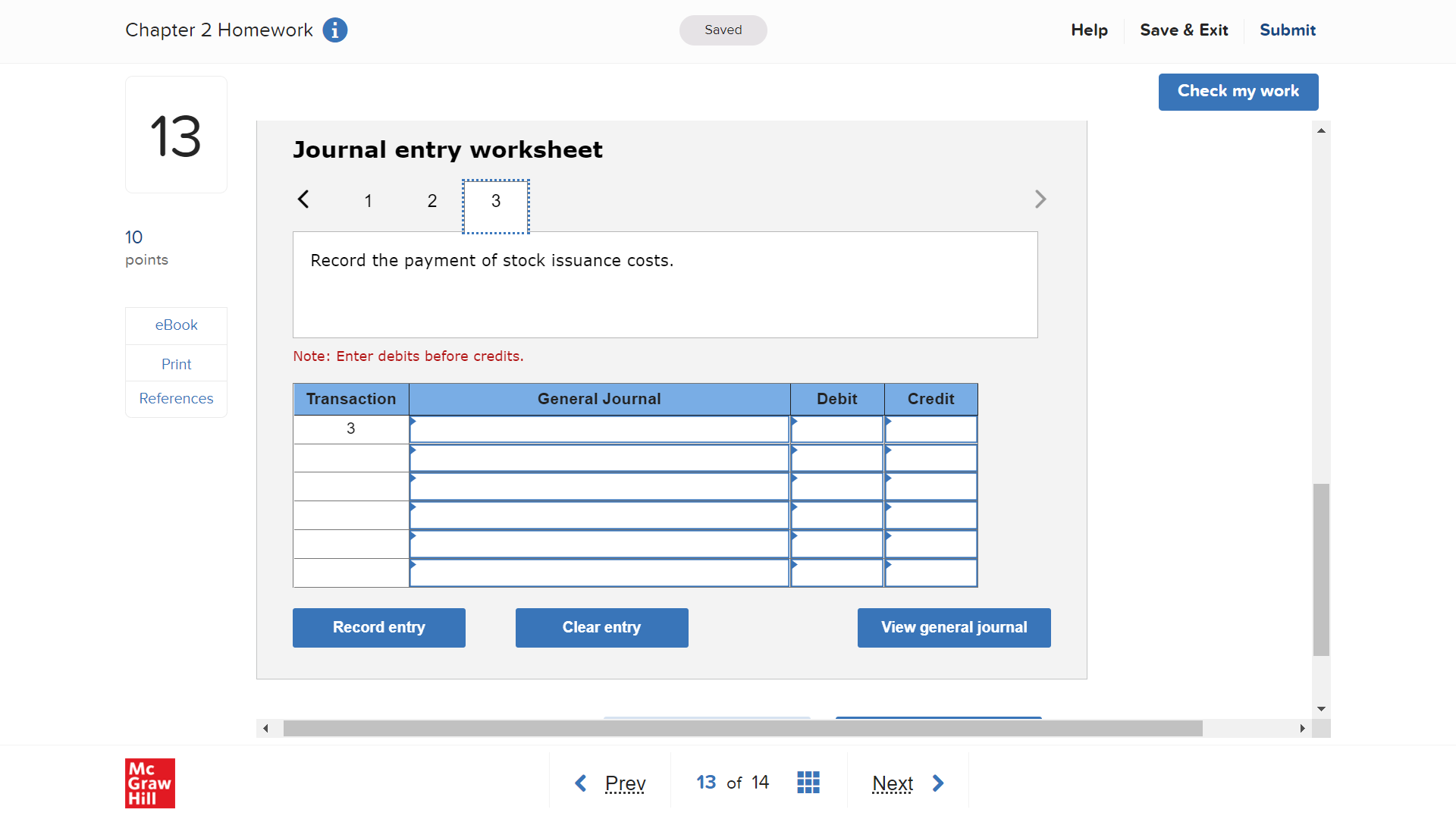

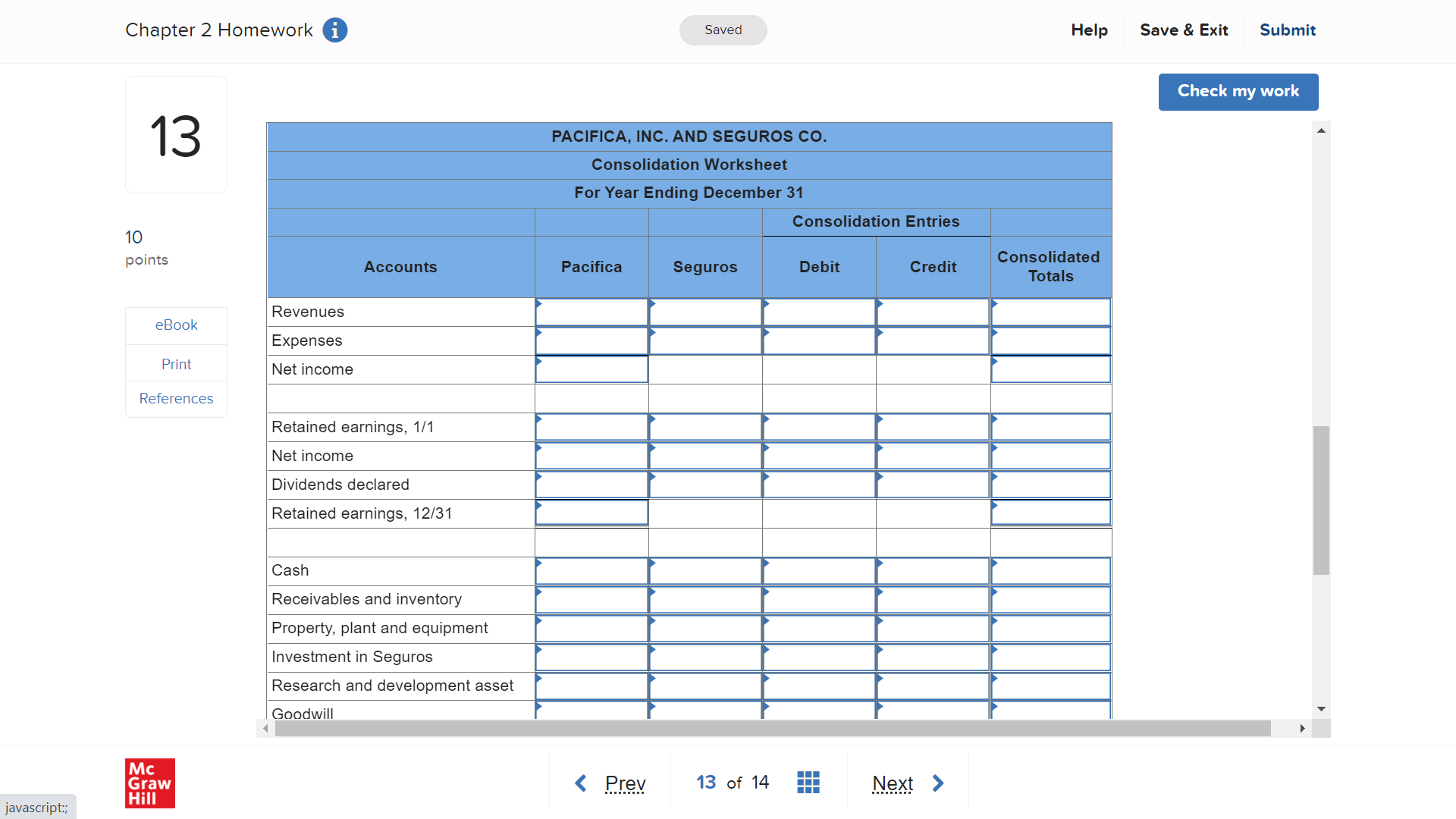

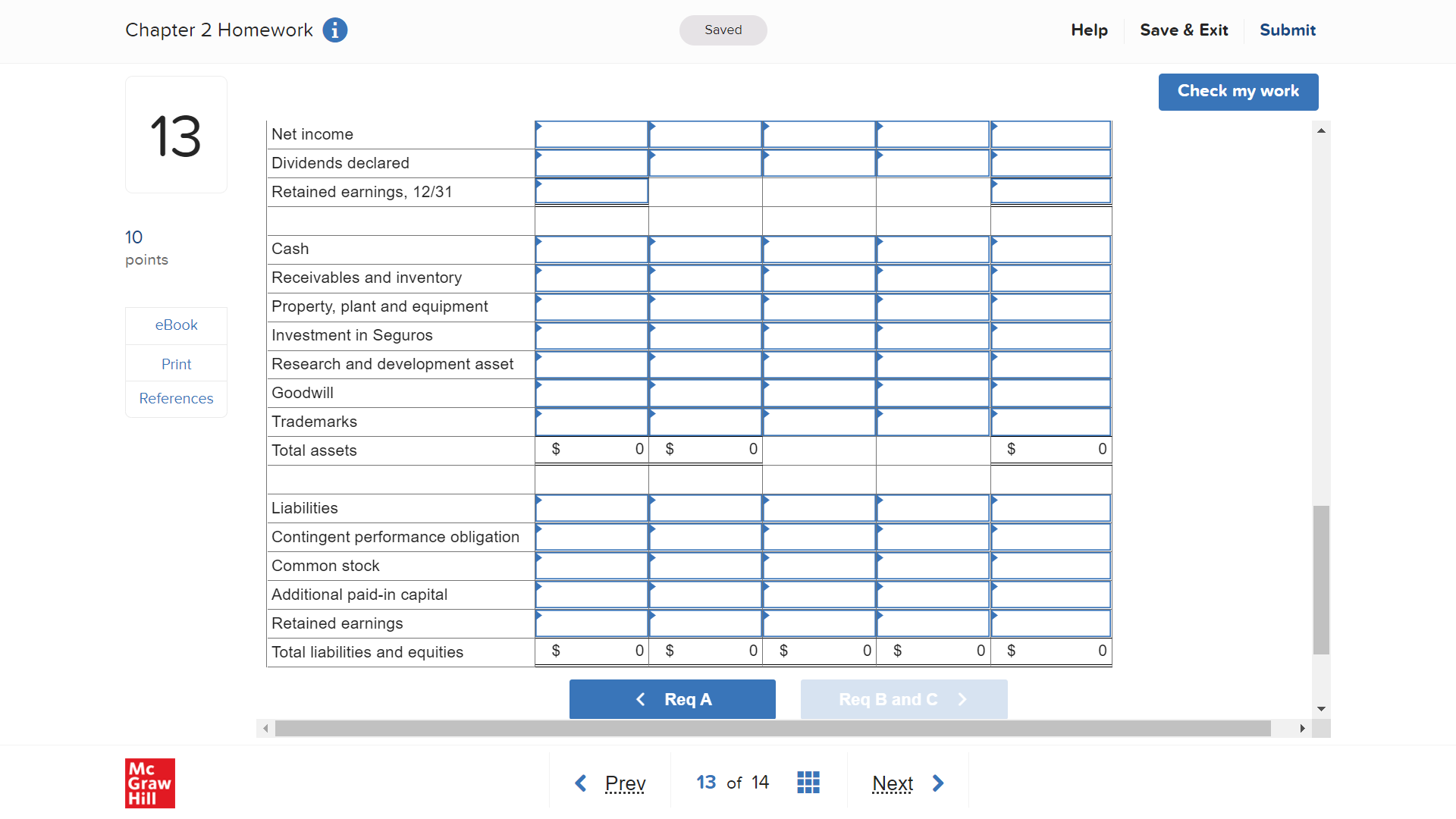

Chapter 2 Homework 0 Saved Help Save & Exit Submit 12 10 points eBook Print References Check my work A On January 1, NewTune Company exchanges 17,496 shares of its common stock for all ofthe outstanding shares of On- theGo, Inc. Each of NewTune's shares has a $4 par value and a $50 fair value. The fair value of the stock exchanged in the acquisition was considered equal to On-the-Go's fair value. NewTune also paid $31,250 in stock registration and issuance costs in connection with the merger. Several of Onthe-Go's accounts' fair values differ from their book values on this date (credit balances in parentheses): Book Values Fair Values Receivables 3 79,999 $ 72,169 Trademarks 99,259 266,569 Record music catalog 86,999 246,569 Inprocess research and development 9 231,669 Notes payable (66,759) (51,469) Precombination book values for the two companies are as follows: NewTune On-the -Ga Cash $ 69,759 $ 35,759 Receivables 96,259 79,969 Trademarks 494,969 99,259 Record music catalog 923,969 86,969 Equipment (net) 365,969 112,999 Total Assets 5 1,849,969 5 496,969 Accounts payable $ (189,969) $ (53,259) Notes payable (416,969) (66,759) Common stock (499,969) (59,999) Addifinna'l Haitiin rnnifn'l {In mam 119 992' Chapter 2 Homework 0 Saved Help Save at Exit Submit Check my work A 12 10 points eBook Receivables _ Investment in OntheGo Print Trademarks References Record music catalog lnprocess research and development Equipment (net) Goodwill Total aesets $ 0 $ 0 $ 0 Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings Total liabilities and equities $ 0 $ 0 $ 0 $ 0 $ 0 - HI" javascript; Chapter 2 Homework i Saved Help Save & Exit Submit Check my work 13 On December 31, Pacifica, Inc., acquired 100 percent of the voting stock of Seguros Company. Pacifica will maintain Seguros as a wholly owned subsidiary with its own legal and accounting identity. The consideration transferred to the owner of Seguros included 56,105 newly issued Pacifica common shares ($20 market value, $5 par value) and an agreement to pay an additional $130,000 cash if Seguros meets certain project completion goals by December 31 of 10 the following year. Pacifica estimates a 50 percent probability that Seguros will be successful in meeting these goals points and uses a 4 percent discount rate to represent the time value of money. Immediately prior to the acquisition, the following data for both firms were available: eBook Seguros Book Seguros Fair Print Pacifica Values Values Revenues $ (1, 480, 090) References Expenses 1, 036, 000 Net income $ (444, 000) Retained earnings, 1/1 $(1, 003, 000 Net income (eee'tot) Dividends declared 167, 000 Retained earnings, 12/31 (000 '087'T) $ Cash $ 137, 000 96, 000 000 '96 Receivables and inventory 195, 000 94, 000 77, 200 Property, plant, and equipment 2, 000, 000 507,000 706, 000 Trademarks 351, 000 235,000 292, 400 Total assets $ 2, 683,000 tA 932,000 Liabilities $ (528, 000) (214, 000) $ Common stock (400, 000) (200, 000) Additional paid-in capital (475, 000) (70, 000 Retained earnings (000' 082'I) (448, 000) Mc Graw HillChapter 2 Homework 0 13 10 points eBook an Reyences Saved Immediately prior to the acquisition, the following data for both firms were available: Revenues Expenses Net income Retained earnings, 1/1 Net income Dividends declared Retained earnings, 12/31 Cash Receivables and inventory Property, plant, and equipment Trademarks Total assets Liabilities Common stock Additional paidin capital Retained earnings Total liabilities and equities Seguros Book Pacifica $(1,486,666) 1,636,666 3 (444,666) S(1,663,666) (444,666) 167,666 $(1,286,666) $ 137,666 $ 195,666 2,666,666 351,666 3 2,663,666 3 S (528,666) 3 (466,666) (475,666) (1,266,666) $(2,683,966) 3 Values 96,666 94,666 567,666 235,666 932,666 (214,666) (266,666) (76,666) (448,980) (932,666) Seguros Fair Values S 96,666 77,266 766,666 292,466 (214,666) Help Save Kc Exit Submit Check my work A In addition, Pacifica assessed a research and development project under way at Seguros to have a fair value of $129,000. Although not yet recorded on its books, Pacifica paid legal fees of $18,000 in connection with the acquisition and $9,100 in stock issue costs. ( REE)! 13 of 14 Chapter 2 Homework 0 Saved Help Save at Exit Submit 13 10 points eBook Print References Graw Hill Check my work A In addition, Pacifica assessed a research and development project under way at Seguros to have a fair value of $129,000. Although not yet recorded on its books, Pacifica paid legal fees of $18,000 in connection with the acquisition and $9,100 in stock issue costs. 3. Prepare Pacifica's entries to account for the consideration transferred to the former owners of Seguros, the direct combination costs, and the stock issue and registration costs. b.&c. Present a worksheet showing the postacquisition column of accounts for Pacifica and the consolidated balance sheet as of the acquisition date. Complete this question by entering your answers in the tabs below. Req A Req B and C Prepare Pacifica's entries to account for the consideration transferred to the former owners of Seguros, the direct combination the stock issue and registration costs. (Use a 0.961538 present value factor where applicable. If no entry is required for a transaction/event, select "No journal entry required" in the first account eld.) View transaction list Journal entry worksheet ( re)! 13 of 14 Chapter 2 Homework Saved Help Save & Exit Submit Check my work 13 Journal entry worksheet HillChapter 2 Homework 0 13 10 points eBde Print References Graw Hill Journal entry worksheet Saved Record the legal fees related to the combination. Note: Enter debits before credits. Record entry Clear entry View general journal Help Hill javascript:;Chapter 2 Homework 0 13 10 pomu eBook an Reyences HI" Net income Dividends declared Retained earnings, 12/31 Saved Help Receivables and inventory Property, plant and equipment Investment in Seguros Research and development asset Goodwill Trademarks Total asaets Liabilities Contingent performance obligation Common stock Additional paid-in capital Retained earnings Total liabilities and equities 0 0 55 Save Kc Exit Submit Check my work A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts