Question: Chapter 3 Homework i Saved Help Save & Exit Submit Check my work 8 Haynes, Inc., obtained 100 percent of Turner Company's common stock on

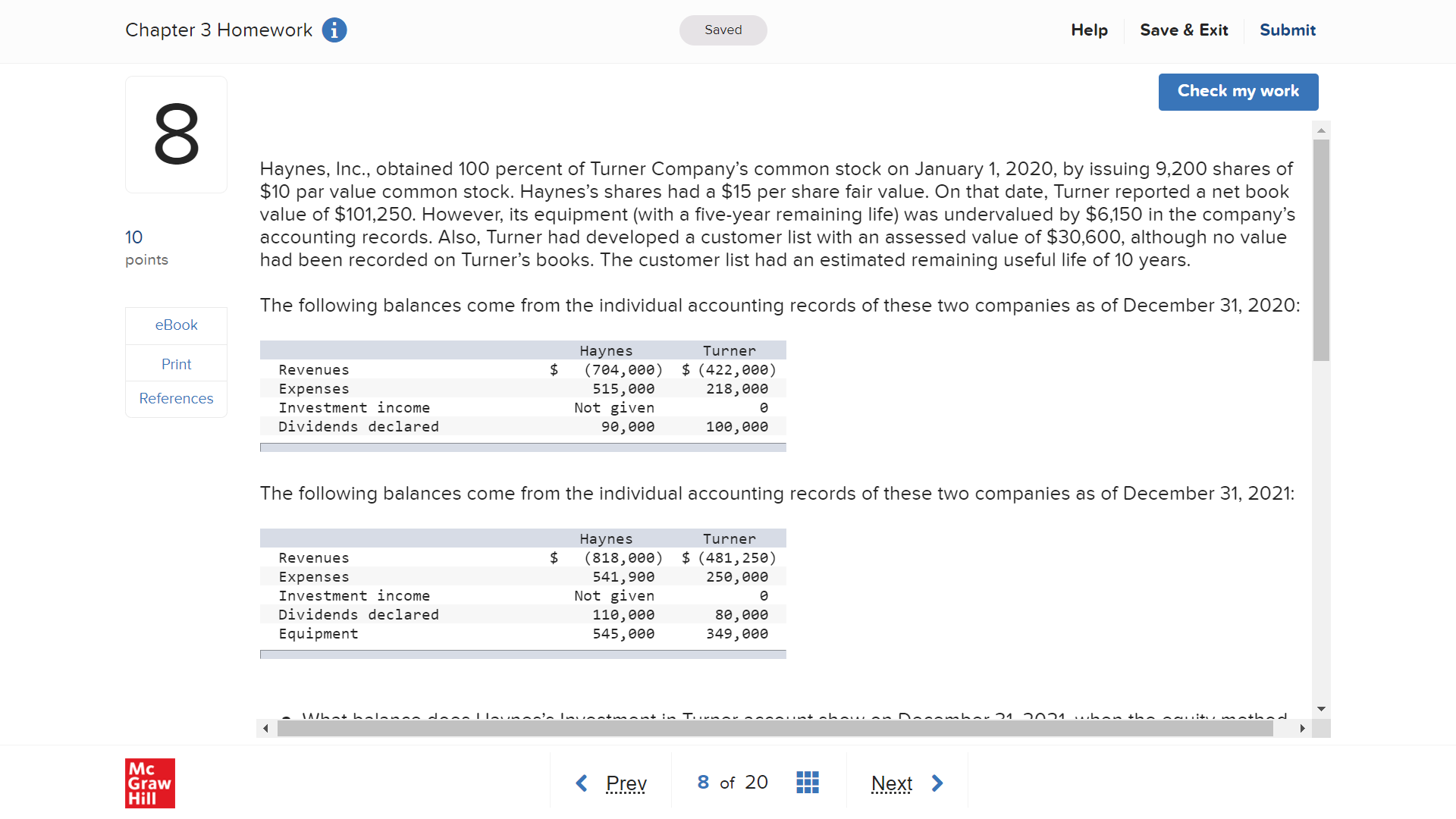

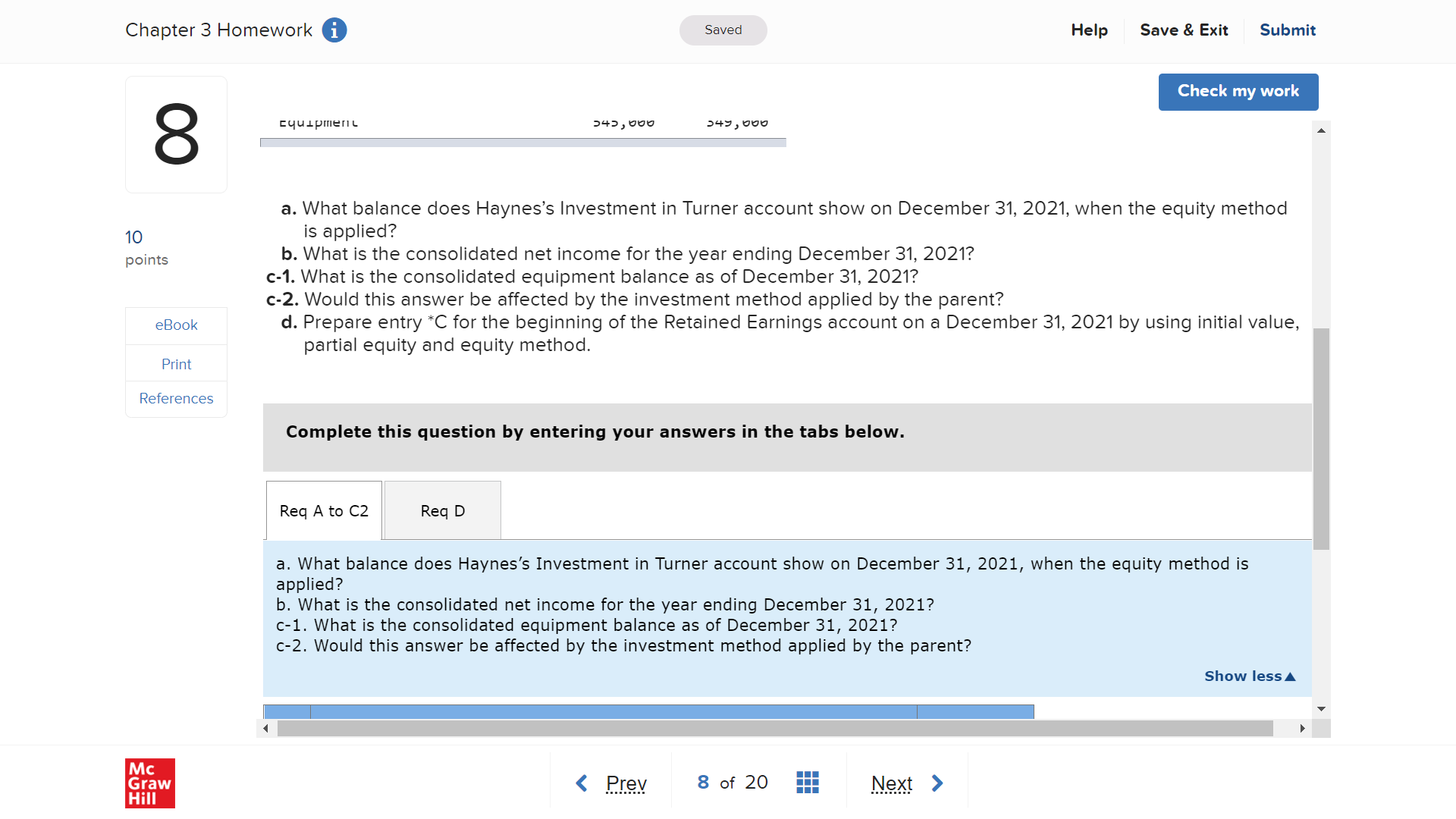

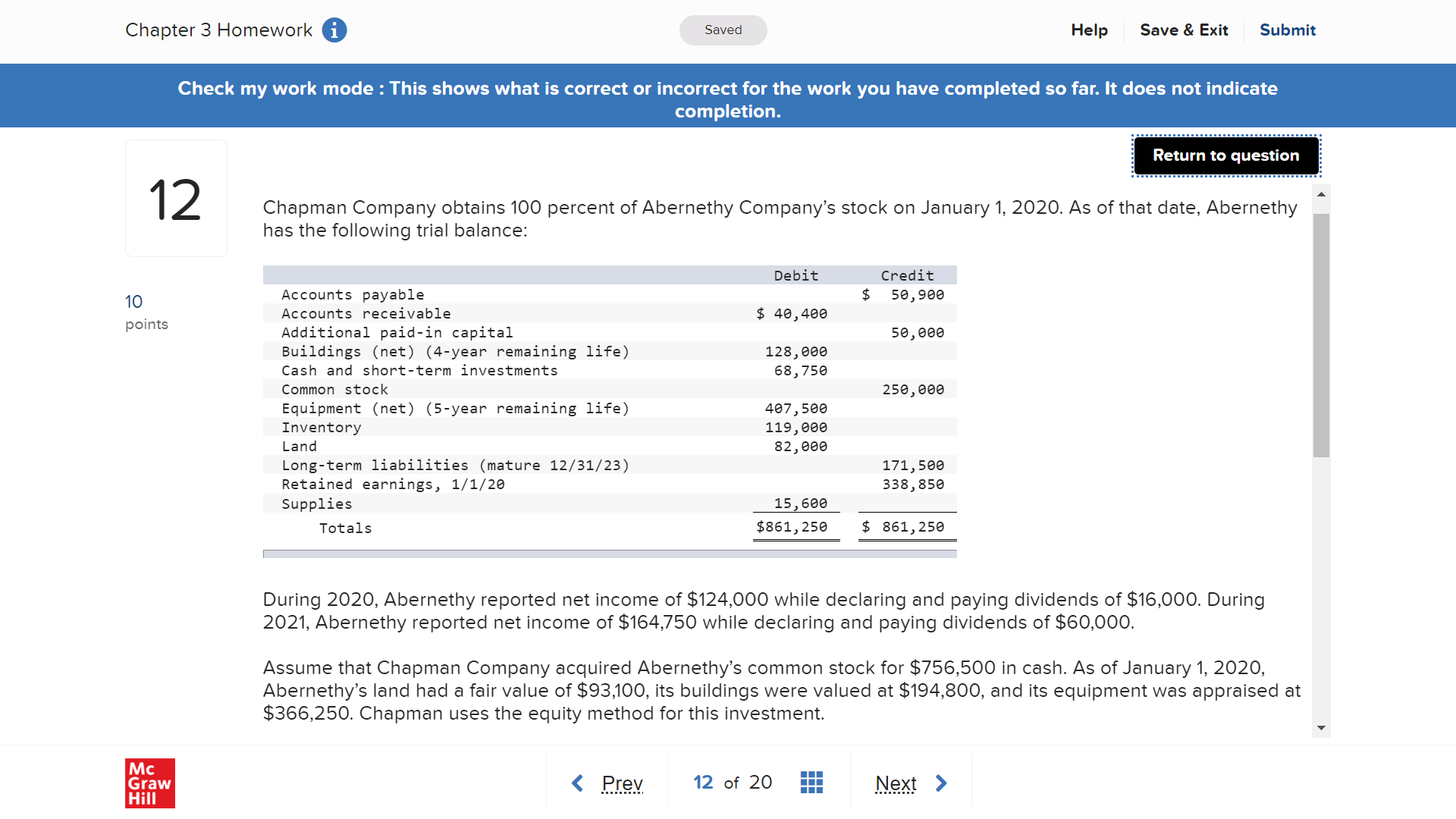

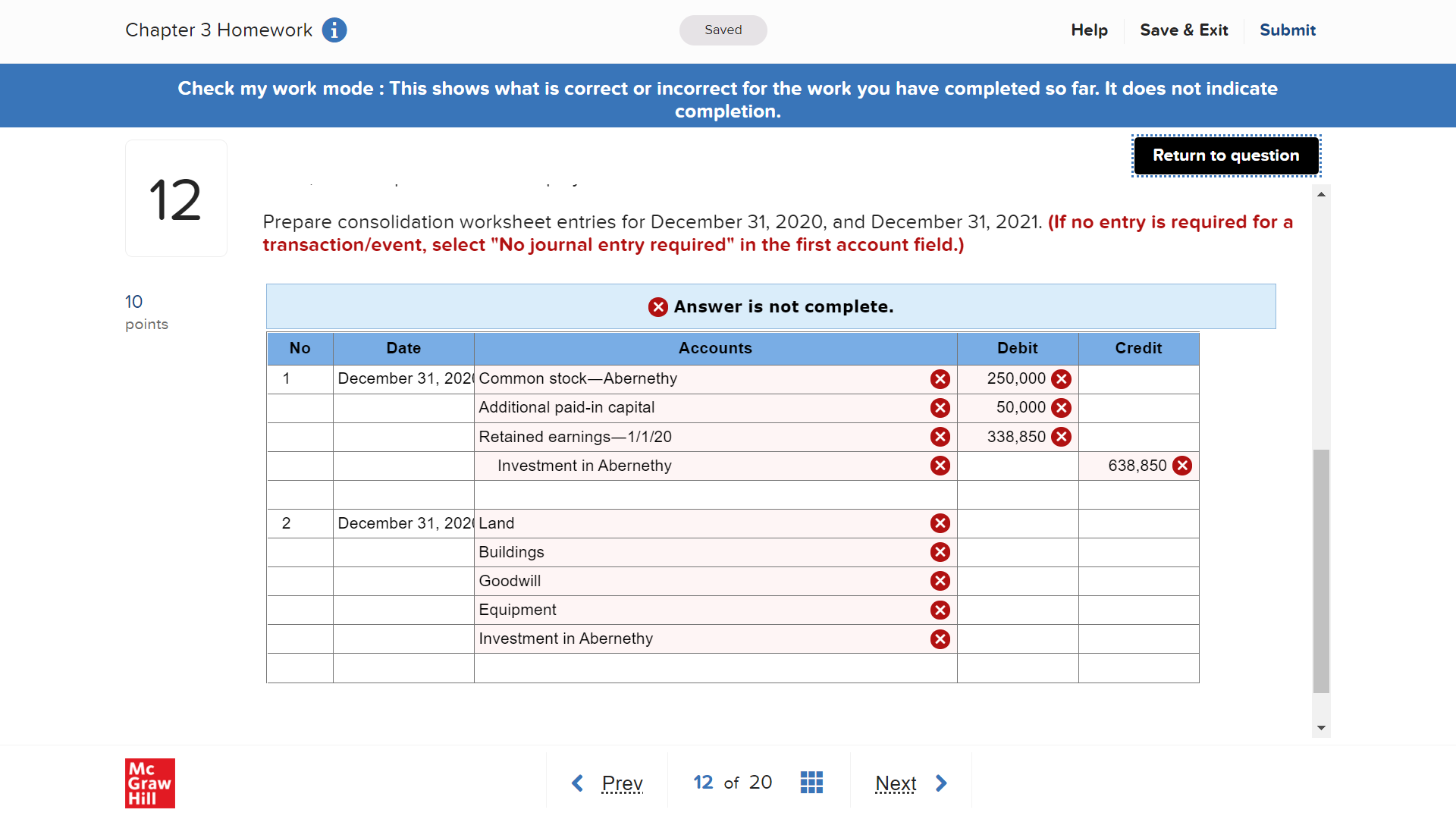

Chapter 3 Homework i Saved Help Save & Exit Submit Check my work 8 Haynes, Inc., obtained 100 percent of Turner Company's common stock on January 1, 2020, by issuing 9,200 shares of $10 par value common stock. Haynes's shares had a $15 per share fair value. On that date, Turner reported a net book value of $101,250. However, its equipment (with a five-year remaining life) was undervalued by $6,150 in the company's 10 accounting records. Also, Turner had developed a customer list with an assessed value of $30,600, although no value points had been recorded on Turner's books. The customer list had an estimated remaining useful life of 10 years. The following balances come from the individual accounting records of these two companies as of December 31, 2020: eBook Haynes Turner Print Revenues $ (704, 000) $ (422, 000) Expenses 515 , 000 218, 000 References Investment income Not given Dividends declared 90, 000 100, 000 The following balances come from the individual accounting records of these two companies as of December 31, 2021: Haynes Turner Revenues $ (818, 000) $ (481, 250) Expenses 541, 900 250, 000 Investment income Not given Dividends declared 110, 000 80, 000 Equipment 545,000 349, 006 Mc Graw HillChapter 3 Homework 0 8 \"Wm.\" l a. What balance does Haynes's Investment in Turner account show on December 31, 2021, when the equity method 10 points eBook Print References Graw Hill 3w:,uuu Saved 34:,uuo is applied? b. What is the consolidated net income for the year ending December 31, 2021'? c-1. What is the consolidated equipment balance as of December 31, 2021? c-2. Would this answer be affected by the investment method applied by the parent? Help Save Kc Exit Submit Check my work A d. Prepare entry 'C for the beginning of the Retained Earnings account on a December 31, 2021 by using initial value, partial equity and equity method. Complete this question by entering your answers in the tabs below. Req A to C2 Req D a. What balance does Haynes's Investment in Turner account show on December 31, 2021, when the equity method is applied? b. What is the consolidated net income for the year ending December 31, 2021? c1. What is the consolidated equipment balance as of December 31, 2021? c-2. Would this answer be affected by the investment method applied by the parent? Show less A Chapter 3 Homework 0 Saved Help Save 9 Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. : Return to question : 12 Chapman Company obtains 100 percent of Abernethy Company's stock on January 1. 2020. As ofthat date, Abernethy A has the following trial balance: Debit Credit 10 Accounts payable 5 59,999 , Accounts receivable 3 49,499 palms Additional paid-in capital 59,999 Buildings (net) (4year remaining life) 128,999 Cash and short-term investments 68,759 Common stock 259,999 Equipment (net) (5-year remaining life) 497,599 Inventory 115,999 Land 82,999 Longterm liabilities (mature 12/31/23) 171,599 Retained earnings, 1/1/29 338,859 Supplies 15,699 Totals $861,259 5 361,259 During 2020, Abernethy reported net income of $124,000 while declaring and paying dividends of $16,000. During 2021, Abernethy reported net income of $164,750 while declaring and paying dividends of $60,000. Assume that Chapman Company acquired Abernethy's common stock for $756,500 in cash. As of January 1, 2020, Abernethy's land had a fair value of $93,100, its buildings were valued at $194,800, and its equipment was appraised at $366,250. Chapman uses the equity method for this investment. Mc "- Graw ( 12 of 20 III llill Chapter 3 Homework i Saved Help Save & Exit Submit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 12 Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 10 x Answer is not complete. points No Date Accounts Debit Credit 1 December 31, 202( Common stock-Abernethy X 250,000 x Additional paid-in capital X 50,000 X Retained earnings-1/1/20 X 338,850 X Investment in Abernethy X 638,850 X 2 December 31, 202( Land X Buildings X Goodwill X Equipment X Investment in Abernethy X Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts