Question: Chapter 2 Homework i Saved Help Save & Exit Submit Check my work 8 On June 30, 2020, Wisconsin, Inc., issued $153,400 in debt and

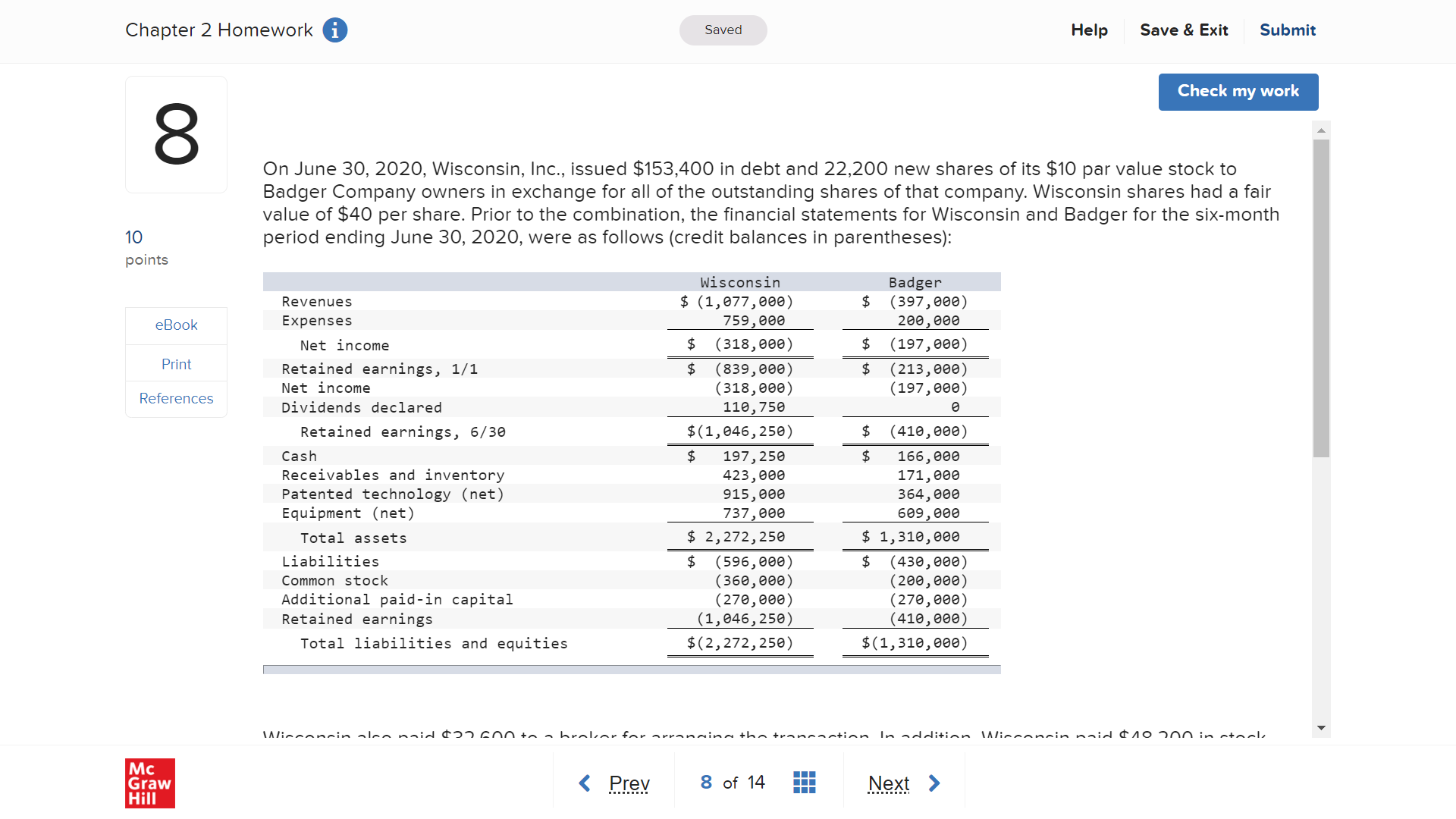

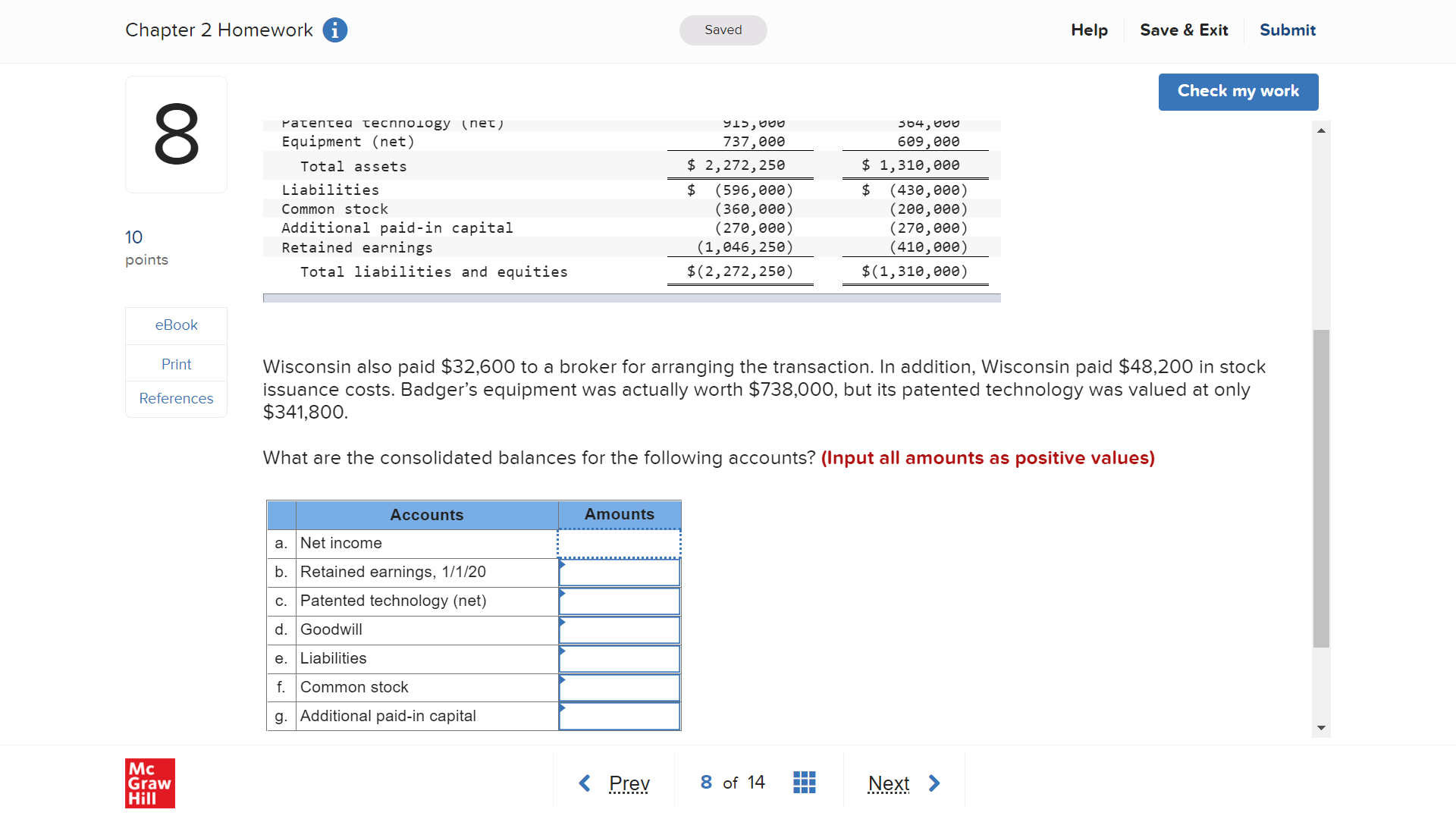

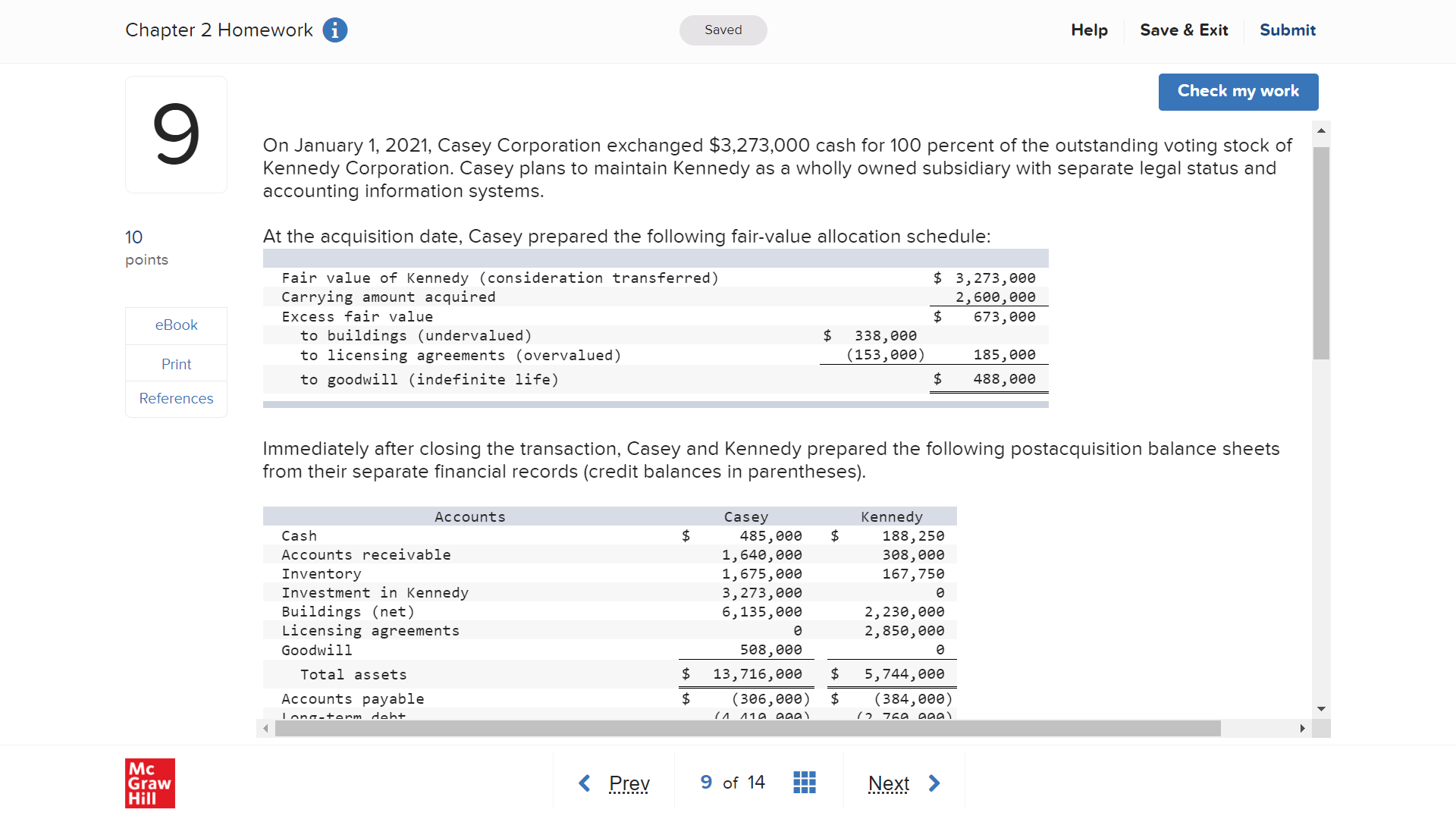

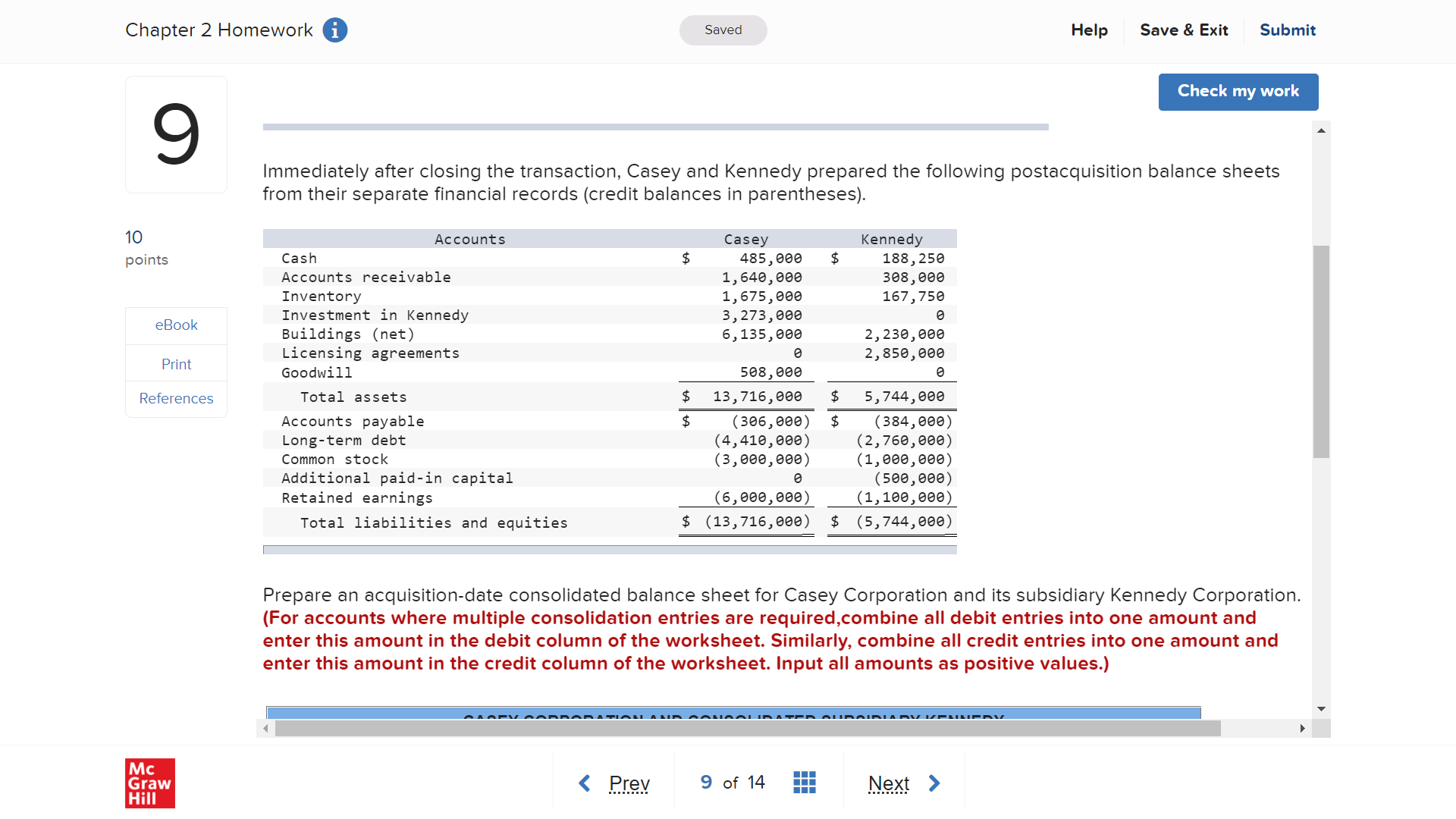

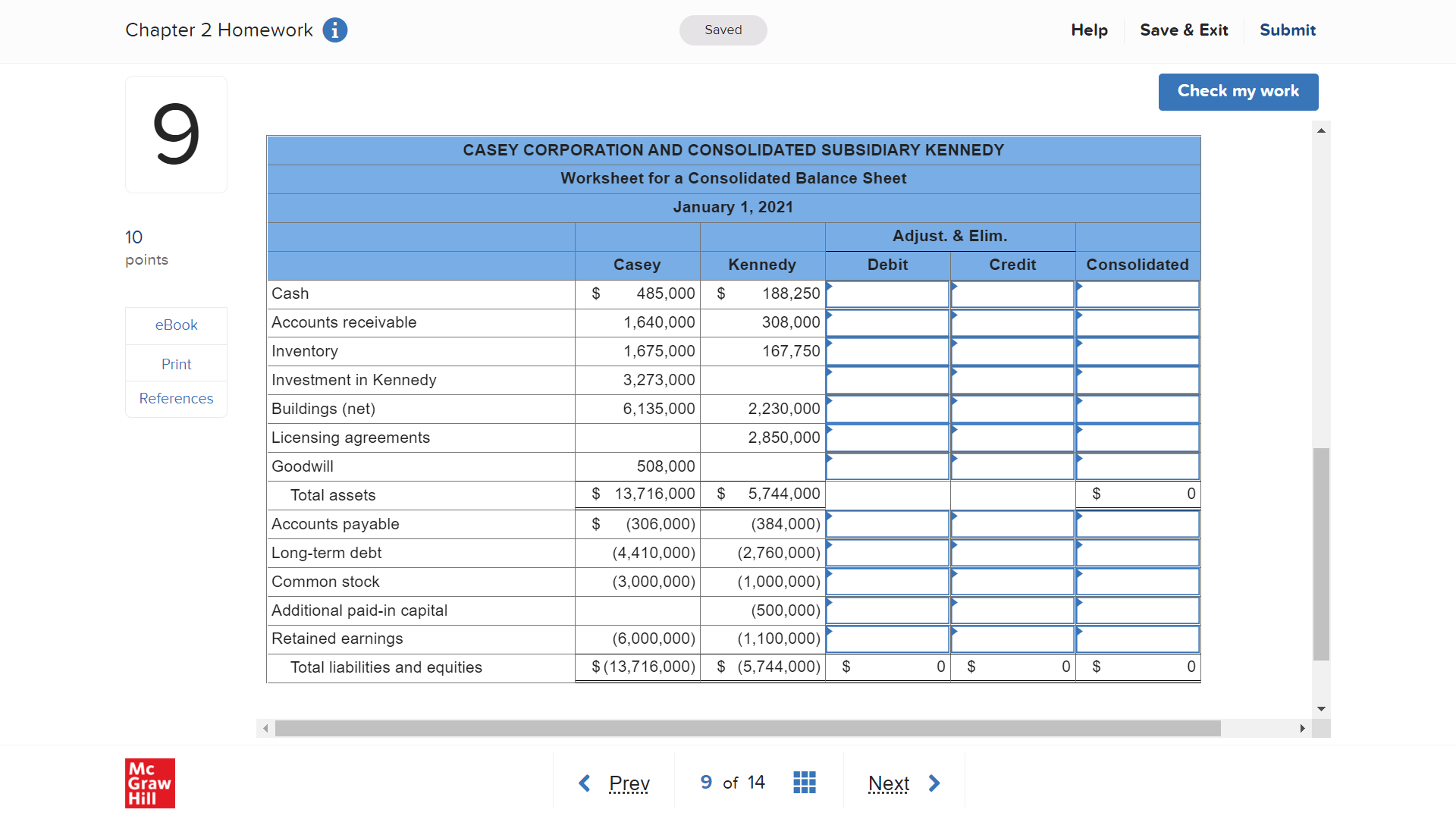

Chapter 2 Homework i Saved Help Save & Exit Submit Check my work 8 On June 30, 2020, Wisconsin, Inc., issued $153,400 in debt and 22,200 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month 10 period ending June 30, 2020, were as follows (credit balances in parentheses): points Wisconsin Badger Revenues $ (1, 077, 000) $ (397, 000) eBook Expenses 000'654 Net income $ (318, 000) $ (197, 000) Print Retained earnings, 1/1 $ (839, 000 $ (213, 000) Net income (000'8TE) (eee' 26T) References Dividends declared 110, 750 Retained earnings, 6/30 $ (1, 046, 250) $ (410, 000) Cash $ 197, 250 $ 166, 000 Receivables and inventory 423,000 171, 000 Patented technology (net) 915, 000 364, 000 Equipment (net) Ooo'LEL 000 '609 Total assets $ 2, 272, 250 $ 1, 310,000 Liabilities $ (596, 000) $ (430, 000) Common stock 000 '098) (200, 000) Additional paid-in capital (270, 000) (270, 000) Retained earnings (1, 046, 250) (410, 000) Total liabilities and equities $ (2, 272, 250) $ (1, 310, 000) Wisconsin alan said ton GAN to a broker for arrangingtha transaction In addition IMindAnain maid 10 0 in atnal , Mc Graw HillChapter 2 Homework i Saved Help Save & Exit Submit Check my work 8 ratentea technology (net) 564, 606 Equipment (net) 737,000 609, 000 Total assets $ 2, 272, 250 $ 1, 310, 000 Liabilities $ (596, 000) $ (430, 000) Common stock (000'09E) (000'0ez) 10 Additional paid-in capital (000'042) (000'042) Retained earnings (1, 046, 250 (410, 000) points Total liabilities and equities $ (2, 272, 250) (000 ' OTE 'T ) $ eBook Print Wisconsin also paid $32,600 to a broker for arranging the transaction. In addition, Wisconsin paid $48,200 in stock References issuance costs. Badger's equipment was actually worth $738,000, but its patented technology was valued at only $341,800. What are the consolidated balances for the following accounts? (Input all amounts as positive values) Accounts Amounts a. Net income b. Retained earnings, 1/1/20 C. Patented technology (net) d. Goodwill e . Liabilities f. Common stock g. Additional paid-in capital Mc Graw HillChapter 2 Homework i Saved Help Save & Exit Submit Check my work 9 On January 1, 2021, Casey Corporation exchanged $3,273,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and accounting information systems. 10 At the acquisition date, Casey prepared the following fair-value allocation schedule: points Fair value of Kennedy (consideration transferred) Carrying amount acquired 2, 600, 000 Excess fair value $ 673,000 eBook to buildings (undervalued) $ 338,000 Print to licensing agreements (overvalued) 153, 000 185,000 to goodwill (indefinite life) $ 488,000 References Immediately after closing the transaction, Casey and Kennedy prepared the following postacquisition balance sheets from their separate financial records (credit balances in parentheses). Accounts Casey Kennedy Cash $ 485,000 $ 188, 250 Accounts receivable 1, 640, 000 308, 000 Inventory 1, 675, 000 167, 750 Investment in Kennedy Do0'EZZ'E Buildings (net) 000'SET'9 000 ' 0 Ez'2 Licensing agreements 000 '058'z Goodwill 508, 000 Total assets $ 13 , 716, 000 $ 5, 744, 000 Accounts payable $ (306, 000) LA (384, 000) I ana - tomm doht Mc Graw HillChapter 2 Homework 0 Saved 10 pomu eBook an Reyences Immediately after closing the transaction, Casey and Kennedy prepared the following postacquisition balance sheets from their separate financial records (credit balances in parentheses). Accounts Casey Cash $ 485, 96% Accounts receivable 1,646,666 Inventory 1,675,666 Investment in Kennedy 3,275,666 Buildings (net) 6,135,666 Licensing agreements 6 Goodwill 568,666 Total assets $ 13,716,666 Accounts payable $ (366,666) Longterm debt (4,416,666) Common stock (3,666,666) Additional paid-in capital 6 Retained earnings (6,666,666) Total liabilities and equities $ (13,7151399) Kennedy 3 199,259 399,999 167,756 6 2,239,999 2,359,999 6 3 5,744,999 $ (394,999) (2,766,666) (1,999,999) (599,999) (1,199,999) $ (5,744,999) Help Save Kc Exit Prepare an acquisition-date consolidated balance sheet for Casey Corporation and its subsidiary Kennedy Corporation. (For accounts where multiple consolidation entries are required,combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Subnt Check my work A Chapter 2 Homework i Saved Help Save & Exit Submit Check my work 9 CASEY CORPORATION AND CONSOLIDATED SUBSIDIARY KENNEDY Worksheet for a Consolidated Balance Sheet January 1, 2021 10 Adjust. & Elim. points Casey Kennedy Debit Credit Consolidated Cash $ 485,000 $ 188,250 eBook Accounts receivable 1,640,000 308,000 Inventory 1,675,000 167,750 Print Investment in Kennedy 3,273,000 References Buildings (net) 6, 135,000 2,230,000 Licensing agreements 2,850,000 Goodwill 508,000 Total assets $ 13,716,000 $ 5,744,000 $ Accounts payable $ (306,000) (384,000) Long-term debt (4,410,000) (2,760,000) Common stock (3,000,000) (1,000,000) Additional paid-in capital (500,000) Retained earnings (6,000,000) (1, 100,000) Total liabilities and equities $ (13,716,000) $ (5,744,000) $ $ o $ 0 Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts