Question: CHAPTER 3 ACCOUNTING INFORMATION SYSTEMS ACCT 300A Dr. John Gleeson, M.D., maintains the accounting records of his medical clinic on a cash basis. During 2008,

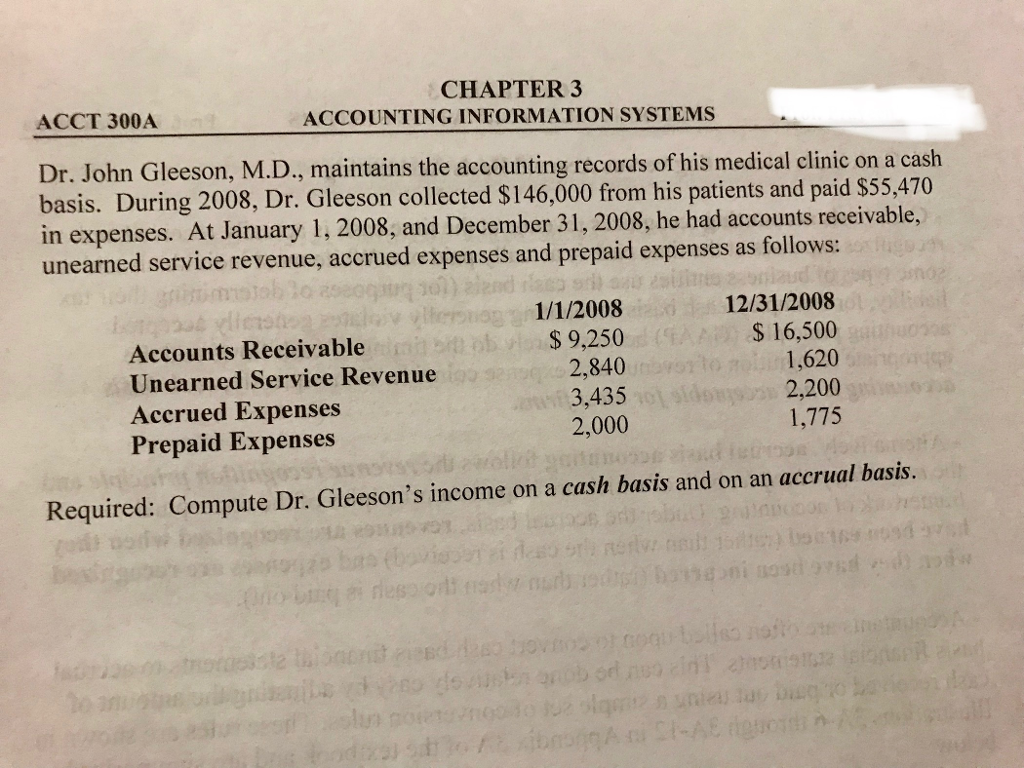

CHAPTER 3 ACCOUNTING INFORMATION SYSTEMS ACCT 300A Dr. John Gleeson, M.D., maintains the accounting records of his medical clinic on a cash basis. During 2008, Dr. Gleeson collected $146,000 from his patients and paid $55,470 in expenses. At January 1, 2008, and December 31, 2008, he had accounts receivable, unearned service revenue, accrued expenses and prepaid expenses as follows: , Accounts Receivable Unearned Service Revenue Accrued Expenses Prepaid Expenses 1/1/2008 $ 9,250 2,840 3,435 2,000 12/31/2008 S 16,500 1,620 2,200 1,775 Required: Compute Dr. Gleeson's income on a cash basis and on an accrual basis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock