Question: Chapter 4: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks.

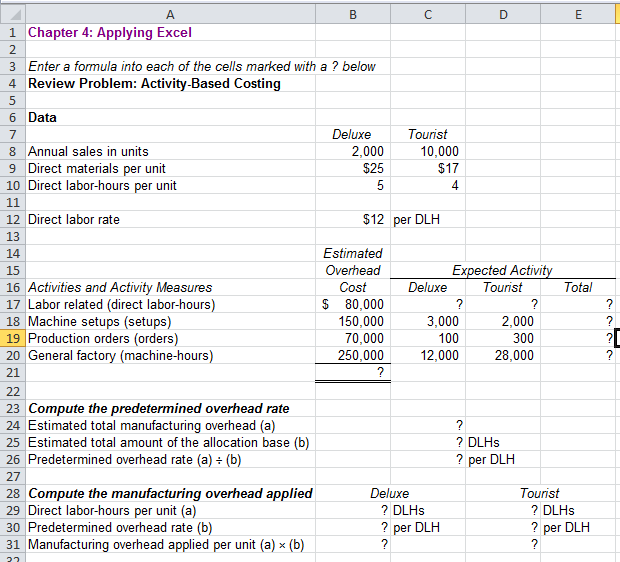

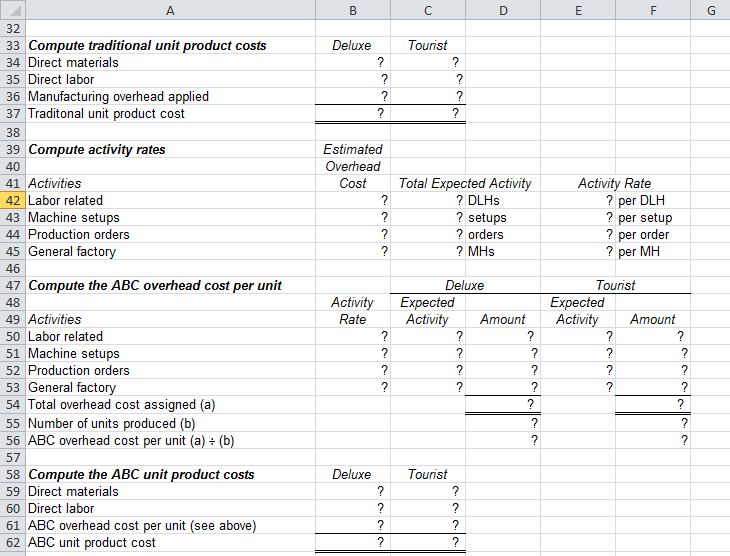

Chapter 4: Applying Excel: Excel Worksheet (Part 1 of 2) Download the Applying Excel form and enter formulas in all cells that contain question marks. Enter formulas in the cells that contain question marks. For example, in cell C17 enter the formula "=B8*B10". After entering formulas in all of the cells that contained question marks, verify that the calculated numbers match the numbers in the Review Problem. Check your worksheet by reducing the direct labor-hours for the Deluxe model in cell B10 from 5 to 2. The Deluxe model's unit product cost under traditional costing should now be $74.00 and the ABC unit product cost should be $143.89. If you do not get these results, fmd the errors in your worksheet and correct them. Save your completed Applying Excel form to your computer and then upload it here by clicking "Browse." Next, click "Save." You will use this worksheet to answer the questions in Part 2. 1 Chapter 4: Applying Excel 2 3 Enter a formula into each of the cells marked with a ? below 4 Review Problem: Activity-Based Costing 5 Deluxe 2,000 $25 Tourist 10,000 $17 4 5 $12 per DLH 6 Data 7 8 Annual sales in units 9 Direct materials per unit 10 Direct labor-hours per unit 11 12 Direct labor rate 13 14 15 16 Activities and Activity Measures 17 Labor related (direct labor-hours) 18 Machine setups (setups) 19 Production orders (orders) 20 General factory (machine-hours) 21 Expected Activity Deluxe Tourist Total Estimated Overhead Cost $ 80,000 150,000 70,000 250,000 3,000 100 12,000 2,000 300 28,000 22 ? DLHs ? per DLH 23 Compute the predetermined overhead rate 24 Estimated total manufacturing overhead (a) 25 Estimated total amount of the allocation base (b) 26 Predetermined overhead rate (a) = (b) 27 28 Compute the manufacturing overhead applied 29 Direct labor-hours per unit (a) 30 Predetermined overhead rate (b) 31 Manufacturing overhead applied per unit (a) (b) Deluxe ? DLHs ? per DLH Tourist ? DLHS ? per DLH Bce E F G Deluxe Tourist Estimated Overhead Cost Total Expected Activity ? DLHS ? setups ? orders ? MHs Activity Rate ? per DLH ? per setup ? per order ? per MH ? ? 32 33 Compute traditional unit product costs 34 Direct materials 35 Direct labor 36 Manufacturing overhead applied 37 Traditonal unit product cost 38 39 Compute activity rates 40 41 Activities 42 Labor related 43 Machine setups 44 Production orders 45 General factory 46 47 Compute the ABC overhead cost per unit 48 49 Activities 50 Labor related 51 Machine setups 52 Production orders 53 General factory 54 Total overhead cost assigned (a) 55 Number of units produced (b) 56 ABC overhead cost per unit (a) = (b) 57 58 Compute the ABC unit product costs 59 Direct materials 60 Direct labor 61 ABC overhead cost per unit (see above) 62 ABC unit product cost Activity Rate Deluxe Expected Activity Amount Tourist Expected Activity Amount ? ? Deluxe Tourist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts