Question: Chapter 2 - Selection 69 EXERCISES Note: These exercises can be done individually or in teams, in class, as homework, or in a virtual environment.

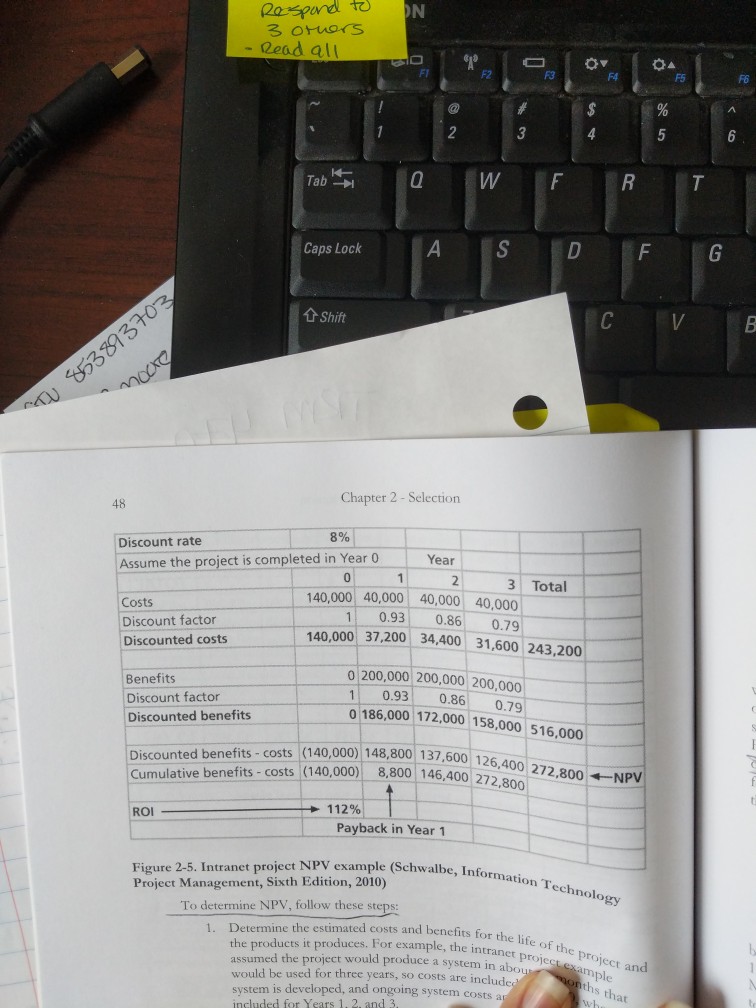

Chapter 2 - Selection 69 EXERCISES Note: These exercises can be done individually or in teams, in class, as homework, or in a virtual environment. Students can either write their results in a paper or prepare a short presentation to show their results. 9 1. Perform a financial analysis for a project using the format provided in Figure 2-5. Assume the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $100,000 in Year 1 and $25,000 each year in Years 2, 3, and 4. (Hint: Just change the years in the template file from 0, 1,2, 3, and 4 to 1, 2, 3, and 4. The discount factors will automatically be recalculated.) Estimated benefits are $O in Year 1 and $80,000 each discount rate. Use the business case financials template provided on the companion Web site to calculate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project based on your financial analysis. year in Years 2, 3, and 4. Use an 8% Create a weighted scoring model to determine which project to select. Assume the criteria are cost, strategic value, risk, and financials, with weights of 15%, 40%, 20%, and 25%, respectively. Enter values for Project 1 as 90, 70, 85, and 50; 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts