Question: Hello, please show work step by step for this problem. The wrong and correct answers are shown. Please show how to get the correct answers

Hello, please show work step by step for this problem. The wrong and correct answers are shown. Please show how to get the correct answers for the wrong ones. Thank you

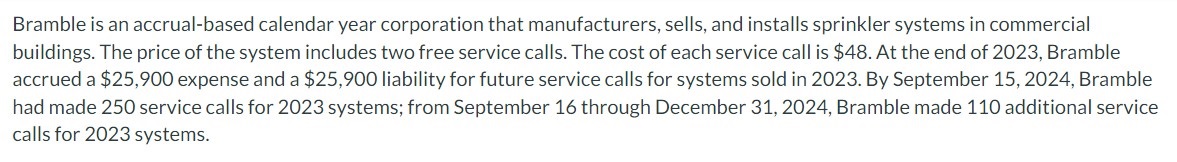

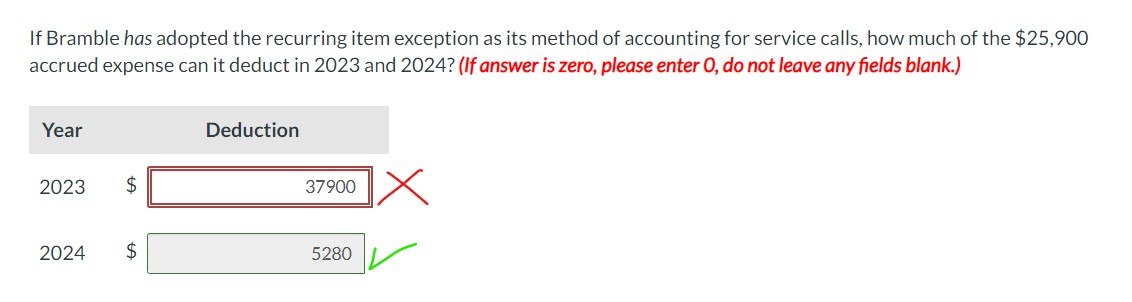

Bramble is an accrual-based calendar year corporation that manufacturers, sells, and installs sprinkler systems in commercial buildings. The price of the system includes two free service calls. The cost of each service call is $48. At the end of 2023 , Bramble accrued a $25,900 expense and a $25,900 liability for future service calls for systems sold in 2023 . By September 15 , 2024, Bramble had made 250 service calls for 2023 systems; from September 16 through December 31, 2024, Bramble made 110 additional service calls for 2023 systems. If Bramble has adopted the recurring item exception as its method of accounting for service calls, how much of the $25,900 accrued expense can it deduct in 2023 and 2024? (If answer is zero, please enter 0, do not leave any fields blank.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts