Question: Chapter 22 E eu Help Save & EXIT Submit Check my work 2 Refer to the Mini-S&P contract in Egure 221 Assume the closing price

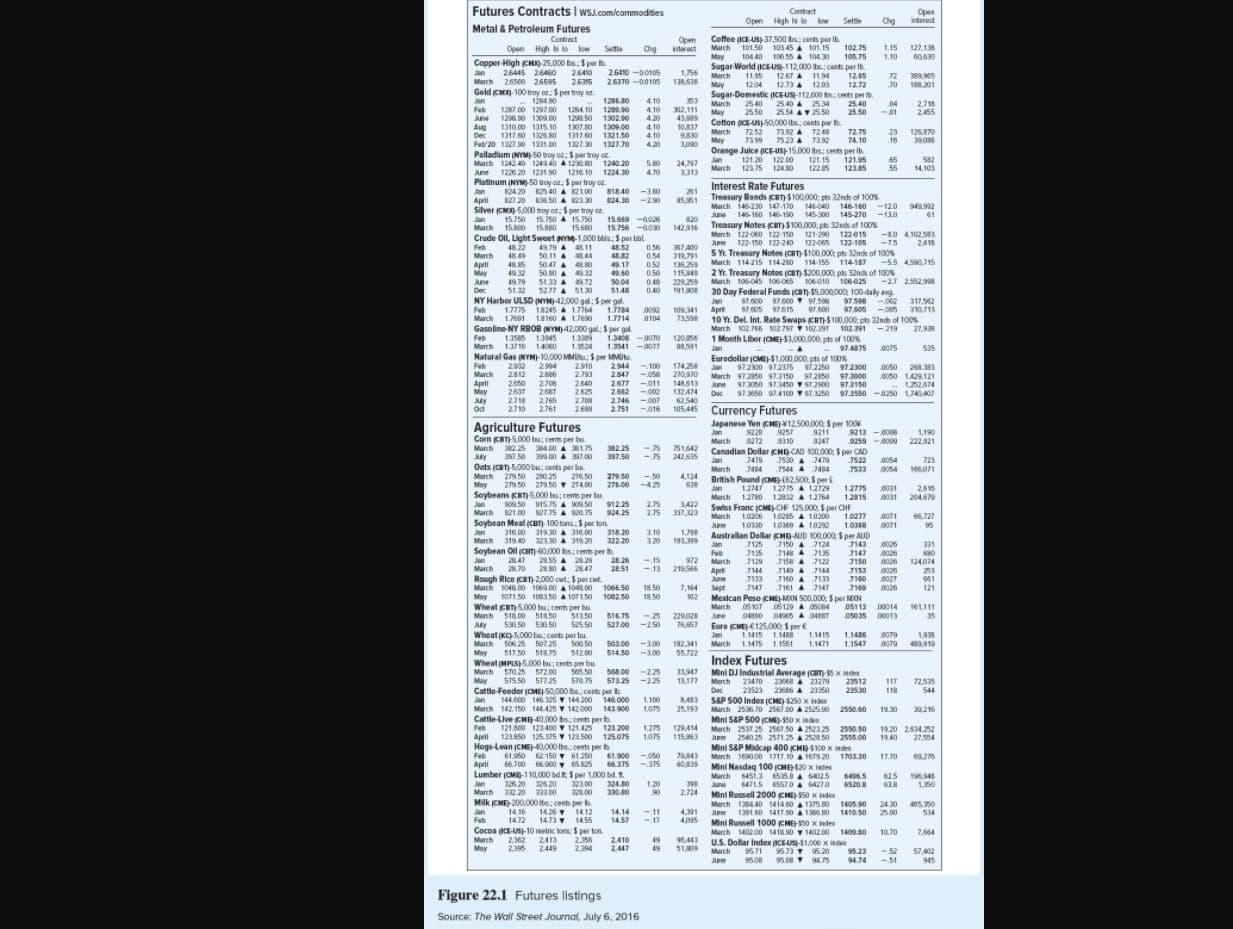

Chapter 22 E eu Help Save & EXIT Submit Check my work 2 Refer to the Mini-S&P contract in Egure 221 Assume the closing price for this day. a. If the margin requirement is 30% of the futures price times the contract multiplier of $50. how much must you deposit with your broker to trade the June maturity contract? (Round your answer to the nearest whole dollar.) 294 points Required margin deposit eBook Print References b. If the June futures price increases to 2599.70, what percentage return will you earn on your investment If you entered the long side of the contract at the price shown in the figure? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment 96 c. If the June futures price falls by 1%, what is your percentage return? (Negative amount should be Indicated by a minus sign. Do not round Intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment Futures Contracts I ws.com commodities Metal & Petroleum Futures Cat 110 220 123012402050024212 Interest Rate Futures Trentury Bonds can 100.000 22.00 SERE 15800 - 900 120 Currency Futures Agriculture Futures WAS 38 142 115 18502 Mexican Peso CHEMON DOS pronta 53403-38-40 W Tune IS 1007 Se 6.00-1000 March 1.10751188 Index Futures Se urch Z170 12 SAP 500 ind March 25 257.00 10.3.2 123400 121 88 BE 32,02 Figure 22.1 Futures listings Source: The Wall Street Journal, July 6, 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts