Question: Chapter 3 Spreadsheet Problem The Financial Environment Diction Publishing estimates that it needs S500,000 to support its expected growth. The underwriting fees charged by the

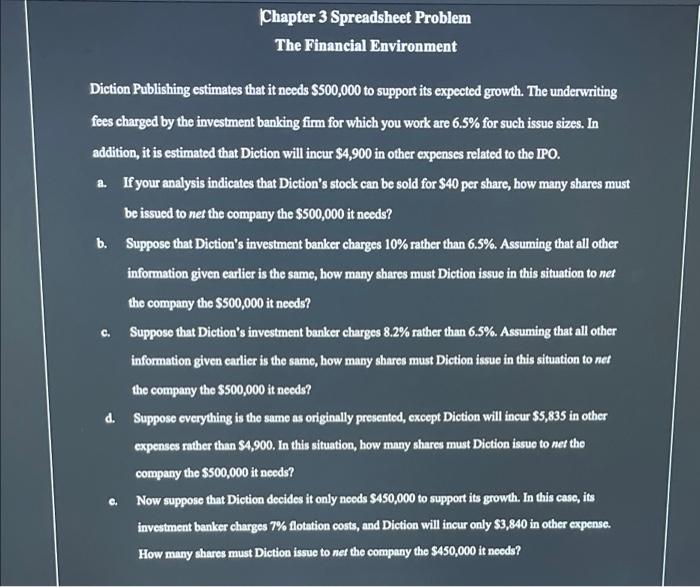

Chapter 3 Spreadsheet Problem The Financial Environment Diction Publishing estimates that it needs S500,000 to support its expected growth. The underwriting fees charged by the investment banking firm for which you work are 6.5% for such issue sizes. In addition, it is estimated that Diction will incur S4,900 in other expenses related to the IPO. a. If your analysis indicates that Diction's stock can be sold for $40 per share, how many shares must be issued to net the company the $500,000 it needs? b. Suppose that Diction's investment banker charges 10% rather than 6.5%. Assuming that all other information given carlier is the same, how many shares must Diction issue in this situation to net the company the $500,000 it noods? c. Suppose that Diction's investment banker charges 8.2% rather than 6.5%. Assuming that all other information given carlier is the same, how many shares must Diction issue in this situation to net the company the $500,000 it noods? d. Suppose everything is the same as originally presented, except Diction will incur $5,835 in other expenses rather than 54,900. In this situation, how many shares must Diction issue to net the company the $500,000 it needs? Now suppose that Diction decidos it only noods S450,000 to support its growth. In this case, its investment banker charges 7% flotation costs, and Diction will incur only $3,840 in other expense. How many shares must Diction issue to net the company the $450,000 it needs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts