Question: Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare lournal entries to close all the temporary accounts. This step includes journalizing

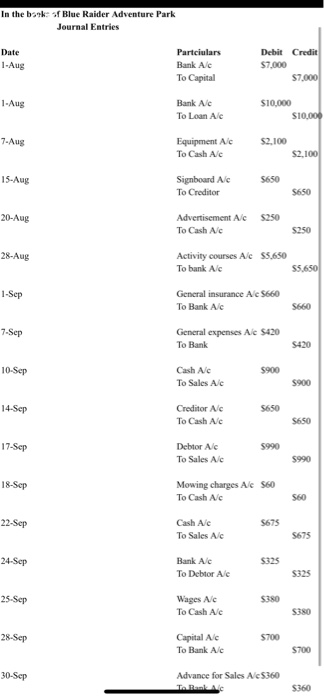

Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare lournal entries to close all the temporary accounts. This step includes journalizing the closing entries in the general lournal and posting them to the appropriate general ledger accounts, using the cross-reference procedure described in Step 3. Use the same general journal and general ledger that you used in the previous steps. Helpful Hints The temporary accounts to be closed are the revenue accounts, expense accounts, and the owner's withdrawal (a.k.a. drawing) account. Note that the owner's capital account before the closing process does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period. Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class Helpful Hints This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Check Figure: Debits and Credits must each equal $18,502. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. In the book of Blue Raider Adventure Park Journal Entries Credit Date 1-Aug Partciulars Bank Ac To Capital Debit $7.000 57.000 1.Aug Bank Ac To Lean Alc $10,000 $10,000 7. Aug Equipment Ac To Cash Ac 52.100 15-Aug Signboard Ale To Creditor 20-Aug Advertisement Ac To Cash Ac $250 28-Aug Activity courses A c 55,650 To bank Alc 1-Sep General insurance Ac 5660 To Bank A/C 7.Sep General expenses Ale 5420 To Bank 10-Sep Cash Ac To Sales Alc 14-Sep Creditor Ac To Cash Ac 17-Sep Debtor AC To Sales Ac 18-5cp Mowing charges AC To Cash Ac 22-Sep Cash Alc To Sales Alc 24-Sep Bank Alc To Debtor AC 25-Sep Wages Ac To Cash Alc 28-Sep Capital Alc To Bank Alc 30-Sep Advance for Sales Ac5360 TRA Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP 8: Prepare lournal entries to close all the temporary accounts. This step includes journalizing the closing entries in the general lournal and posting them to the appropriate general ledger accounts, using the cross-reference procedure described in Step 3. Use the same general journal and general ledger that you used in the previous steps. Helpful Hints The temporary accounts to be closed are the revenue accounts, expense accounts, and the owner's withdrawal (a.k.a. drawing) account. Note that the owner's capital account before the closing process does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period. Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class Helpful Hints This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Check Figure: Debits and Credits must each equal $18,502. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. In the book of Blue Raider Adventure Park Journal Entries Credit Date 1-Aug Partciulars Bank Ac To Capital Debit $7.000 57.000 1.Aug Bank Ac To Lean Alc $10,000 $10,000 7. Aug Equipment Ac To Cash Ac 52.100 15-Aug Signboard Ale To Creditor 20-Aug Advertisement Ac To Cash Ac $250 28-Aug Activity courses A c 55,650 To bank Alc 1-Sep General insurance Ac 5660 To Bank A/C 7.Sep General expenses Ale 5420 To Bank 10-Sep Cash Ac To Sales Alc 14-Sep Creditor Ac To Cash Ac 17-Sep Debtor AC To Sales Ac 18-5cp Mowing charges AC To Cash Ac 22-Sep Cash Alc To Sales Alc 24-Sep Bank Alc To Debtor AC 25-Sep Wages Ac To Cash Alc 28-Sep Capital Alc To Bank Alc 30-Sep Advance for Sales Ac5360 TRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts