Question: Chapter 2 Question 22 You've just opened a margin account with $20,000 at your local brokerage firm. You instruct your broker to purchase 500 shares

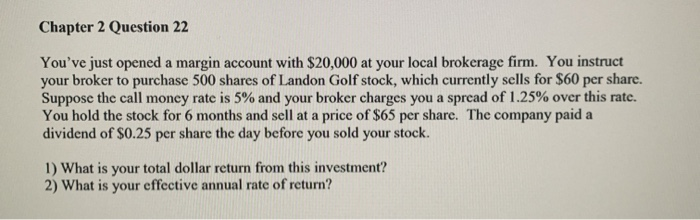

Chapter 2 Question 22 You've just opened a margin account with $20,000 at your local brokerage firm. You instruct your broker to purchase 500 shares of Landon Golf stock, which currently sells for $60 per share. Suppose the call money rate is 5% and your broker charges you a spread of 1.25% over this rate. You hold the stock for 6 months and sell at a price of $65 per share. The company paid a dividend of $0.25 per share the day before you sold your stock. 1) What is your total dollar return from this investment? 2) What is your effective annual rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts