Question: Chapter 3 (Accounting Cycle Steps 5, 6, & 7) ACCOUNTING CYCLE STEP 5: Adjust the appropriate a TCLE STEP 5: Adjust the appropriate accounts of

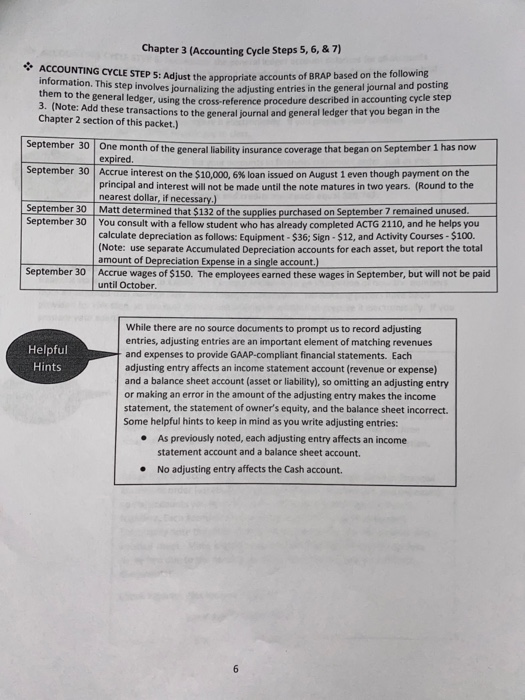

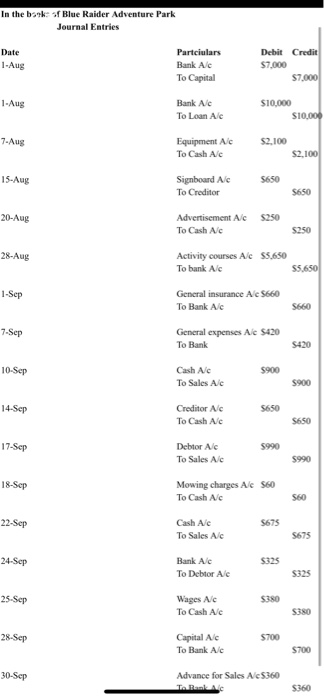

Chapter 3 (Accounting Cycle Steps 5, 6, & 7) ACCOUNTING CYCLE STEP 5: Adjust the appropriate a TCLE STEP 5: Adjust the appropriate accounts of BRAP based on the following information. This step involves lournalining the distine entries in the general journal and poss seneral ledger, using the cross-reference procedure described in accounting cycle step Add these transactions to the general journal and general ledger that you began in the Chapter 2 section of this packet.) September 30 One month of the general liability insurance coverage that began on September 1 has now expired. September 30 Accrue interest on the $10.000. 6% loan issued on August 1 even though payment on the principal and interest will not be made until the note matures in two years. (Round to the nearest dollar, if necessary.) September 30 Matt determined that $132 of the supplies purchased on September remained unused. September 30 You consult with a fellow student who has already completed ACTG 2110, and he helps you calculate depreciation as follows: Equipment - $36: Sign-$12, and Activity Courses - $100. (Note: use separate Accumulated Depreciation accounts for each asset, but report the total amount of Depreciation Expense in a single account.) September 30 Accrue wages of $150. The employees earned these wages in September, but will not be paid until October Helpful Hints While there are no source documents to prompt us to record adjusting entries, adjusting entries are an important element of matching revenues and expenses to provide GAAP-compliant financial statements. Each adjusting entry affects an income statement account (revenue or expense) and a balance sheet account (asset or liability), so omitting an adjusting entry or making an error in the amount of the adjusting entry makes the income statement, the statement of owner's equity, and the balance sheet incorrect. Some helpful hints to keep in mind as you write adjusting entries: As previously noted, each adjusting entry affects an income statement account and a balance sheet account. No adjusting entry affects the Cash account. In the book of Blue Raider Adventure Park Journal Entries Credit Date 1-Aug Partciulars Bank Ac To Capital Debit $7.000 57.000 1.Aug Bank Ac To Lean Alc $10,000 $10,000 7. Aug Equipment Ac To Cash Ac 52.100 15-Aug Signboard Ale To Creditor 20-Aug Advertisement Ac To Cash Ac $250 28-Aug Activity courses A c 55,650 To bank Alc 1-Sep General insurance Ac 5660 To Bank A/C 7.Sep General expenses Ale 5420 To Bank 10-Sep Cash Ac To Sales Alc 14-Sep Creditor Ac To Cash Ac 17-Sep Debtor AC To Sales Ac 18-5cp Mowing charges AC To Cash Ac 22-Sep Cash Alc To Sales Alc 24-Sep Bank Alc To Debtor AC 25-Sep Wages Ac To Cash Alc 28-Sep Capital Alc To Bank Alc 30-Sep Advance for Sales Ac5360 TRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts