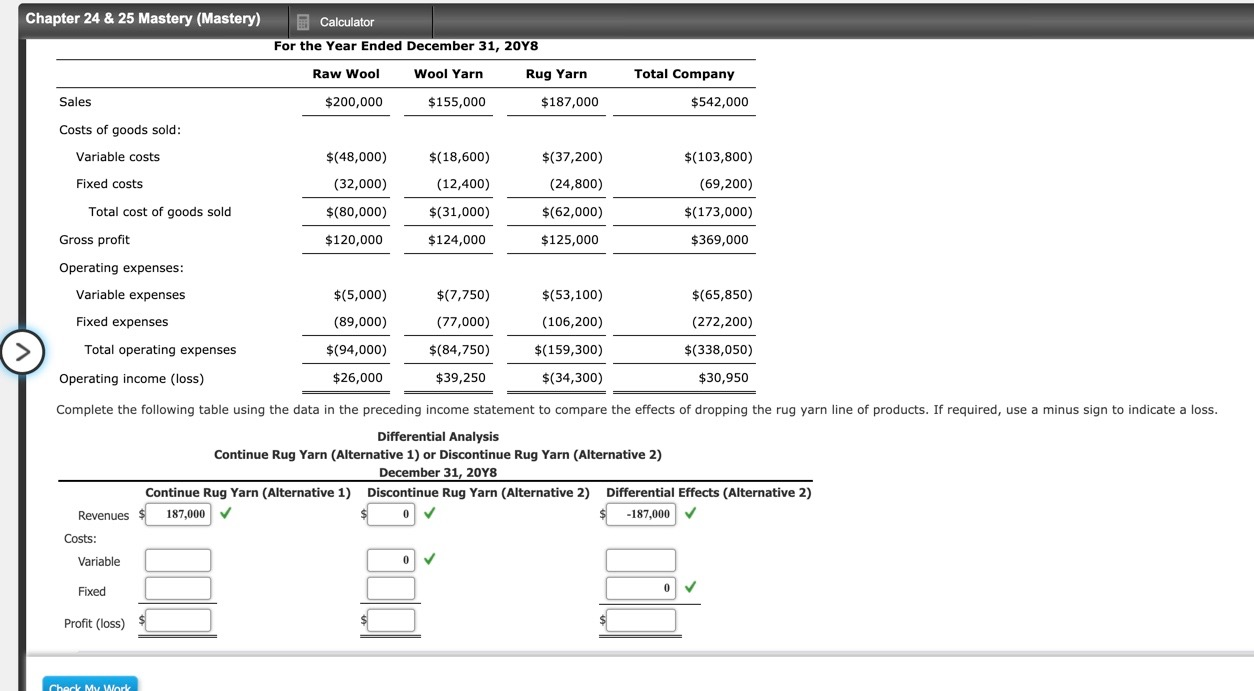

Question: Chapter 24 & 25 Mastery (Mastery) Calculator For the Year Ended December 31, 2048 Raw Wool Wool Yarn Rug Yarn $200,000 $155,000 $187,000 Total Company

Chapter 24 & 25 Mastery (Mastery) Calculator For the Year Ended December 31, 2048 Raw Wool Wool Yarn Rug Yarn $200,000 $155,000 $187,000 Total Company $542,000 Sales Costs of goods sold: Variable costs $(18,600) (12,400) $(103,800) (69,200) Fixed costs $(48,000) (32,000) $(80,000) $120,000 $(37,200) (24,800) $(62,000) $125,000 Total cost of goods sold $(31,000) $(173,000) $369,000 Gross profit $124,000 Operating expenses: Variable expenses $(53,100) $(65,850) Fixed expenses $(5,000) (89,000) $(94,000) $26,000 $(7,750) (77,000) $(84,750) $39,250 (106,200) $(159,300) Total operating expenses Operating income (loss) (272,200) $(338,050) $30,950 $(34,300) Complete the following table using the data in the preceding income statement to compare the effects of dropping the rug yarn line of products. If required, use a minus sign to indicate a loss. Differential Analysis Continue Rug Yarn (Alternative 1) or Discontinue Rug Yarn (Alternative 2) December 31, 20Y8 Continue Rug Yarn (Alternative 1) Discontinue Rug Yarn (Alternative 2) Differential Effects (Alternative 2) Revenues $ 187,000 $ -187,000 Costs: Variable Fixed Profit (loss) Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts