Question: Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare journal entries to close all the temporary accounts. This step includes journalizing

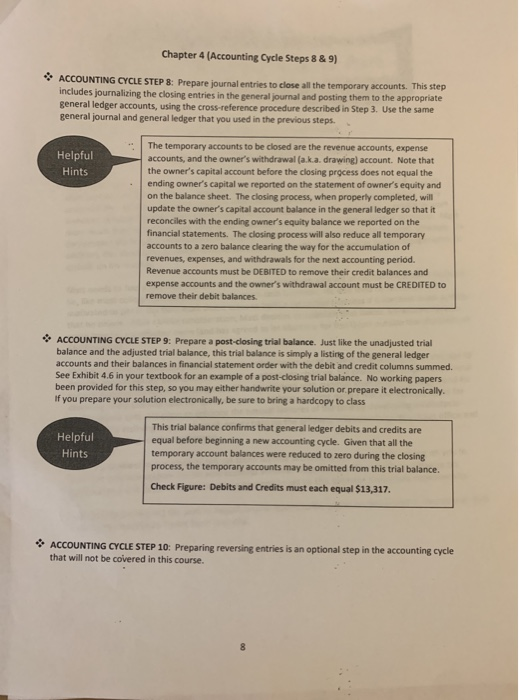

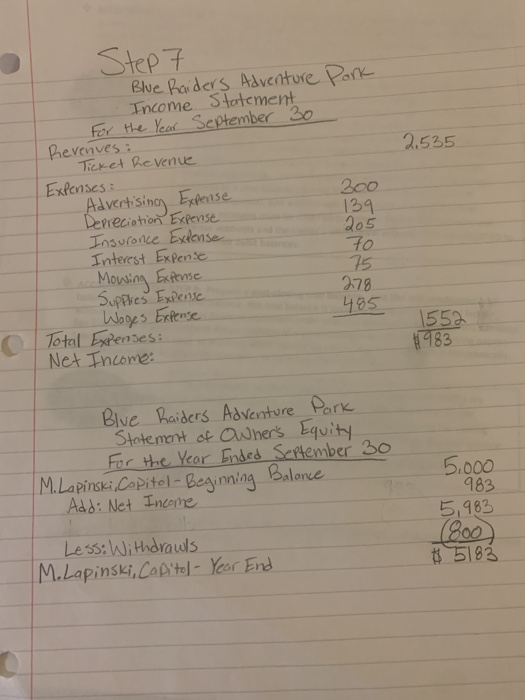

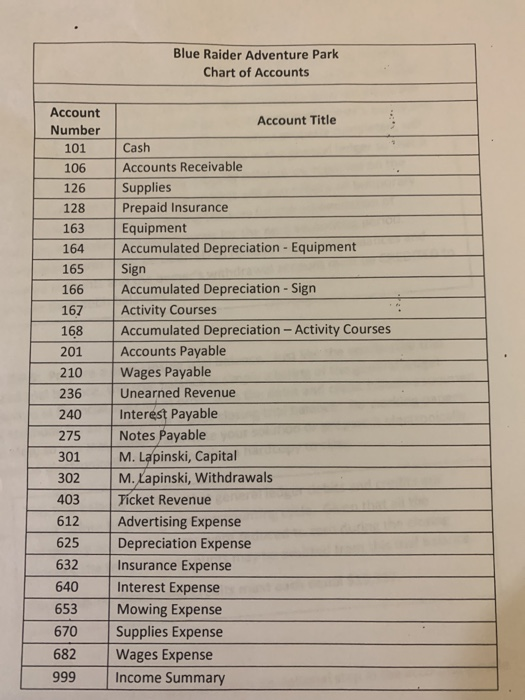

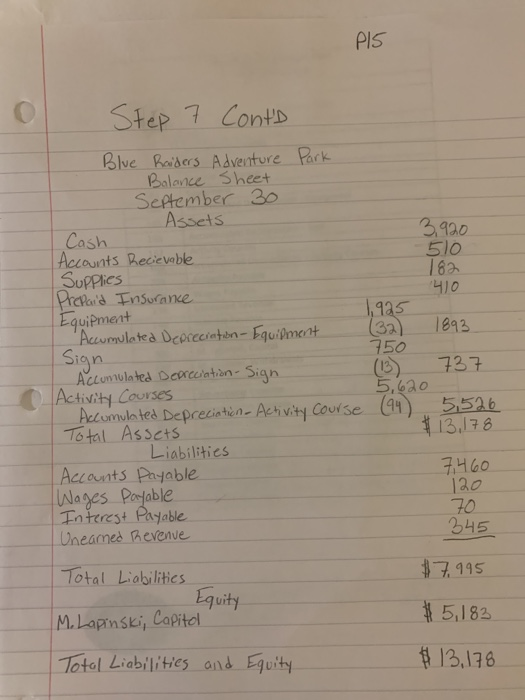

Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare journal entries to close all the temporary accounts. This step includes journalizing the closing entries in the general journal and posting them to the appropriate general ledger accounts, using the cross-reference procedure described in Step 3. Use the same general journal and general ledger that you used in the previous steps. The temporary accounts to be closed are the revenue accounts, expense Helpful accounts, and the owner's withdrawal (a.k.a. drawing) account. Note that Hints the owner's capital account before the closing prgcess does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period. Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Helpful Hints Check Figure: Debits and Credits must each equal $13,317. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. Step 7 Blue Paiders Adventure Park Income Statement Fer the Year eptember 30 Phevenves: 2.535 TicKet Revenue Exfenses Advectisino Ertase Depreciotion Expense Insurance Exlense Interst Expense 200 139 205 Mowing Extme Suppres Exene Woges brfense Total Expenses: Net Theome: 75 278 485 1559 1983 Blue haiders Adventure Park Statement of ONher's Equity For the Year Ended September 30 5.000 983 M.Lapinski Capitel-Beginning Balance Add: Net Income 5,983 Less:Withdrauls M.Lapinski,Capitel-Year End # 51.83 Blue Raider Adventure Park Chart of Accounts Account Account Title Number Cash 101 Accounts Receivable 106 Supplies 126 128 Prepaid Insurance Equipment 163 Accumulated Depreciation - Equipment 164 Sign 165 Accumulated Depreciation - Sign 166 Activity Courses 167 Accumulated Depreciation - Activity Courses 168 Accounts Payable 201 210 Wages Payable Unearned Revenue 236 Interest Payable Notes Payable M. Lapinski, Capital M.Lapinski, Withd rawa ls Ticket Revenue 240 275 301 302 403 612 Advertising Expense 625 Depreciation Expense 632 Insurance Expense 640 Interest Expense 653 Mowing Expense 670 Supplies Expense 682 Wages Expense 999 Income Summary PIS 7 ContD Step Blue Raiders Adventure Park Balance Sheet Scftember 30 Assets 3.920 510 16a 410 Cash Accounts Becieveble SUPPies PrePa'd Fnsurance EquiPment 1995 1893 Accwouletea Deprecieten- Equipment 750 Sign 737 Accunulated Dearcciation- Sign Activity Courses Accomula ted Deprecintien Activity Couise To tal Asscts 5.6a0 5.526 1) 13.178 Liabilities FH60 130 70 345 Accants Payable LAlages Pafable Interest Payable Uneamed Revenve #7195 Total Liabilities Equity M. Lapinski, Capitol 5,182 13,176 Totol Liabilitics and Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts