Question: Please help with E, F The problem requires you to use File CO3 on the computer problem spreadsheet. Diction Publishing estimates that it needs $500,000

Please help with E, F

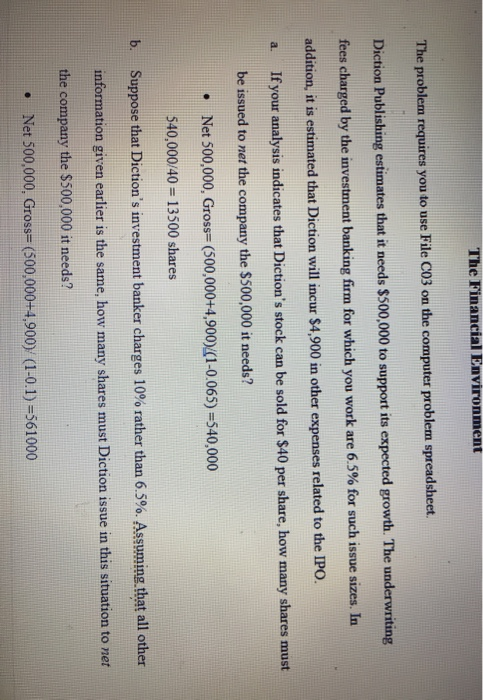

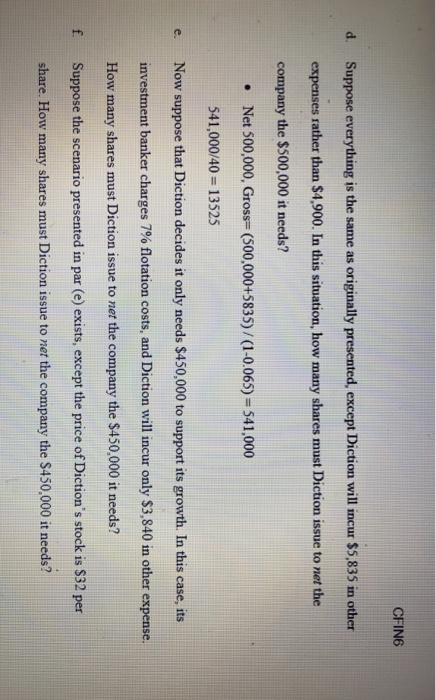

Please help with E, F The problem requires you to use File CO3 on the computer problem spreadsheet. Diction Publishing estimates that it needs $500,000 to support its expected growth. The underwriting fees charged by the investment banking firm for which you work are 65% for such issue sizes. In addition, it is estimated that Diction will incur $4,900 in other expenses related to the IPO. a. If your analysis indicates that Diction's stock can be sold for $40 per share, how many shares must be issued to net the company the $500,000 it needs? Net 500,000, Gross- (500,000+4,900)/1-0.065) S40,000 540,000/40-13500 shares Suppose that Diction's investment banker charges 10% rather than 6.5%. Assuming-that all other information given earlier is the same, how many shares must Diction issue in this situation to net the company the $500,000 it needs? b. Net 500,000, Gross= (500,000+4,900) (1-01)-561000 . CFIN6 Suppose everything is the same as originally presented, except Diction will incur $5,835 in other expenses rather than $4,900. In this situation, how many shares must Diction issue to net the company the $500,000 it needs? d. Net 500,000, Gross- (500,000+5835)/(1-0.065)-541,000 . 541,000/40 13525 e. Now suppose that Diction decides it only needs $450,000 to support its growth. In this case, its investment banker charges 790 flotation costs, and Diction will incur only $3,840 in other expense. How many shares must Diction issue to net the company the $450,000 it needs? f. Suppose the scenario presented in par (e) exists, except the price of Diction's stock is $32 per share. How many shares must Diction issue to net the company the $450,000 it needs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts