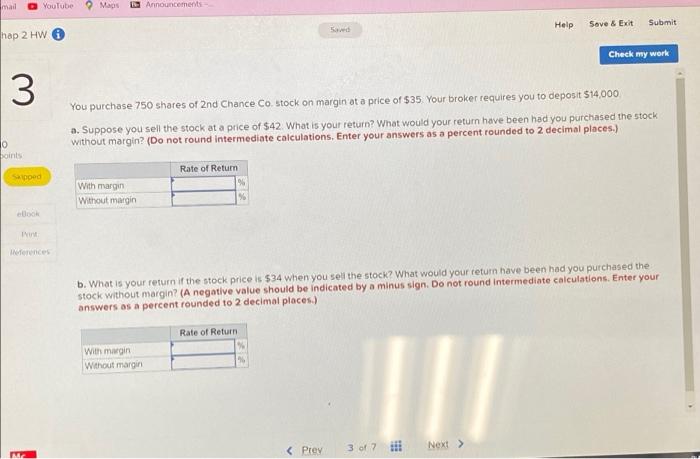

Question: mail YouTube Maps Announcements Help Save & Exit Submit 5d hap 2 HW Check my werk 3 You purchase 750 shares of 2nd Chance Co

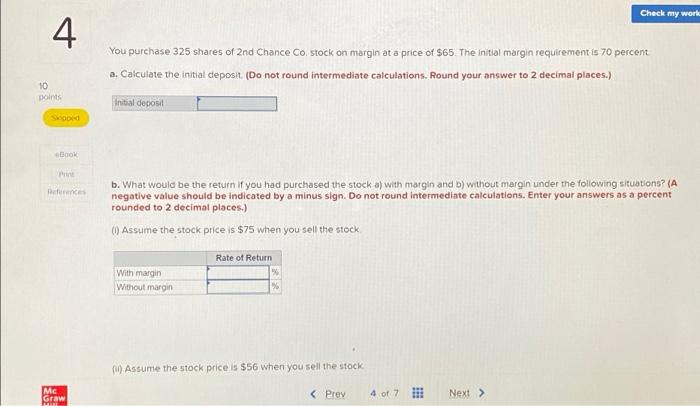

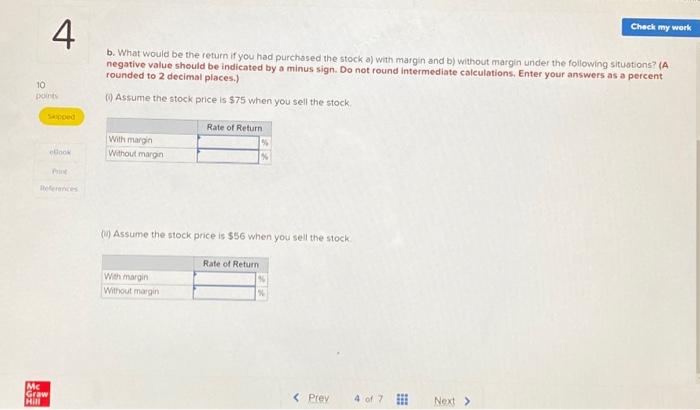

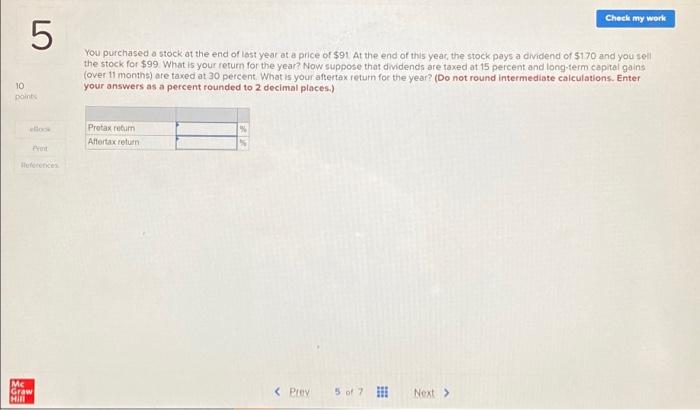

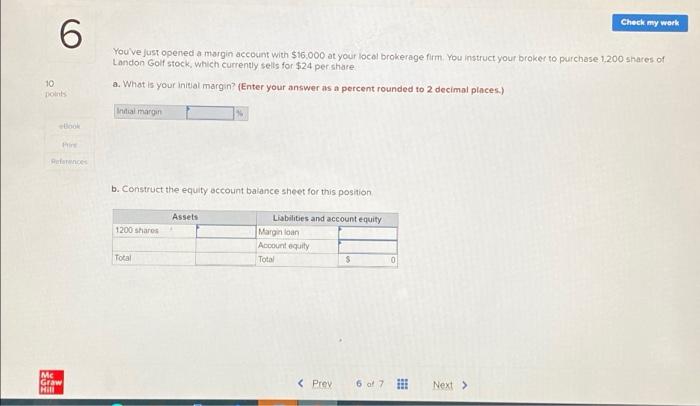

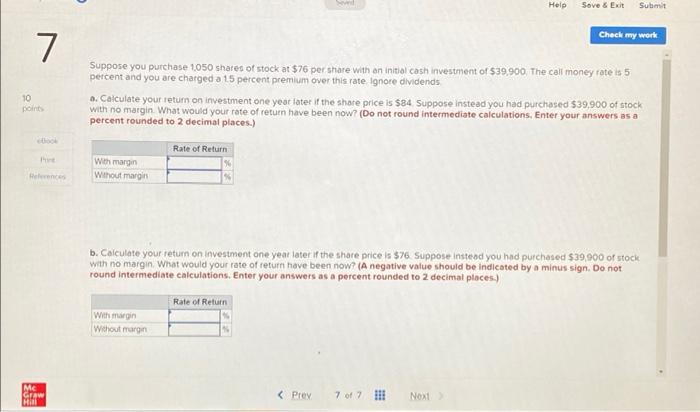

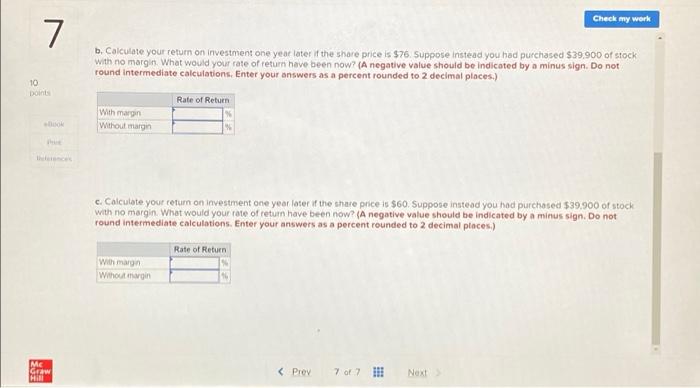

mail YouTube Maps Announcements Help Save & Exit Submit 5d hap 2 HW Check my werk 3 You purchase 750 shares of 2nd Chance Co stock on margin at a price of $35. Your broker requires you to deposit $14,000 a. Suppose you sell the stock at a price of $42. What is your return? What would your return have been had you purchased the stock without margin? (Do not round intermediate calculations, Enter your answers as a percent rounded to 2 decimal places.) 0 points Rate of Return Sad With margin Without margin . It Inferences b. What is your return if the stock price is $34 when you sell the stock? What would your return have been had you purchased the stock without margin? (A negative value should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Rate of Return With mingin Without margin Check my work 4 You purchase 325 shares of 2nd Chance Co. stock on margin at a price of $65. The initial margin requirement is 70 percent a. Calculate the initial deposit (Do not round intermediate calculations. Round your answer to 2 decimal places.) 10 points Initial deposit Swooped Book b. What would be the return if you had purchased the stock a) with margin and D) without margin under the following situations? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) (1) Assume the stock price is $75 when you sell the stock Rate of Return With margin Without margin 0) Assume the stock price is $56 when you sell the stock Mc Graw Check my work 4. b. What would be the return if you had purchased the stock a) with margin and b) without margin under the following situations? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) (9) Assume the stock price is $75 when you sell the stock 10 points Rate of Return With margin Without margin (1) Assume the stock price is $56 when you sell the stock Rate of Return With margin Without margin Mc Graw Check my work 5 You purchased a stock at the end of last year at a price of $91 At the end of this year, the stock pays a dividend of $170 and you sell the stock for $99 What is your return for the year? Now suppose that dividends are taxed at 15 percent and long-term capital gains (over 11 months) are taxed at 30 percent. What is your aftertax return for the year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 10 point Protax return Affortax return Buferences M Graw Check my work 6 You've just opened a margin account with $15,000 at your local brokerage firm. You instruct your broker to purchase 1.200 shares of Landon Golf stock, which currently sells for $24 per share a. What is your initial margin? (Enter your answer as a percent rounded to 2 decimal places) 10 Intal margin b. Construct the equity account balance sheet for this position Assets 1200 shares Liabilities and account equity Margin loan Account equity Total $ Total ME Graw HU Help Sove & Exit Submit Check my work 7 Suppose you purchase 1050 shares of stock at $76 per share with an initial cash investment of $39,900 The call money rate is 5 percent and you are charged a 15 percent premium over this rate ignore dividends 0. Calculate your return on investment one year later if the share price is $84. Suppose instead you had purchased $39,900 of stock with no margin What would your rate of return have been now? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 10 points Rate of Return With margin Without margin b. Calculate your return on investment one year later if the share price is 376 Suppose instead you had purchased $39,900 of stock with no margin. What would your rate of return have been now? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Rate of Return With margin Without margin M Graw Prey 7 of 7 III Next Check my work 7 b. Calculate your return on investment one year later if the share price is $76. Suppose instead you had purchased $39.900 of stock with no margin. What would your rate of return have been now? (A negative value should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) 10 Rate of Return With margin Without margin c. Calculate your return on investment one year later if the share price is $60. Suppose instead you had purchased $39.900 of stock with no margin. What would your rate of return have been now?(A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Rate of Return With margin Without in ME Graw HIR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts