Question: Chapter 26 Using Excel P26-39 Using Excel for capital budgeting calculations Glacier Creek Textiles is planning to purchase new manufacturing equipment. The equipment has an

Chapter 26

Using Excel

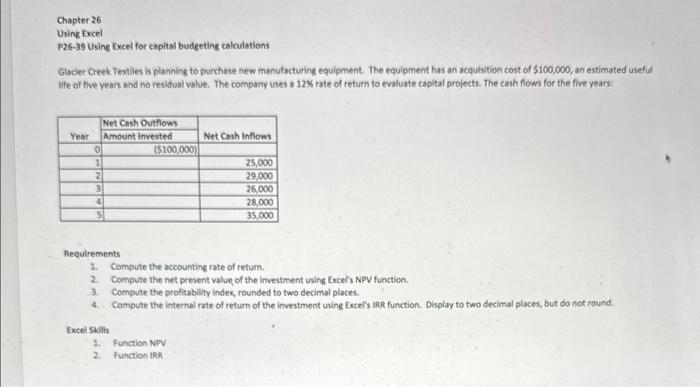

P26-39 Using Excel for capital budgeting calculations

Glacier Creek Textiles is planning to purchase new manufacturing equipment. The equipment has an acquisition cost of $100,000, an estimated useful life of five years and no residual value. The company uses a 12% rate of return to evaluate capital projects. The cash flows for the five years:

PLEASE HELP AND SHOW FORMULAS AND THE STEPS I DONT UNDERSTAND HOW TO DO THIS AND WOULD LIKE TO KNOW ALL THE STEPS AND FORMULAS USED

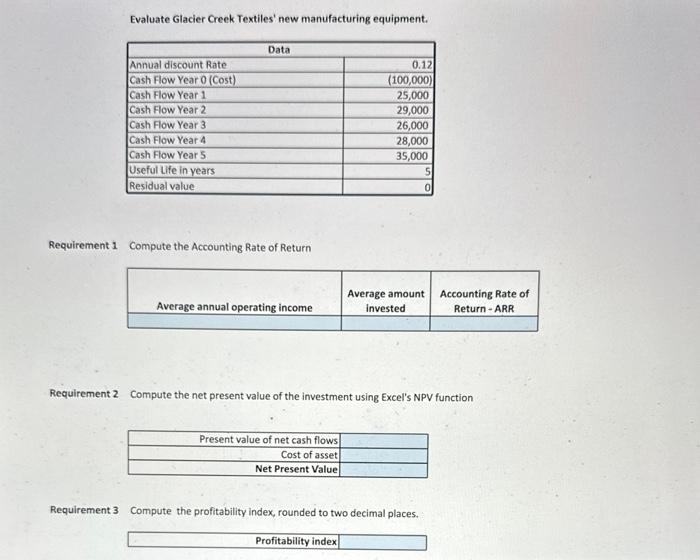

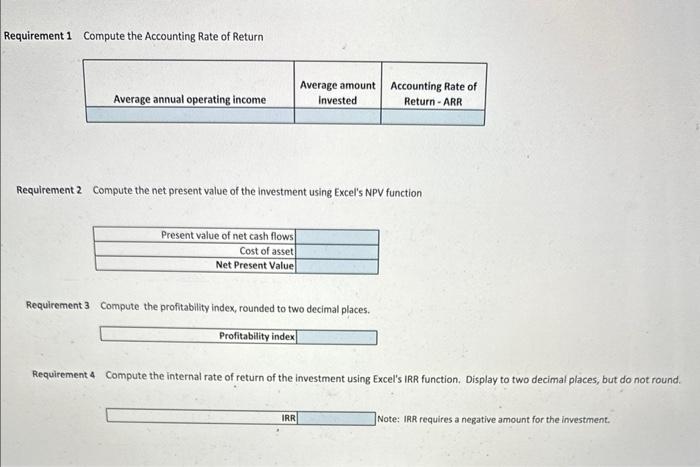

Chapter 26 Using Excel P26-39 Using Excel for capital budgeting calculations Glocier Creek Tevtles is planning to purchase new manufacturing equipment. The equipment has an acquisition cost of $100,000, an estimated useful life of five years and no residual value. The company uses a 12N rate of return to evaluate capital projects. The cash flows for the five years: Requlrements 1. Compute the accountine rate of return. 2. Compute the net present value of the investment using Excels NPV function. 3. Compute the profitability indes, rounded to two decimal places. 4. Compute the internal rate of return of the investment using Excel's IRR function. Olsplay to two decimal places, but do not round. Excel Skills 1. Function NPV Evaluate Glacier Creek Textiles' new manufacturing equipment. Requirement 1 Compute the Accounting Rate of Return Requirement 2 Compute the net present value of the investment using Excel's NPV function Requirement 3 Compute the profitability index, rounded to two decimal places. Requirement 1 Compute the Accounting Rate of Return Requirement 2 Compute the net present value of the investment using Excel's NPV function Requirement 3 Compute the profitability index, rounded to two decimal places. Requirement 4 Compute the internal rate of return of the investment using Excel's IRR function. Display to two decimal places, but do not round. lote: IRR requires a negative amount for the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts