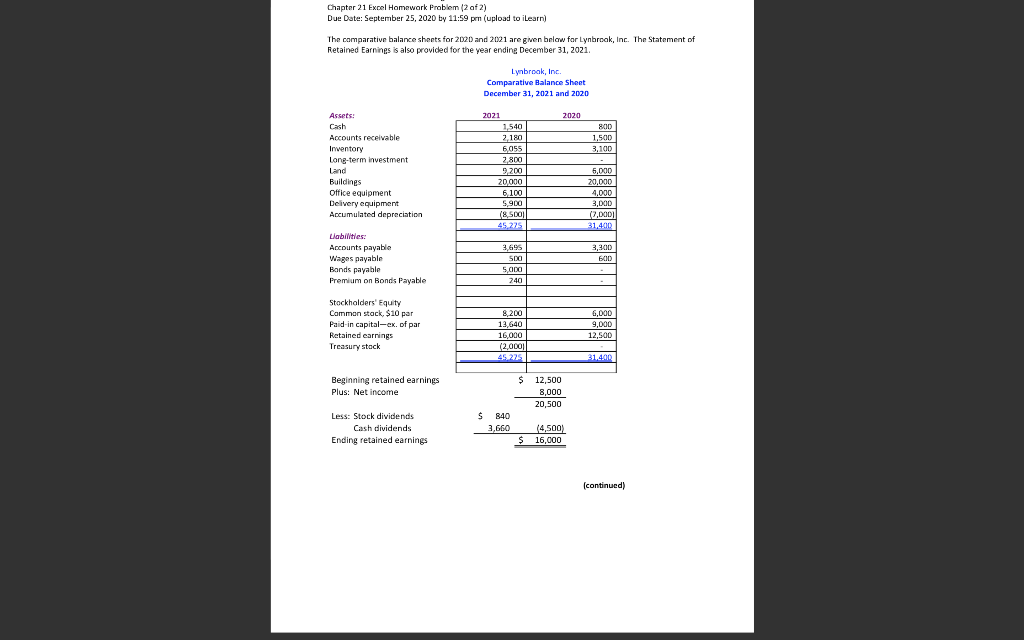

Question: Chapter 21 Excel Homework Problem (2 af 2) Due Date: September 25, 2020 by 11:59 pm (upload to Learn) The comparative balance sheets for 2020

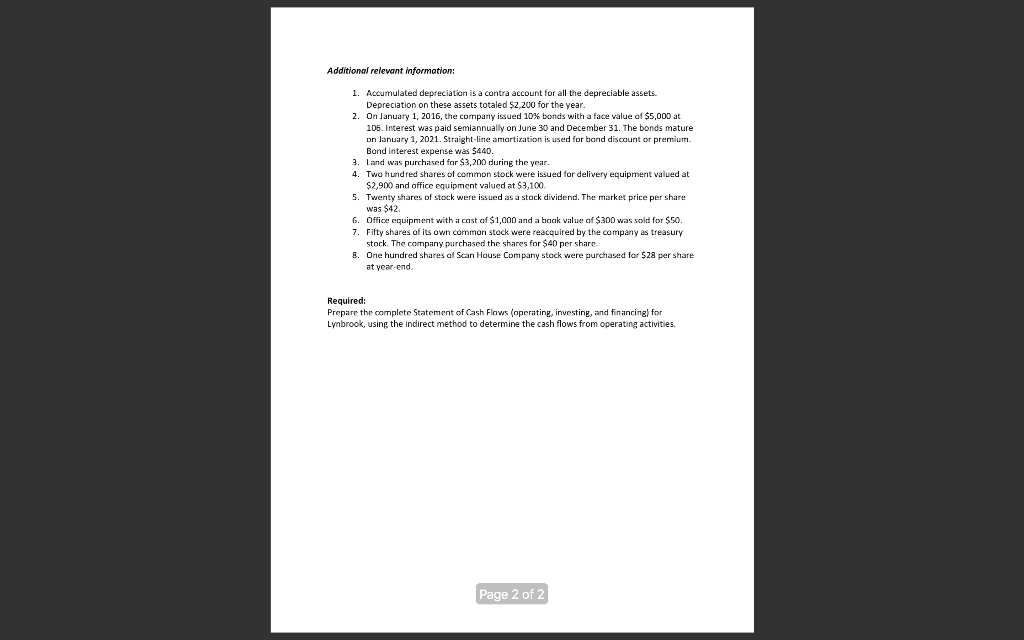

Chapter 21 Excel Homework Problem (2 af 2) Due Date: September 25, 2020 by 11:59 pm (upload to Learn) The comparative balance sheets for 2020 and 2021 are given below for Lynbroak, Inc. The Statement of Retained Earnings is also provided for the year ending December 31, 2021. Lynbrook, Inc. Comparative Balance Sheet December 31, 2021 and 2020 2020 800 1,500 3.100 Assets: Cash Accounts receivable Inventory Long-term investment Land Buildings Office equipment Delivery equipment Accumulated depreciation 2021 1,540 2,180 6,055 2.800 9.200 20,000 6.100 5.900 (8 500 45.225 6,000 20,000 4,000 3,000 (7,000) 31,400 Liabilities: Accounts payable Wages payable Bonds payable Premium on Bonds Payable 3,300 600 3,695 500 5 ano 240 Stockholders' Equity Common stock, $10 par Paid-in capital-ek of par Retained earnings Treasury stock 8.200 13,640 16,000 (2.0001 45.225 6,000 9,000 12,500 31.490 Beginning retained earnings Plus: Net income $ 12,500 8,000 20,500 $ Less: Stock dividends Cash dividends Ending retained earnings 840 3,660 (4,500) $ 16,000 (continued) Additional relevant information: 1. Accumulated depreciation is a contra account for all the depreciable assets. Depreciation on these assets totaled $2,200 for the year. 2. On January 1, 2016, the company issued 10% bonds with a face value of $5,000 at 105. Interest was paid semiannually on June 30 and December 31. The bonds mature on January 1, 2021. Straight-line amortization is used for band discount or premium Bond interest expense was $440. 3. Land was purchased for $3,200 during the year. 4. Two hundred shares of common stock were issued for delivery equipment valued at $2,900 and office equipment valued at $3,100 5. Twenty shares of stock were issued as a stock dividend. The market price per share was $42 6. Office equipment with a cost of $1,000 and a back value of $300 was sold for $50. 7. Fifty shares of its own common stock were reacquired by the company as treasury stock. The company purchased the shares for $40 per share. 8. One hundred shares of Scan House Company stock were purchased for $28 per share at year-end Required: Prepare the complete Statement of Cash Flows operating, investing, and financing) for Lynbrook, using the indirect method to determine the cash flows from operating activities. Page 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts