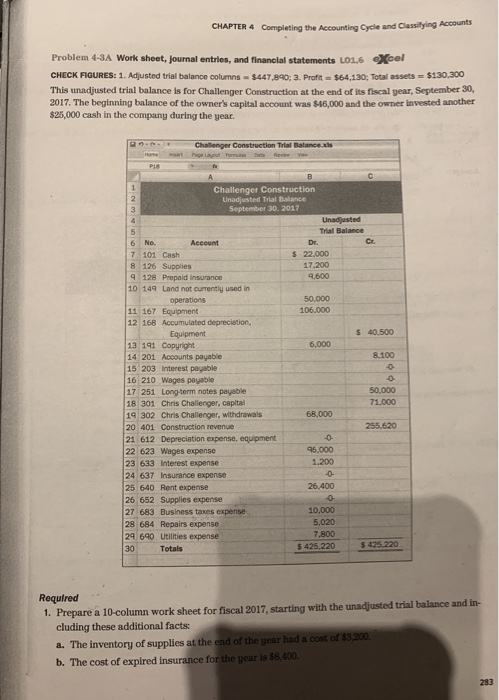

Question: CHAPTER 4 Completing the Accounting Cycle and Classitying Accounts Problem 4-3A Work sheet, journal entries, and financial statements LO16 Xcel CHECK FIGURES: 1. Adjusted trial

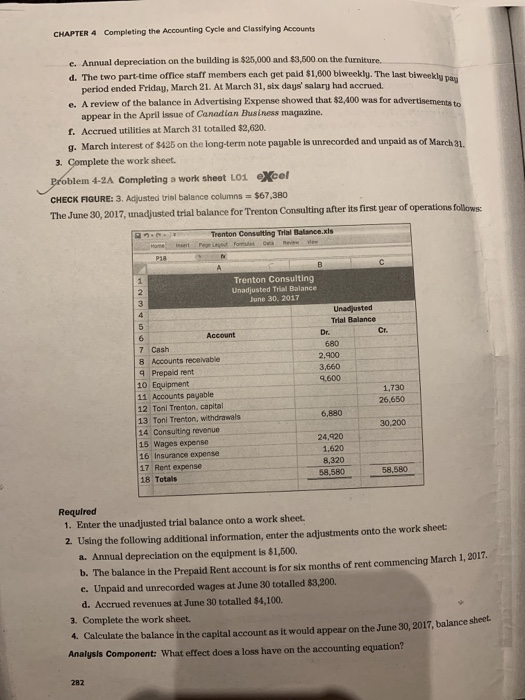

CHAPTER 4 Completing the Accounting Cycle and Classitying Accounts Problem 4-3A Work sheet, journal entries, and financial statements LO16 Xcel CHECK FIGURES: 1. Adjusted trial balance columns $447,820: 3. Proft $64,130: Total assets- $130,300 This unadjusted trial balance is for Challenger Construction at the end of its fiscal gear, September 30, 2017. The beginning balance of the owner's capital account was $46,000 and the owner invested another $25,000 cash in the company during the year. Challenger Construction Unadjusted Trial Balance September 30, 2017 Trial Balance 6 No. 7 101 Cash 8 126 Supplies s 22,000 17.200 4,600 128 Prepaid insurance 10 149 Land not currently used in 50,000 11 167 Equipment 12 168 Accumulated deprecistion, s 40.500 Equipment 13 191 Copyright 8.100 14 201 Accounts payable 15 203 Interest payable 16 210 Wages payable 17 251 Long-term nates payable 18 301 Chris Challenger, capital 19 302 Chris Challenger, withdrawals 20 401 Construction revenue 21 612 Depreciation expense, equipment 22 623 Wages expense 23 633 Interest expense 24 637 Insurance expense 25 640 Rent expense 26 652 Supplies expense 27 683 Business taxes expense 28 684 Repairs expense 249 690 Utilities expense 30 50,000 71,000 255,620 95.000 1.200 10,000 5,020 7,800 $ 425,220 $ 425220 Totals Required 1. Prepare 10-column work sheet for fiscal 2017, starting with the unadjusted trial balance and in- cluding these additional facts a. The inventory of supplies at the end of the gear had a cost of $3 b. The cost of expired insurance for the gear is $8,400 283 CHAPTER 4 Completing the Accounting Cycle and Classityling Accounts e. Annual depreclation on the building is $25,000 and $3,500 on the furniture. d. The two part time office staff members each get paid $1,800 blweekly. The last biweekly pan period ended Friday, March 21. At March 31, six days' salary had accrued e. A review of the balance in Advertising Expense showed that $2,400 was for advertisements to appear in the April Issue of Canadian Business magazine. f. Accrued utilities at March 31 totalled $2,620. g. March interest of 9425 on the long-term note payable is unrecorded and unpaid as of March 31. 3. Complete the work sheet. blem 4-2A Completing a work sheet LO1 eXcel CHECK FIGURE: 3. Adjusted trial balance columns-$67,380 The June 30, 2017, unadjusted trial balance for Trenton Consulting after its first year of operations follows Trenton Consuliting Trial Balance.xis Trenton Consulting Unadjusted Trial Balance June 30, 2017 Unadjusted Trial Balance Dr. Account Cr. 680 2,900 3,660 9,600 7 Cash 8 Accounts receivable 9 Prepaid rent 10 Equipment 11 Accounts payable 12 Toni Trenton, capital 13 Toni Trenton, withdrawals 14 Consulting revenue 15 Wages expense 16 Insurance expense 17 Rent expense 18 Totals 1,730 26,650 6,880 30,200 24,920 1,620 8,320 58,580 58,580 Required 1. Enter the unadjusted trial balance onto a work sheet 2 Using the following additional information, enter the adjustments onto the work sheet: a. Annual depreciation on the equipment is $1,500 b. The balance in the Prepaid Rent account is for six months of rent commencing March 1, 2017 c. Unpaid and unrecorded wages at June 30 totalled $3,200. d. Accrued revenues at June 30 totalled $4,100 Complete the work sheet. a. 4. Calculate the balance in the capital account as it would appear on the June 30, 2017, balance sheet Analysls Component: What effect does a loss have on the accounting equation? 282

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts