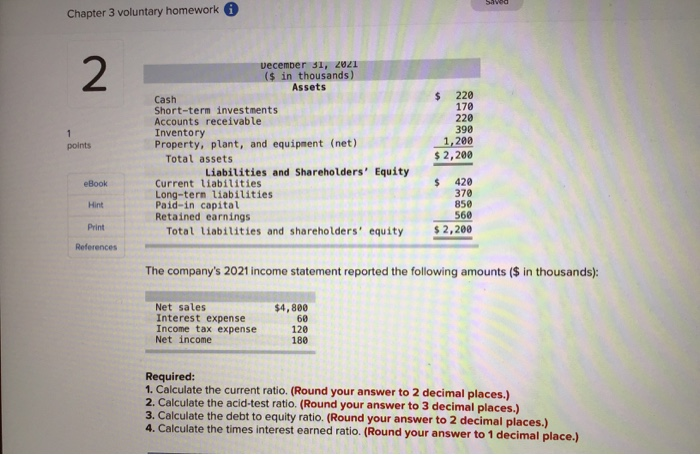

Question: Chapter 3 voluntary homework 2 December 31, 2021 ($ in thousands) Assets Cash Short-term investments Accounts receivable Inventory Property, plant, and equipment (net) Total assets

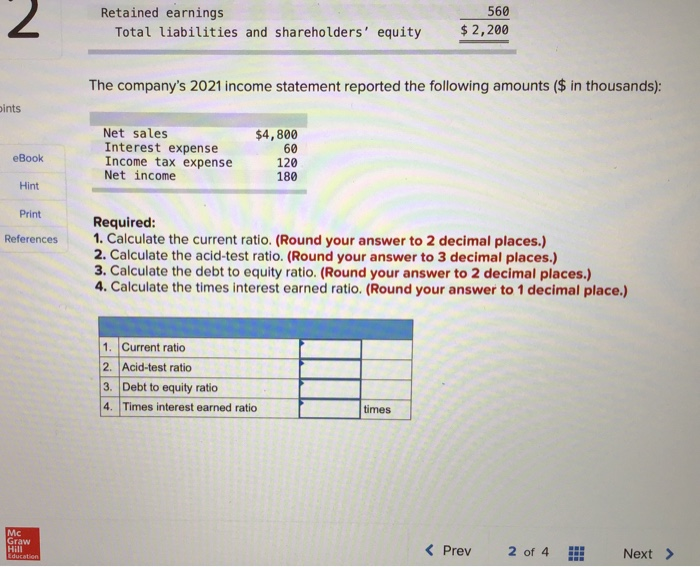

Chapter 3 voluntary homework 2 December 31, 2021 ($ in thousands) Assets Cash Short-term investments Accounts receivable Inventory Property, plant, and equipment (net) Total assets Liabilities and Shareholders' Equity Current liabilities Long-tern liabilities Paid-in capital Retained earnings Total liabilities and shareholders' equity $ 220 170 220 390 1,200 $ 2,200 1 points eBook Hint $ 420 370 850 560 $2,200 Print References The company's 2021 income statement reported the following amounts ($ in thousands): Net sales Interest expense Income tax expense Net income $4,800 60 120 180 Required: 1. Calculate the current ratio. (Round your answer to 2 decimal places.) 2. Calculate the acid-test ratio. (Round your answer to 3 decimal places.) 3. Calculate the debt to equity ratio. (Round your answer to 2 decimal places.) 4. Calculate the times interest earned ratio. (Round your answer to 1 decimal place.) 2 Retained earnings Total liabilities and shareholders' equity 560 $2,200 The company's 2021 income statement reported the following amounts ($ in thousands): bints eBook Net sales Interest expense Income tax expense Net income $4,800 60 120 180 Hint Print References Required: 1. Calculate the current ratio. (Round your answer to 2 decimal places.) 2. Calculate the acid-test ratio. (Round your answer to 3 decimal places.) 3. Calculate the debt to equity ratio. (Round your answer to 2 decimal places.) 4. Calculate the times interest earned ratio. (Round your answer to 1 decimal place.) 1. Current ratio 2. Acid-test ratio 3. Debt to equity ratio 4. Times interest earned ratio times Mc Graw Hill Education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts