Question: Chapter 3 Editing Add - ins Problem 3 . 1 9 Journal entries, entering beginning account balances, posting to , T accounts, and trial balance

Chapter

Editing

Addins

Problem

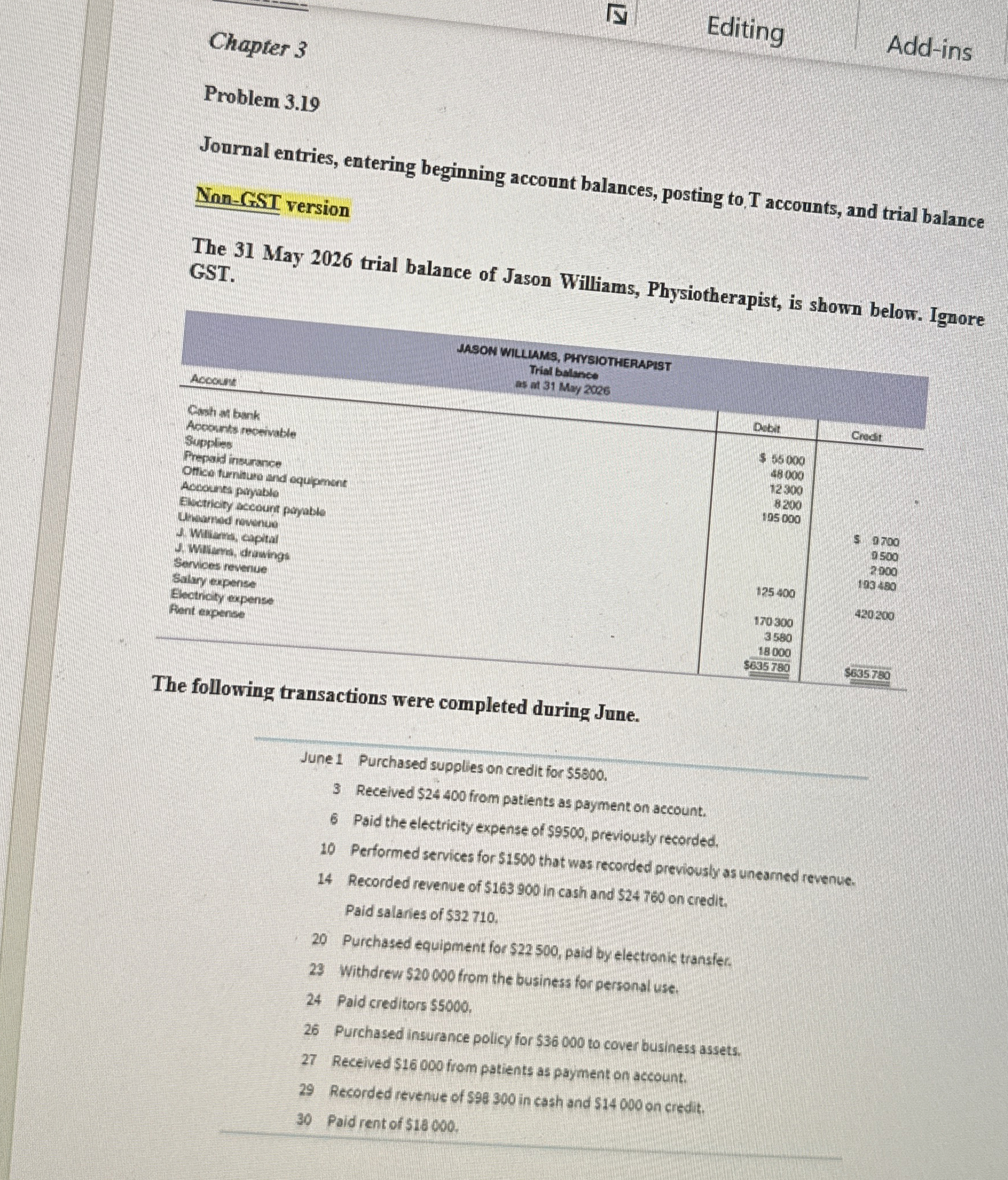

Journal entries, entering beginning account balances, posting to accounts, and trial balance

NanGST version

The May trial balance of Jason Williams, Physiotherapist, is shown below. Ignore GST

The following transactions were completed during June.

June Purchased supplies on credit for $

Received $ from patients as payment on account.

Paid the electricity expense of $ previously recorded.

Performed services for $ that was recorded previowsly as unearned revenue.

Recorded revenue of in cash and $ on credit.

Paid salaries of $

Purchased equipment for $ paid by electronic transier.

Withdrew $ from the business for personal use.

Paid creditors $

Purchased insurance policy for $ to cover business assets.

Received $ from patients as payment on account.

Recorded revenue of $ in cash and $ on eredit.

Paid rent of $

Required:

a prepare journal entries

b Open T accounts for the accounts shown in trial balance

Enter may balance in each account

Post journal entries to the T account

c Prepare trial balance june

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock